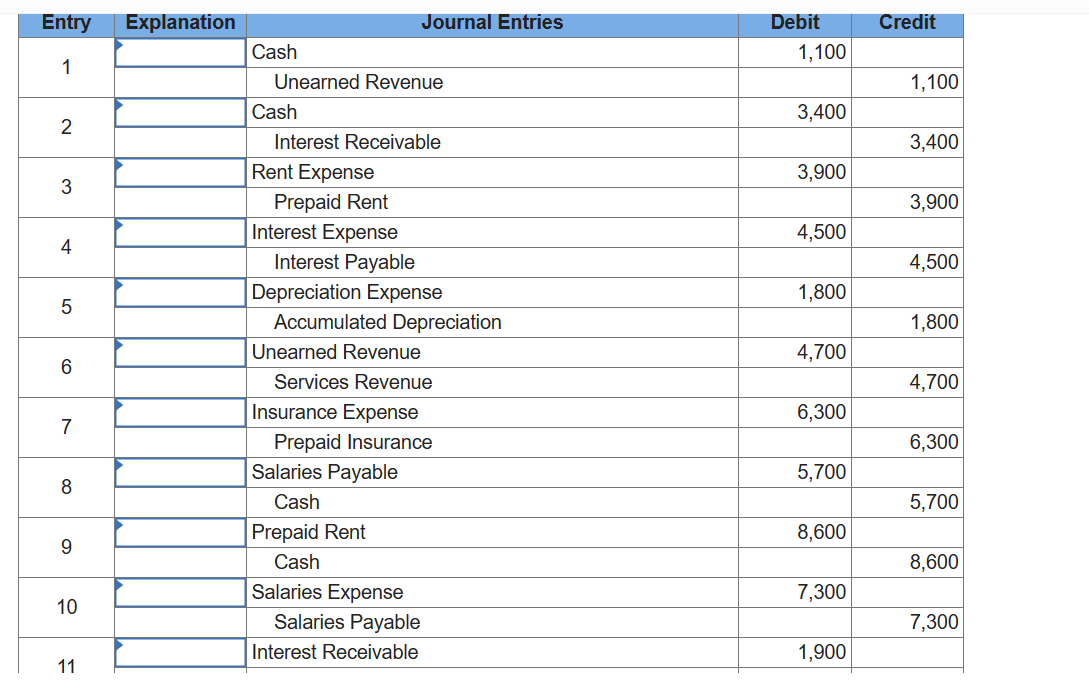

For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. To record receipt of unearned revenue. To record this period's earning of prior unearned revenue. To record payment of an accrued expense. To record receipt of an accrued revenue. To record an accrued expense. To record an accrued revenue. To record this period's use of a prepaid expense. To record payment of a prepaid expense. To record this period's depreciation expense.

For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. To record receipt of unearned revenue. To record this period's earning of prior unearned revenue. To record payment of an accrued expense. To record receipt of an accrued revenue. To record an accrued expense. To record an accrued revenue. To record this period's use of a prepaid expense. To record payment of a prepaid expense. To record this period's depreciation expense.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

For

- To record receipt of unearned revenue.

- To record this period's earning of prior unearned revenue.

- To record payment of an accrued expense.

- To record receipt of an accrued revenue.

- To record an accrued expense.

- To record an accrued revenue.

- To record this period's use of a prepaid expense.

- To record payment of a prepaid expense.

- To record this period's

depreciation expense.

Transcribed Image Text:Entry

1

2

3

4

5

co

6

7

8

9

10

11

Explanation

Cash

Unearned Revenue

Cash

Interest Receivable

Rent Expense

Prepaid Rent

Interest Expense

Journal Entries

Interest Payable

Depreciation Expense

Accumulated Depreciation

Unearned Revenue

Services Revenue

Insurance Expense

Prepaid Insurance

Salaries Payable

Cash

Prepaid Rent

Cash

Salaries Expense

Salaries Payable

Interest Receivable

Debit

1,100

3,400

3,900

4,500

1,800

4,700

6,300

5,700

8,600

7,300

1,900

Credit

1,100

3,400

3,900

4,500

1,800

4,700

6,300

5,700

8,600

7,300

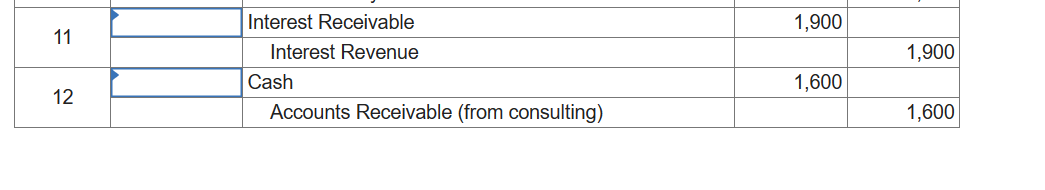

Transcribed Image Text:11

12

Interest Receivable

Interest Revenue

Cash

Accounts Receivable (from consulting)

1,900

1,600

1,900

1,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College