adjusted taxable income

Q: Hershey, Inigo, Jessa and Kyle are partners who share profits and losses in the ratio of 3:2:1:4. As…

A: 14. Given information Partners profits and losses sharing ratio = 3:2:1:4 Capital…

Q: z i The year-end adjusted trial balance of Aggies Corporation included the following account…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: a Company is exiting bankruptcy reorganization with the following accounts: Book Value Fair…

A: Answer : Journal entry : Account title Debit Credit Building (430,000-315,000) $115,000…

Q: Fill in the blanks in the following schedule. Each case is independent of the others. In all cases,…

A: Margin :— It is calculated by dividing net operating income by sales revenue. Turnover :— It is…

Q: ABA Ltd. Has collected the following data and asks you to prepare the Balance Sheet at 12/31/20X2:…

A: A balance sheet is a statement that proves the establishment of an accounting equation. In other…

Q: DDD 14-11 (Condensed Income Statement-Periodic Inventory Method) Presented below are selected ledger…

A: Income statement - is a major portion of an entity's financial statements that reports the financial…

Q: 8 16 Paste FILE Coboard 12 13 24 20 . &.. Cash Budget with Supporting Cash Collections and…

A: The cash budget is the presentation of all the cash incomes and revenues and all the cash costs and…

Q: Account Titles Cash Accounts receivable Prepaid insurance Machinery Accumulated depreciation…

A: The retained earnings are the cumulative profits of the business. The retained earnings are…

Q: (b) Compute the ending inventory using lower-of-average-cost-or-market. Ending inventory at…

A: Ending inventory will be the total inventory to be listed on the balance sheet at the end of the…

Q: Assets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets…

A: Accounting Ratios: Accounting ratios are the mathematical relation between two financial figures to…

Q: Apartments-for-Rent Corporation received cash of $7,200 on August 1, 2020 for one year's rent in…

A: The financial transactions of a firm is usually recorded using the accrual basis of accounting.…

Q: Contracting by Negotiation provides the Government flexibility with the use of the Best Value…

A: The Best Value Continuum is a concept used in the procurement of goods and services by government…

Q: (Answers that are Multiples (x) or Percents (%) should be carried to 1 decimal place or 2 if…

A: NET WORKING CAPITAL Working Capital is the money available to meet your current short-term…

Q: Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total…

A: Statement of financial position is also known as balance sheet of the business. Cash is one of the…

Q: Which of the following is FALSE of the progressive tax system in the U.S. for couples filing a joint…

A: ANSWER:- Option 4: "The average tax rate will be greater than the highest marginal tax rate." is…

Q: 11. LIBERTAD CO., is a VAT registered trader of construction supplies, had the following data for…

A: Value Added Tax: Value added tax is levied by the state government on the consumption of goods and…

Q: The following balances were taken from the books of Sheffield Fabrication Limited on December 31,…

A: Lets understand the basics. There are various stages through which income statement gets prepared.…

Q: On June 1, 2021, Gustav Corp. and Gabby Limited merged to form Carla Vista Inc. A total of 680,000…

A: The fractional ownership interests in a corporation are called shares. Some businesses employ shares…

Q: Sunny Thursday Info Cost of goods sold Depreciation Interest Dividends paid Selling and general…

A: Taxable income is the amount of income which is calculated after deducting all the expenses from the…

Q: Flora Tea Company began operations on January 1, 2022. Flora's adjusted trial balance at December…

A: A closing entry is a type of journal entry made to close the value of temporary accounts to…

Q: Lily Wyatt is unable to reconcile the bank balance at January 31. Lily's reconciliation is as…

A: The management prepares bank reconciliation statements at a particular time period. This statement…

Q: Transaction Analysis and Financial Statements Expert Consulting Services Inc. was organized on March…

A: Accounting equation is the basic premise of accounting. The accounting equation states that total…

Q: 23. A resident corporation is one that a. organized under the laws of the Philippines that does…

A: Resident Corporation A corporation incorporated under Philippine law and conducting business there…

Q: Prepare a multiple-step income statement.

A: Income statement represents the net income or net loss that is calculated by deducting the expenses…

Q: Question. Garcia Corporation purchased a truck by issuing an $80,000, 4-year, zero-interest-bearing…

A: INTRODUCTION: A journal, often known as the Book of Original Entry or the Day Book, is a book that…

Q: On January 1, 2015, Vaughn Manufacturing issued $17820000 of 10% ten-year bonds at 1 The bonds are…

A: Straight line basis is a method of calculating depreciation and amortization, the process of…

Q: Max Wholesaler borrowed $13,000 on a 10%, 120-day note. After 45 days, Max paid $4,550 on the note.…

A: a)Given information is Principal Amount (P) = $13,000 Rate of interest (R) = 10% In…

Q: Mocha Bescco, a firm that provided Operations Research services, bought a karaokemachine 8 years…

A: Depreciation Depreciation is the practice of dispersing a long-term asset's cost over the course of…

Q: marginal tax

A: When a person receives a job offer, he must evaluate it from various aspects, including the salary,…

Q: Explain the differences between right issues and bonus issues. Your answer should include the…

A: INTRODUCTION: Rights shares are sold at a lower price than the market price. Bonus shares are…

Q: You work as a freelance accounting professional and have been recently engaged by the auditors of…

A: Dividend: -Dividend is the distribution from the company profit to its shareholders.

Q: Nichols Inc. issued 3,000 $1,000 bonds at 102. Each bond was issued with one detachable stock…

A: Proportional Method of Allocation between bond and Warrant The division of the proceeds from a bond…

Q: Data table I Plan A: Pay $0.09 per minute of long-distance calling. Plan B: Pay a fixed monthly fee…

A: Budgeting is a process of planning future income and expenses. This make us able to arrange money…

Q: How do total variable costs behave as production increases? (Definition of linear:…

A: There are two main types of costs – fixed costs and variable costs. Fixed costs remains constant…

Q: Question. Prepare a partial balance sheet to indicate how the above contract information would be…

A: Construction company used contract accounting techniques for maintaining its books of accounts in…

Q: Vicksburg Laundry reported assets of $850 and equity of $520. What is Vicksburg's debt ratio? (Round…

A: Accounting Equation :— This equation shows how assets, liabilities and owner's equity are related to…

Q: On January 1, 2017, Gordon Co. enters into a contract to sell a customer a wiring base and shelving…

A: The Cost of Goods Supplied (COGS) is the sum of direct costs incurred for the goods or services…

Q: Pearl Company sells 9% bonds having a maturity value of $1,610,000 for $1,435,895. The bonds are…

A: Amortization schedule is the one which is prepared to show the discount or premium amortization on a…

Q: Sandhill Manufacturing Inc. has the following cost and production data for the month of April. Units…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: upervis employee of XYZ Corporation. He provided the following data for the taxable year 2022:…

A: Total EXEMPT de minimis benefits: P64,000 (rice allowance of P2,500 x 12 months + medical cash…

Q: weighted-average cost of capital

A: Weighted average cost of the capital represents the rate on which the company would be paying to…

Q: b. Apply Pareto analysis to draw conclusions about the combined amount of money in checking and…

A: Pareto analysis: Pareto analysis is know as 80/20 rule. Because 80% results are drawn by 20%. In…

Q: Raw Material inventory $657 $277 Work-in-Process inventory $4473 $1444 Finished Goods inventory…

A: Total Manufacturing Cost :— It is the sum of direct material used, direct labour cost and…

Q: Calculate the 2022 Return on Common Stockholder's Equity ratio.

A: Retrun on stockholders' equity represents the earnings of the company that is entitled to the…

Q: Prepare a journal entries to record the above transactions.(date, account titles and explanations,…

A: The fundamental accounting equation, also called the balance sheet equation, represents the…

Q: Western Manufacturing produces a single product. The original budget for April was based on expected…

A: Variable Cost :— It is the cost that changes with change in activity of cost driver. Variable cost…

Q: The owner of a bicycle repair shop forecasts revenues of $160,000 a year. Variable costs will be…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Your company is considering the purchase of a second-hand scanning microscope at a cost of $10,500,…

A: Depreciation :— It is the allocation of depreciable cost of asset over its useful life.…

Q: Real Estate Tax Property Tax Purchase Price Market Value A. $2,240 C. $26,600 1.4% $160,000 $190,000…

A: Taxes are mandatory payments made to individuals or organizations by the government, whether…

Q: (Select all the answers that apply.) A. As with any analysis using ratios, you should investigate…

A: Both the current ratio and quick ratio are important measures of liquidity. Current ratio is the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

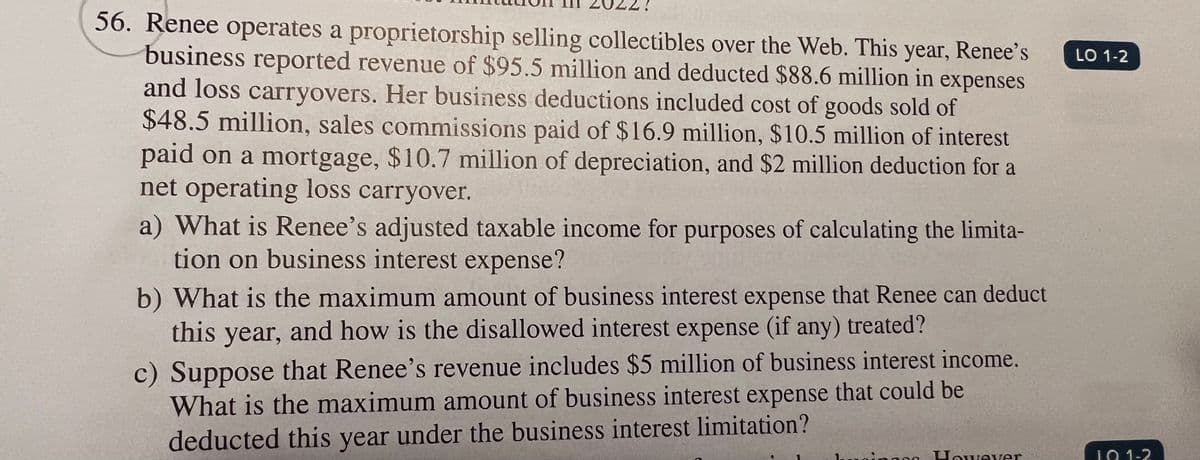

- 47. In preparing the 2021 Annual Income Tax Return of Nicanor, the following information were culled from his accounting records: Gross sales – Php 2,500,000 Cost of sales – Php 1,000,000 Salaries and wages – Php 100,000 Rent Expense – Php 100,000 Depreciation – Php 100,000 Utilities Expense – Php 100,000 Repairs and Maintenance – Php 100,000 Other income: Rental income – Php 1,000,000 Interest income from bank deposits in Bank of the Pelepens – Php 100,000 Dividends from ABC Corp., a DC – Php 100,000 Cash Prizes – Php 100,000 The duly filed 1st quarterly income tax return indicated that Nicanor opted 8% taxation. In addition, he provided…Renee operates a proprietorship selling collectibles over the Web, and last year she purchased a building for $24 million for her business. This year, Rene’s proprietorship reported revenue of $95.5 million and incurred total expenses of $88.6 million. Her expenses included cost of goods sold of $48.5 million. Sales commissions paid of $16.9 million. $10.5 million of interest paid on the building mortgage, and $12.7 million of depreciation. What’s Renee’s adjusted taxable income for purposes of calculating the limitation on business interest expense? What is the maximum amount of business interest expense that Renee can deduct this year, and how is the disallowed interest expense (if any) treated? Suppose that Renee’s revenue includes $5 million of business interest income. What is the maximum amount of business interest expense that could be deducted this year under the business interest limitation?1. John reports the following business transactions: Gross sales - P850,000 Sales discounts - 25,000 Cost of sales - 250,000 Operating expenses - 190,000 Interest income on bank deposits- BPI - 10,000 John also earned a total compensation of P410.020, from a part-time employment of which, P105,000 is excluded from taxation. Compute the taxable income of John which is subject to regular income tax: a. P680,000 b. P690,000 c. P705,000 d. P870,000 2. The negligence of AC, driver of a certain bus company, resulted in the death of JP's wife, physical injuries to JP that prevented him from working for a month, and the total wreck of JP's brand new car which he had bought for P400.000. In the action for damages filed by JP against the bus company, the court awarded the following: • P30,000 for JP's injuries consisting mainly in the loss of his right hand; • P45,000 for JP's loss of one month salary: • P25,000 for the death of his wife: • P100,000 moral damages on account of the…

- Jackel, Inc. has the following information for the current tax year: Gross sales $350,000 Cost of goods sold 50,000 Dividends received from 10% owned domestic corporation 40,000 Operating expenses 30,000 Charitable contributions 45,000 What is Jackel's taxable income? Correct Answer should be $259,000During the year, Irv had the following transactions: Long-term loss on the sale of business use equipment $7,000 Long-term loss on the sale of personal use camper 6,000 Long-term gain on the sale of personal use boat 3,000 Short-term loss on the sale of stock investment 4,000 Long-term loss on the sale of land investment 5,000 How are these transactions handled for income tax purposes?Zhie reports the following business transactions: Gross sales P840,000 Sales discounts 25,000 Cost of sales 250,000 Operating expenses 190,000 Interest income on bank deposits- BPI 10,000 Zhie also earned a total compensation of P410.020, from a part-time employment of which, P105,000 is excluded from taxation. Compute the taxable income of zhie which is subject to regular income tax:

- Trevorson Electronics is a small company privately owned by Jon Trevorson, an electrician whoinstalls wiring in new homes. Because the company’s financial statements are prepared only for taxpurposes, Jon uses the direct write-off method. During 2015, its first year of operations, TrevorsonElectronics sold $30,000 of services on account. The company collected $26,000 of these receivables during the year, and Jon believed that the remaining $4,000 was fully collectible. In 2016,Jon discovered that none of the $4,000 would be collected, so he wrote off the entire amount. Tomake matters worse, Jon sold only $5,000 of services during the year.Required:1. Prepare journal entries to record the transactions in 2015 and 2016.2. Using only the information provided (ignore other operating expenses), prepare comparativeincome statements for 2015 and 2016. Was 2015 really as profitable as indicated by its incomestatement? Was 2016 quite as bad as indicated by its income statement? What should Jon…Last year, lana purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected. a.$7,000 gain b.$3,000 loss c.$13,000 loss d.$2,000 gainVanquish, Incorporated, a C Corporation, had the following items of income and expense during 2021. Gross profit from sales $220,000 Interest income on bank account $3,650 Interest income on State of Missouri Bonds $4,000 [ Long term capital loss on sale of stock $5,000 Wages expense $90,000 Charitable contributions $17,000 Other deductible expenses $57,000 Depreciation – BOOK $10,000 Depreciation – TAX (MACRS) $15,000 Federal income tax credit $2,500 What is Vanquish, Incorporated's tax rate? Solve as we have in class (on your own paper, WORD doc, Excel, etc.) and attach a file showing your work. a) Compute Taxable Income and Tax Due (or Refund) for the Corporation. b) What specific items and amounts from 2021 does the Corporation have to CarryForward? Why?

- In preparing the Annual Income Tax Return of Nicanor, the following information were culled from his accounting records: Gross sales – Php 1,500,000 Cost of sales – Php 500,000 Gross Profit – Php 1,000,000 Operating expenses: Depreciation – Php 100,000 Rent Expense – Php 100,000 Repairs and Maintenance – Php 100,000 Salaries and wages – Php 100,000 Utilities Expense – Php 100,000 Other income: Cash Prizes – Php 100,000 Dividends from ABC Corp. – Php 100,000 Interest income from bank deposits – Php 100,000 Rental income – Php 1,000,000 In addition, you learned that Nicanor intends to sell a residential house and lot which he inherited from his father and 1,000 shares of stocks in a domestic corporation which were sold by her mother to him in the amount of Php 1 Million. He provided you the information the following: Real property classified as capital asset: Zonal value of lot – Php 5 Million Assessor’s fair value of lot – Php 4 Million Assessor’s fair value of house – Php 5 Million…In preparing the Annual Income Tax Return of Nicanor, the following information were culled from his accounting records: Gross sales – Php 1,500,000 Cost of sales – Php 500,000 Gross Profit – Php 1,000,000 Operating expenses: Depreciation – Php 100,000 Rent Expense – Php 100,000 Repairs and Maintenance – Php 100,000 Salaries and wages – Php 100,000 Utilities Expense – Php 100,000 Other income: Cash Prizes – Php 100,000 Dividends from ABC Corp. – Php 100,000 Interest income from bank deposits – Php 100,000 Rental income – Php 1,000,000 In addition, you learned that Nicanor intends to sell a residential house and lot which he inherited from his father and 1,000 shares of stocks in a domestic corporation which were sold by her mother to him in the amount of Php 1 Million. He provided you the…In preparing the Annual Income Tax Return of Nicanor, the following information were culled from his accounting records: Gross sales – Php 1,500,000 Cost of sales – Php 500,000 Gross Profit – Php 1,000,000 Operating expenses: Depreciation – Php 100,000 Rent Expense – Php 100,000 Repairs and Maintenance – Php 100,000 Salaries and wages – Php 100,000 Utilities Expense – Php 100,000 Other income: Cash Prizes – Php 100,000 Dividends from ABC Corp. – Php 100,000 Interest income from bank deposits – Php 100,000 Rental income – Php 1,000,000 In addition, you learned that Nicanor intends to sell a residential house and lot which he inherited from his father and 1,000 shares of stocks in a domestic corporation which were sold by her mother to him in the amount of Php 1 Million. He provided you the…