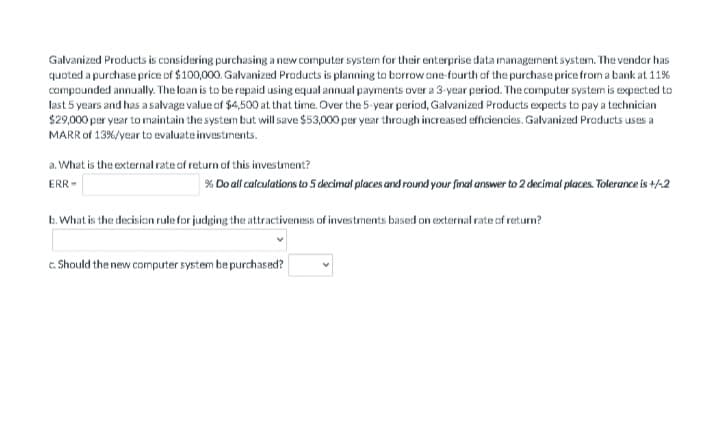

Galvanized Products is considering purchasing a new computer systen for their enterprise data managernent system. The vendor has quoted a purchase price of $100,000. Galvanized Praducts is planning to borrow ane fourth of the purchase price from a bank at 11% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer systern is expectad to last 5 years and has asalvage value of $4,500 at that time. Over the 5-year pariod, Galvanized Products expects to pay a technician $29,000 per ynar to naintain the system but will save $53,000 par year through increased officiencies. Galvanizud Praducts uses a MARR of 13%/year to evaluate investinents. a. What is the external rate of return of this investment? ERR - % Do alf catculations to 5 decimal places and round your final answer to 2 decimal places. Tolerance is +/2 b. What is the decision rule for judging the attractiveness of investments based on external rate of return? c. Should the new computer system be purchasad?

Galvanized Products is considering purchasing a new computer systen for their enterprise data managernent system. The vendor has quoted a purchase price of $100,000. Galvanized Praducts is planning to borrow ane fourth of the purchase price from a bank at 11% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer systern is expectad to last 5 years and has asalvage value of $4,500 at that time. Over the 5-year pariod, Galvanized Products expects to pay a technician $29,000 per ynar to naintain the system but will save $53,000 par year through increased officiencies. Galvanizud Praducts uses a MARR of 13%/year to evaluate investinents. a. What is the external rate of return of this investment? ERR - % Do alf catculations to 5 decimal places and round your final answer to 2 decimal places. Tolerance is +/2 b. What is the decision rule for judging the attractiveness of investments based on external rate of return? c. Should the new computer system be purchasad?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

M2

Transcribed Image Text:Galvanized Products is considering purchasing a new computer system for their enterprise data managernent systen. The vendor has

quoted a purchase price of $100,000. Galvanized Praducts is planning to borrowane fourth of the purchase price from a bank at 11%

compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer systern is expected to

last 5 years and has a salvage value of $4,500 at that time. Over the 5-year period, Galvanized Products expects to pay a technician

$29,000 per year to maintain the system but will save $53,000 per year through increased efficiencies. Galvanized Products uses a

MARR of 13%/year to evaluate investinents.

a. What is the external rate of return of this investment?

ERR -

% Do all calculations to 5 decimal places and round your final answer to 2 decimal places. Tolerance is +/-2

b. What is the decision rule for judging the attractiveness of investments based on external rate of return?

a. Should the new computer system be purchased?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning