FOR THE YEAR ENDED DECEMBER 31, 2020 Sales Revenue Cost of goods sold Gross Margin Selling and administrative expenses Income from operations Other revenues and gains Gain on sale of investments Income bafor tax Income tax expense Net income Cash dividends Income retained in business 6860 4710 2150 920 1230 80 1310 530 780 260 520 Additonal Information: During the year, $120 of common stock was issued in exchange for plant assets. No plant assets were sold in 2020 Prepare a statement of cash flows using the direct method

FOR THE YEAR ENDED DECEMBER 31, 2020 Sales Revenue Cost of goods sold Gross Margin Selling and administrative expenses Income from operations Other revenues and gains Gain on sale of investments Income bafor tax Income tax expense Net income Cash dividends Income retained in business 6860 4710 2150 920 1230 80 1310 530 780 260 520 Additonal Information: During the year, $120 of common stock was issued in exchange for plant assets. No plant assets were sold in 2020 Prepare a statement of cash flows using the direct method

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

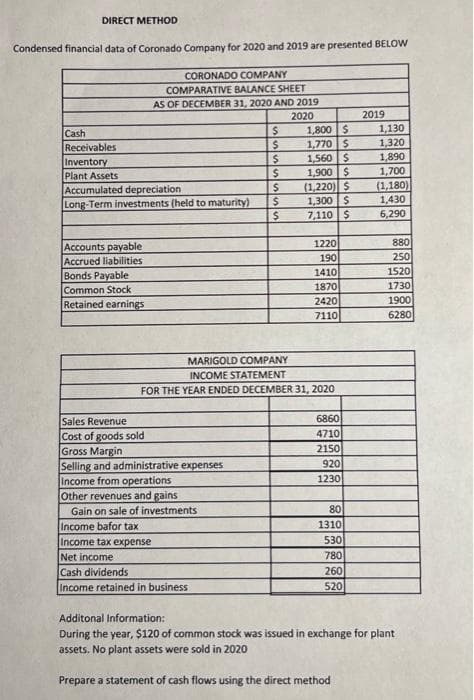

Transcribed Image Text:DIRECT METHOD

Condensed financial data of Coronado Company for 2020 and 2019 are presented BELOW

CORONADO COMPANY

COMPARATIVE BALANCE SHEET

AS OF DECEMBER 31, 2020 AND 2019

2020

Cash

Receivables

Inventory

Plant Assets

Accumulated depreciation

Long-Term investments (held to maturity)

Accounts payable.

Accrued liabilities

Bonds Payable

Common Stock

Retained earnings

Sales Revenue

Cost of goods sold

Gross Margin

Selling and administrative expenses

Income from operations

S

$

Other revenues and gains

Gain on sale of investments

Income bafor tax

Income tax expense

Net income

Cash dividends

Income retained in business

$

$

$

$

$

1,800 $

1,770 S

1,560 $

1,900 $

(1,220) S

1,300 $

7,110 $

MARIGOLD COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2020

1220

190

1410

1870

2420

7110

6860

4710

2150

920

1230

80

1310

530

780

260

520

2019

1,130

1,320

1,890

1,700

(1,180)

1,430

6,290

880

250

1520

1730

1900

6280

Additonal Information:

During the year, $120 of common stock was issued in exchange for plant

assets. No plant assets were sold in 2020

Prepare a statement of cash flows using the direct method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning