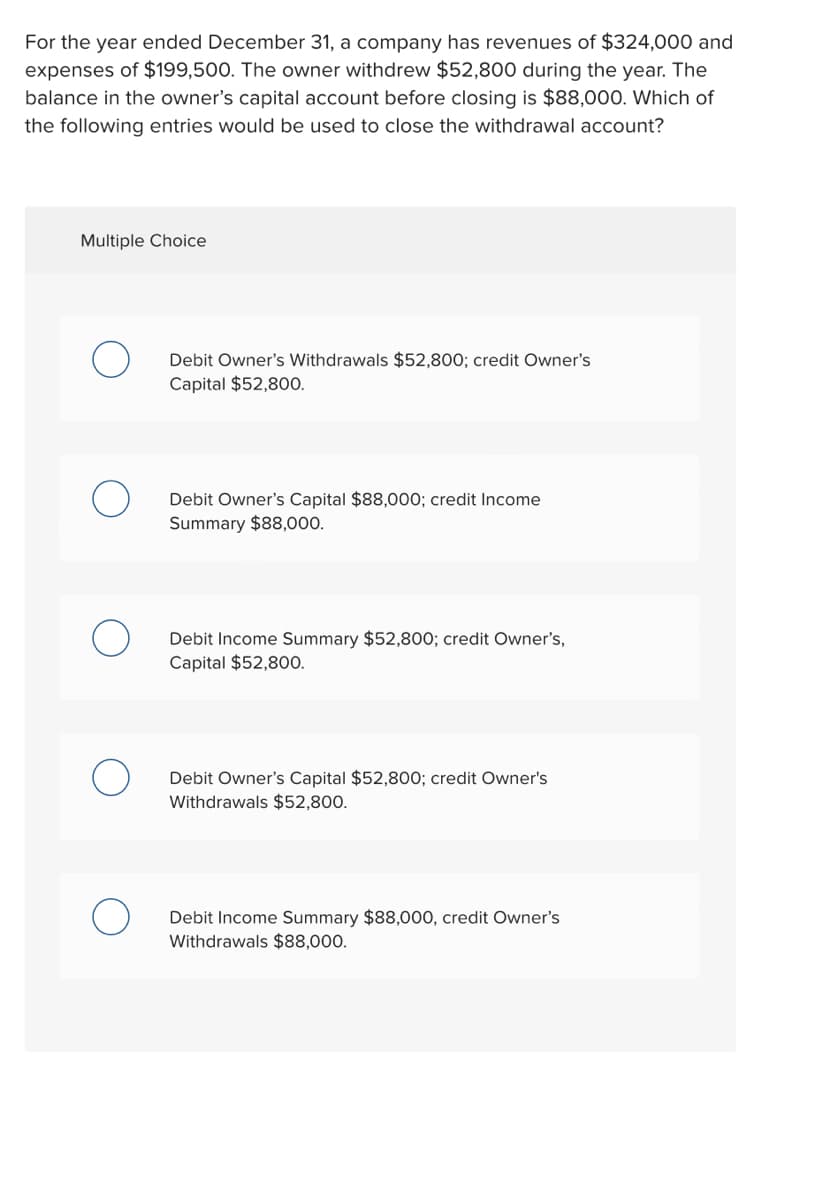

For the year ended December 31, a company has revenues of $324,000 and expenses of $199,500. The owner withdrew $52,800 during the year. The balance in the owner's capital account before closing is $88,000. Which of the following entries would be used to close the withdrawal account? Multiple Choice Debit Owner's Withdrawals $52,800; credit Owner's Capital $52,800. Debit Owner's Capital $88,000; credit Income Summary $88,000. Debit Income Summary $52,800; credit Owner's, Capital $52,800.

Q: X Company, a manufacturer, incurred the following costs in 2021: Selling costs $5,802 Factory superv...

A: Product Cost - Product Cost is the cost incurred by the organization for the product of the entity. ...

Q: Following are two income statements for Alexis Co. for the year ended December 31. The left number c...

A: Journal is the book of original entry in which all the transactions of the business are recorded ini...

Q: On December 1, 2021, ABC Company acquired all the assets and liabilities of XYZ Inc. issuing 100,000...

A: Fair Value of net-assets acquired is equal to total assets minus total liabilities of the company. G...

Q: ABC Ltd. ABC Ltd.’s principal business activity is the assembly of circuit boards. One of the key ma...

A: A risk-based auditing is an approach to identify risks with the greatest potential impact on a bus...

Q: Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in ...

A: Receivable means debtors and turnover mean how many times in a year credit sales is realized. In thi...

Q: Lancelot is a dealer of household appliances. He reported the following in 2019 and 2020: 2019 20...

A: Accrual Basis of accounting means recording transaction on Accrual basis i.e. as and when they inten...

Q: c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incu...

A: adjusting entry is passed when transactions occurs at the end of accounting period to record any inc...

Q: The following items are reported on a company's balance sheet: Cash $550,800 Marketable securities 4...

A: Ratio analysis helps to analyze the financial statements of the company. The management can take dec...

Q: XYZ Co had the following accounts at the time it was acquired by ABC Inc (see image below). ABC paid...

A: Fair value of net identifiable assets = P133,000 + P900,000 - P10,000 = P1,023,000

Q: Which of the following activities in not an element of a CPA firm's quality control system to be con...

A: The effectiveness of a company's quality control system is primarily reliant on its employees' abili...

Q: In preparing a statement of cash flows, which of the following transactions would be considered an i...

A: solution concept cash flow statement consists of -cash flow from operating activitie...

Q: The following information is departmental cost allocation with two service departments and two produ...

A: Lets understand the basics. In this method, cost of the service department is allocated to another s...

Q: On January 1, 2019, an entity purchased 15,000 shares of another entity representing a 12% interest ...

A: Profit and loss Account In the profit and loss account which includes all type of revenues and expen...

Q: Record adjusting journal entries for each separate case below for year ended December 31. Assume no ...

A: Adjusting Entry – These entries make the cash transaction the accrual one. Adjusting entries do not ...

Q: Problem 6-9B Record transactions and prepare a partial income statement using a periodic in system (...

A: The periodic inventory method does not keep record for cost of goods sold with every purchase transa...

Q: XYZ Co had the following accounts at the time it was acquired by ABC Inc (see image below). ABC paid...

A: Cost of acquisition means total expenses incurred by entity to purchase other entity or assets.

Q: 5. The following account balances were taken from the 2021 adjusted trial balance of the Bowler Corp...

A: Income Statement is the statement which shows the net income earned or net loss incurred by the comp...

Q: Use the following information for the next five questions:On January 1, 2021, ABC Co. acquired all o...

A: Answer: Fair value of consideration = Total equity capital and premium after combination - Equity ca...

Q: ABC paid finder's fees of P80,000, legal fees of P26,000, audit fees related to stock issuance of P2...

A: Acquisitions method refers to a industry dominant company acquiring another company. In order to acq...

Q: 6. ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On Janua...

A: When a company acquires all the shares of another company, all the assets and liabilities of the tra...

Q: Required information [The following information applies to the questions displayed below.] Following...

A: Journal is the book of primary entry. All the transactions are recorded initially in the journal,acc...

Q: During 2014, Search Company which uses the allowance method of accounting for doubtful accounts, rec...

A: Cash flows from operating activities is one of the important section of cash flows statement which s...

Q: BC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January 1...

A: Solution given Purchase price 40000 Fair value of current assets of XYZ 26000 Fair v...

Q: ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January ...

A: Current Assets of Combined Entity = Current Assets of ABC + Current Assets of XYZ (Fair Value) Not...

Q: Required information Use the following information for the Exercises below. (Algo) 1 [The following ...

A: >Process costing includes calculation of Equivalent units and cost per equivalent units. >...

Q: Cash of $12,000 will be received in year 6. Assuming an opportunity cost of capital of 7.2%, which o...

A: Future value is the amount of to be received or paid in future by taking into account the discountin...

Q: On January 2, 2020, P Company acquired 80% interest in S Company for P4,125,000 cash. On this date, ...

A: Consolidation is the process where a company acquires various small companies by obtaining controlli...

Q: Question 3 Which of the following is an analytical procedure that an auditor most likely would perfo...

A: Audit: It implies to the detailed examination and investigation of company's financial records so as...

Q: Which of the following is not added to net income as an adjustment to reconcile net income to cash f...

A: Cash flows from operating activities is one of the important section of cash flows statement which s...

Q: When a company pays dividends a) the dividends account will be decreased with a debit. b) it doesn't...

A: >Dividends are the payments made to the stockholders for the amount invested by them in form of c...

Q: АВС Со (carrying amounts) (fair values) 9,600,000 XYZ Inc Combined entifiable assets 6,400,000 16,00...

A: In case of acquisition, goodwill to be recognise in the books of account if purchase consideration i...

Q: What does the balance sheet measure? What is the “ Accounting Equation” used in a balance sheet?

A: The financial statements of the business include the balance sheet and income statement.

Q: PROBLEM 4 July Corporation uses process costing in its two producing departments. In Department 2, i...

A:

Q: The following information is extracted from a recent year's financial records of a company which mak...

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or str...

Q: After preparing and posting the closing entries for revenues and expenses, the income summary accoun...

A: Closing entries are made every year in order to ascertain the results. For a manufacturing concern...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: The multi-step Income Statement is a detailed vertical format income statement in which we can have ...

Q: Other accrued liabilities—real estate taxes Glennelle’s Boutique Inc. operates in a city in which r...

A: The real estate tax bills for 2019 are received only in May 2020. However, the firm has already incu...

Q: Freedom Co. purchased a new machine on July 2, 2019, at a total installed cost of $132,000. The mach...

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of th...

Q: On quesiton C: Johnson’s borrowed $282,000 at a(n) 9 percent annual interest rate on April 1 of the...

A: Adjusting entries are those journal entries which are passed at the end of accounting period in orde...

Q: Johnson Corporation acquired all of the outstanding common stock of Smith Corporation for $12,200,00...

A: Goodwill is the amount of excess of consideration paid over the fair value of net assets of the acqu...

Q: Explain: Understanding the intentions of accounting students to pursue career as a professional acco...

A: Answer: There are wide variety of scope for accounting field. Accounting field students have career...

Q: 6. ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On Janua...

A: Consolidated financial statements are being prepared for combining and consolidating two entities, i...

Q: what is the difference between imprest fund system and fluctuating fund system?

A: Petty cash funds are funds established for the purpose of small petty expenses in the business. Pett...

Q: Problem 6-3B Record transactions and prepare a partial income statement using a perpetual inventory ...

A: The perpetual inventory system updates the sales and purchase of inventory with every transaction ma...

Q: By how much did Declan's Designs' Gross PPE decrease during 2022? Please do not provide the net chan...

A: The fixed asset such as Property, plant and equipment get decreased by sale of assets during the per...

Q: ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On January ...

A: solution given Purchase price 40000 Fair value of current assets of XYZ 26000 Fair v...

Q: Statement of Earnings, Statement of Retained Earnings, and Statement of Financial Position McDonald...

A: The income statement, along with the balance sheet and the statement of cash flows, is one of three ...

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: solution given Number of ABC co’s share 60000 Par value per share 40 Fair value of i...

Q: se the following information for the next five questions:On January 1, 2021, ABC Co. acquired all of...

A: solution given Number of ABC co’s share 60000 Par value per share 40 Fair value of i...

Q: BC paid finder's fees of P80,000, legal fees of P26,000, audit fees related to stock issuance of P20...

A: solution concept as per the provision of IFRS 3 The direct and indirect cost related to business acq...

The closing entries are prepared to close the temporary accounts of the business including revenue, expenses, Drawings, dividend, etc.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- After all revenue and expenses have been closed at the end of the fiscal period ended December 31, Income Summary has a debit of 45,550 and a credit of 36,520. On the same date, D. Mau, Drawing has a debit balance of 12,000 and D. Mau, Capital had a beginning credit balance of 63,410. a. Journalize the entries to close the remaining temporary accounts. b. What is the new balance of D. Mau, Capital after closing the remaining temporary accounts? Show your calculations.For each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Accounts Payable B. Accounts Receivable C. Cash D. Dividends E. Fees Earned Revenue F. Insurance Expense G. Prepaid Insurance H. SuppliesThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?For each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Retained Earnings B. Prepaid Rent C. Rent Expense D. Rent Revenue E. Salaries Expense F. Salaries Payable G. Supplies Expense H. Unearned Rent RevenueDetermining an Ending Account Balance Jessies Accounting Services was organized on June 1. The company received a contribution of $1,000 from each of the two principal owners. During the month, Jessies Accounting Services provided services for cash of $1,400 and services on account for $450, received $250 from customers in payment of their accounts, purchased supplies on account for $600 and equipment on account for $1,350, received a utility bill for $250 that will not be paid until July, and paid the full amount due on the equipment. Use a T account to determine the companys Cash balance on June 30.

- On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services rendered on December 31, 20Y7. How would you record the January 24 transaction, using the accrual basis? A. Increase Cash, $5,700; decrease Fees Earned, $5,700 B. Increase Accounts Receivable, $5,700; increase Fees Earned, $5,700 C. Increase Cash, $5,700; decrease Accounts Receivable, $5,700 D. Increase Cash, $5,700; increase Fees Earned, $5,700On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.