Problem 6-9B Record transactions and prepare a partial income statement using a periodic in system (LO6-8) [The following information applies to the questions displayed below.] At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions oc month of June. June 2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45. June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310. June 8 Return defective radios to Radio World and receive credit, $400. June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750. June 18 Receive payment on account from customers, $3,100. June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30. June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150. June 26 Return damaged radios to Sound Unlimited and receive credit of $500. June 28 Pay Sound Unlimited in full.

Problem 6-9B Record transactions and prepare a partial income statement using a periodic in system (LO6-8) [The following information applies to the questions displayed below.] At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions oc month of June. June 2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45. June 4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310. June 8 Return defective radios to Radio World and receive credit, $400. June 10 Pay Radio World in full. June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750. June 18 Receive payment on account from customers, $3,100. June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30. June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150. June 26 Return damaged radios to Sound Unlimited and receive credit of $500. June 28 Pay Sound Unlimited in full.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter5: Inventories And Cost Of Goods Sold

Section: Chapter Questions

Problem 5.24MCE

Related questions

Topic Video

Question

![!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 2

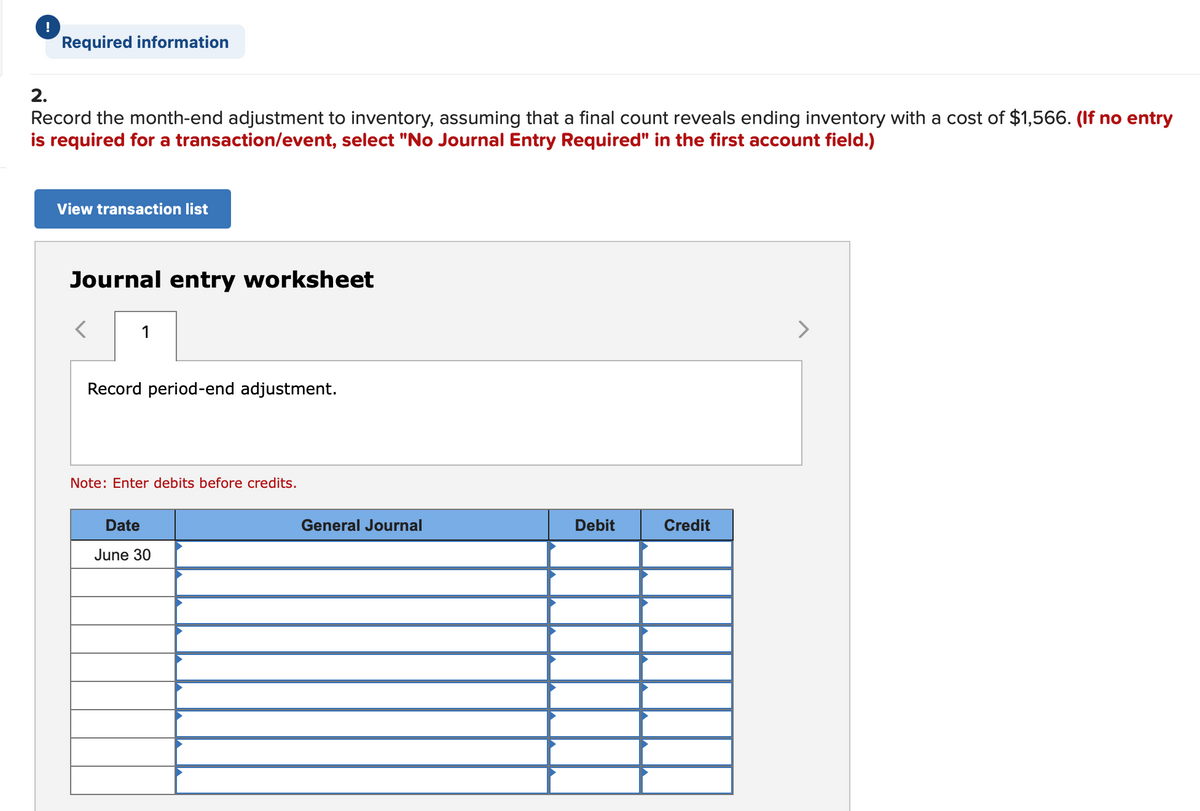

2.

Record the month-end adjustment to inventory, assuming that a final count reveals ending inventory with a cost of $1,566. (If no entry

is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcc35bfef-1e1d-4e62-a745-481127990680%2F470834a0-5218-42ef-aae3-a62863901b53%2Fwtnn8t_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

Problem 6-9B Record transactions and prepare a partial income statement using a periodic inventory

system (LO6-8)

[The following information applies to the questions displayed below.]

At the beginning of June, Circuit Country has a balance in inventory of $2,550. The following transactions occur during the

month of June.

2 Purchase radios on account from Radio World for $2,250, terms 2/15, n/45.

4 Pay cash for freight charges related to the June 2 purchase from Radio World, $310.

8 Return defective radios to Radio World and receive credit, $400.

June

June

June

June 10 Pay Radio World in full.

June 11 Sell radios to customers on account, $4,100, that had a cost of $2,750.

June 18 Receive payment on account from customers, $3,100.

June 20 Purchase radios on account from Sound Unlimited for $3,350, terms 2/10, n/30.

June 23 Sell radios to customers for cash, $4,850, that had a cost of $3,150.

June 26 Return damaged radios to Sound Unlimited and receive credit of $500.

June 28 Pay Sound Unlimited in full.

Problem 6-9B Part 2

2.

Record the month-end adjustment to inventory, assuming that a final count reveals ending inventory with a cost of $1,566. (If no entry

is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

Transcribed Image Text:!

Required information

2.

Record the month-end adjustment to inventory, assuming that a final count reveals ending inventory with a cost of $1,566. (If no entry

is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

1

>

Record period-end adjustment.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

June 30

Expert Solution

Step 1 Introduction

The periodic inventory method does not keep record for cost of goods sold with every purchase transaction.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage