For the year, partnership net income was P420,000. Compute the ending capital for each partner:

For the year, partnership net income was P420,000. Compute the ending capital for each partner:

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 3SEB

Related questions

Question

100%

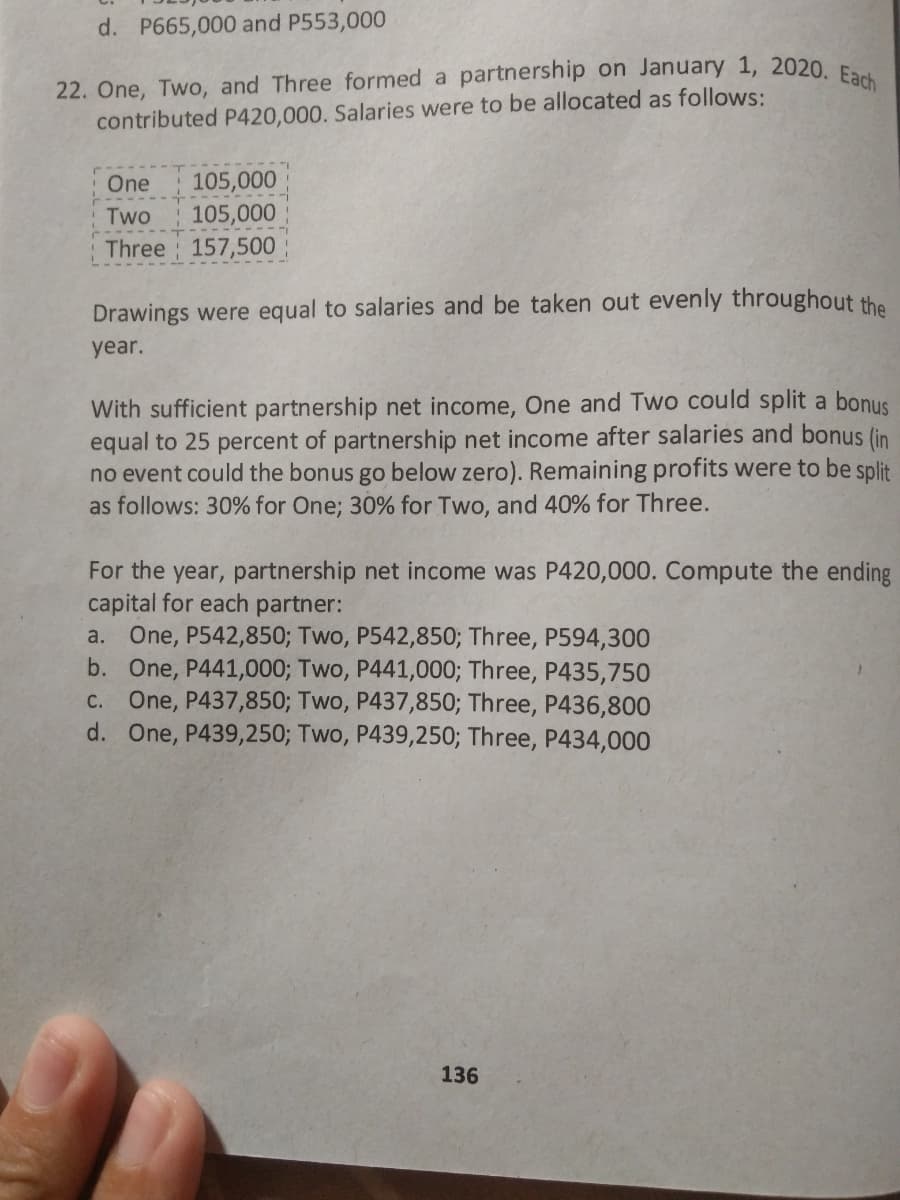

Transcribed Image Text:22. One, Two, and Three formed a partnership on January 1, 2020. Each

d. P665,000 and P553,000

contributed P420,000. Salaries were to be allocated as follows:

One

105,000

Two

105,000

Three 157,500

Drawings were equal to salaries and be taken out evenly throughout the

year.

With sufficient partnership net income, One and Two could split a bonuS

equal to 25 percent of partnership net income after salaries and bonus (in

no event could the bonus go below zero). Remaining profits were to be split

as follows: 30% for One; 30% for Two, and 40% for Three.

For the year, partnership net income was P420,000. Compute the ending

capital for each partner:

a. One, P542,850; Two, P542,850; Three, P594,300

b. One, P441,000; Two, P441,000; Three, P435,750

c. One, P437,850; Two, P437,850; Three, P436,800

d. One, P439,250; Two, P439,250; Three, P434,000

136

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College