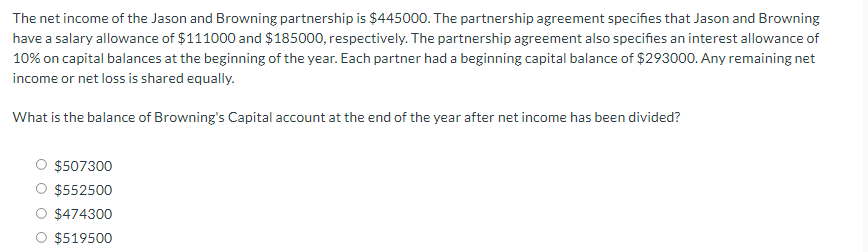

The net income of the Jason and Browning partnership is $445000. The partnership agreement specifies that Jason and Browning have a salary allowance of $111000 and $185000, respectively. The partnership agreement also specifies an interest allowance of 10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $293000. Any remaining net income or net loss is shared equally. What is the balance of Browning's Capital account at the end of the year after net income has been divided? O $507300 O $552500 O $474300 O $519500

The net income of the Jason and Browning partnership is $445000. The partnership agreement specifies that Jason and Browning have a salary allowance of $111000 and $185000, respectively. The partnership agreement also specifies an interest allowance of 10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $293000. Any remaining net income or net loss is shared equally. What is the balance of Browning's Capital account at the end of the year after net income has been divided? O $507300 O $552500 O $474300 O $519500

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 12DQ

Related questions

Question

Transcribed Image Text:The net income of the Jason and Browning partnership is $445000. The partnership agreement specifies that Jason and Browning

have a salary allowance of $111000 and $185000, respectively. The partnership agreement also specifies an interest allowance of

10% on capital balances at the beginning of the year. Each partner had a beginning capital balance of $293000. Any remaining net

income or net loss is shared equally.

What is the balance of Browning's Capital account at the end of the year after net income has been divided?

$507300

$552500

$474300

$519500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College