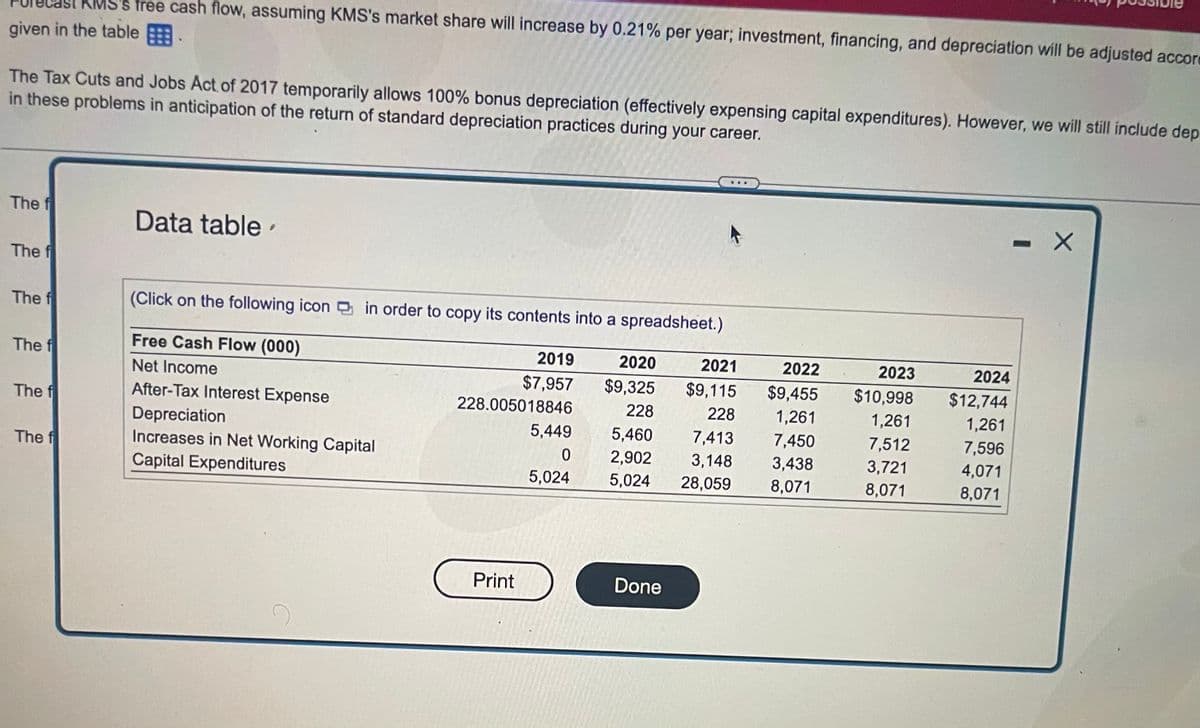

Forecast KMS's free cash flow, assuming KMS's market share will increase by 0.21% per year, investment, financing, and depreciation will be adjusted accordingly, and working capital will be as given in the table The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. The free cash flow in 2019 will be $ The free cash flow in 2020 will be $ The free cash flow in 2021 will be $ The free cash flow in 2022 will be $ The free cash flow in 2023 will be $ The free cash flow in 2024 will be $ thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) (...)

Forecast KMS's free cash flow, assuming KMS's market share will increase by 0.21% per year, investment, financing, and depreciation will be adjusted accordingly, and working capital will be as given in the table The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. The free cash flow in 2019 will be $ The free cash flow in 2020 will be $ The free cash flow in 2021 will be $ The free cash flow in 2022 will be $ The free cash flow in 2023 will be $ The free cash flow in 2024 will be $ thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) thousand. (Round to the nearest integer.) (...)

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

The second image is the data table in the question (first image)

Transcribed Image Text:'s tree cash flow, assuming KMS's market share will increase by 0.21% per year; investment, financing, and depreciation will be adjusted accord

given in the table.

The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include dep

in these problems in anticipation of the return of standard depreciation practices during your career.

The f

The f

The f

The f

The f

The f

Data table.

(Click on the following icon in order to copy its contents into a spreadsheet.)

Free Cash Flow (000)

Net Income

After-Tax Interest Expense

Depreciation

Increases in Net Working Capital

Capital Expenditures

2019

$7.957

228.005018846

Print

5,449

0

5,024

2022

2020

2021

$9,325 $9,115 $9,455

228

228

1,261

5,460

7,413

7,450

2,902

3,148

3,438

5,024 28,059

8,071

Done

2023

$10,998

1.261

7,512

3,721

8,071

2024

$12,744

1,261

7,596

4,071

8,071

O

X

Transcribed Image Text:←

Forecast KMS's free cash flow, assuming KMS's market share will increase by 0.21% per year; investment, financing, and depreciation will be adjusted accordingly; and working capital will be as

given in the table.

The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and

in these problems in anticipation of the return of standard depreciation practices during your career.

The free cash flow in 2019 will be $

The free cash flow in 2020 will be $

The free cash flow in 2021 will be $

The free cash flow in 2022 will be $

The free cash flow in 2023 will be $

The free cash flow in 2024 will be $

thousand. (Round to the nearest integer.)

thousand. (Round to the nearest integer.)

thousand. (Round to the nearest integer.)

thousand. (Round to the nearest integer.)

thousand. (Round to the nearest integer.)

thousand. (Round to the nearest integer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College