Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter14: Real Options

Section: Chapter Questions

Problem 3MC: Tropical Sweets is considering a project that will cost $70 million and will generate expected cash...

Related questions

Question

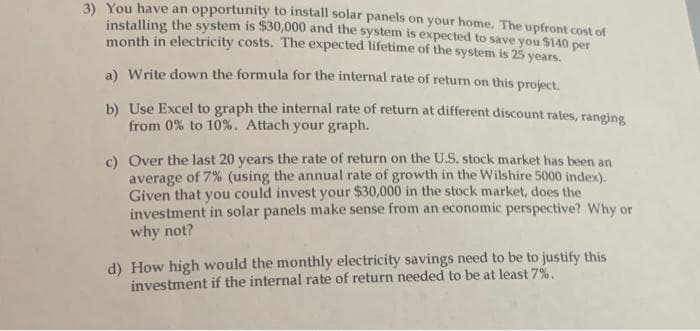

Transcribed Image Text:3) You have an opportunity to install solar panels on your home. The upfront cost of

installing the system is $30,000 and the system is expected to save you $140 per

month in electricity costs. The expected lifetime of the system is 25 years.

a) Write down the formula for the internal rate of return on this project.

b) Use Excel to graph the internal rate of return at different discount rates, ranging

from 0% to 10%. Attach your graph.

c) Over the last 20 years the rate of return on the U.S. stock market has been an

average of 7% (using the annual rate of growth in the Wilshire 5000 index).

Given that you could invest your $30,000 in the stock market, does the

investment in solar panels make sense from an economic perspective? Why or

why not?

d) How high would the monthly electricity savings need to be to justify this

investment if the internal rate of return needed to be at least 7%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning