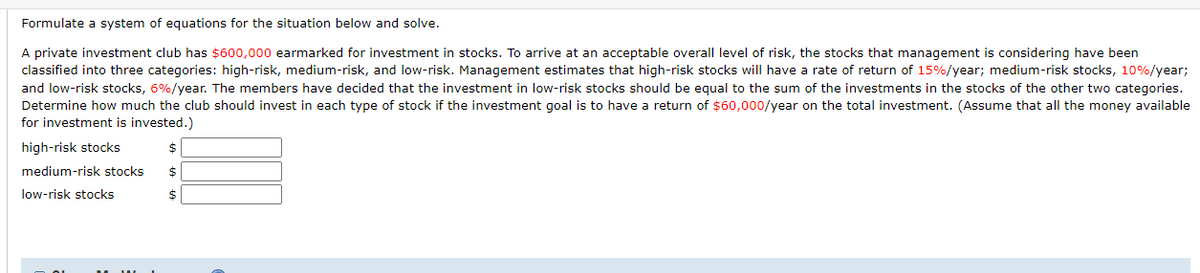

Formulate a system of equations for the situation below and solve. A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 15%/year; medium-risk stocks, 10%/year; and low-risk stocks, 6%/year. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested.) high-risk stocks 2$ medium-risk stocks $4 low-risk stocks 2$

Formulate a system of equations for the situation below and solve. A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 15%/year; medium-risk stocks, 10%/year; and low-risk stocks, 6%/year. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested.) high-risk stocks 2$ medium-risk stocks $4 low-risk stocks 2$

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 39EQ

Related questions

Question

Please explain process.

Transcribed Image Text:Formulate a system of equations for the situation below and solve.

A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been

classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 15%/year; medium-risk stocks, 10%/year;

and low-risk stocks, 6%/year. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories.

Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available

for investment is invested.)

high-risk stocks

%24

medium-risk stocks

$

low-risk stocks

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL