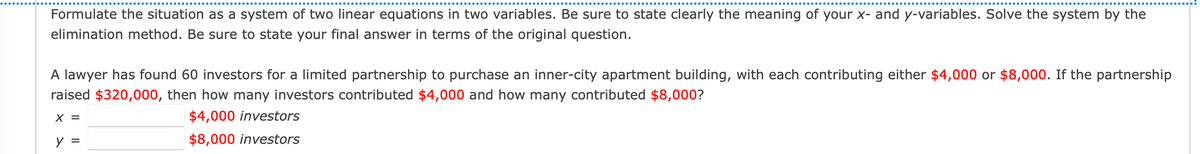

Formulate the situation as a system of two linear equations in two variables. Be sure to state clearly the meaning of your x- and y-variables. Solve the system by the elimination method. Be sure to state your final answer in terms of the original question. A lawyer has found 60 investors for a limited partnership to purchase an inner-city apartment building, with each contributing either $4,000 or $8,000. If the partnership raised $320,000, then how many investors contributed $4,000 and how many contributed $8,000? X = $4,000 investors $8.000 investors

Formulate the situation as a system of two linear equations in two variables. Be sure to state clearly the meaning of your x- and y-variables. Solve the system by the elimination method. Be sure to state your final answer in terms of the original question. A lawyer has found 60 investors for a limited partnership to purchase an inner-city apartment building, with each contributing either $4,000 or $8,000. If the partnership raised $320,000, then how many investors contributed $4,000 and how many contributed $8,000? X = $4,000 investors $8.000 investors

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 33P

Related questions

Question

2.6h

Transcribed Image Text:Formulate the situation as a system of two linear equations in two variables. Be sure to state clearly the meaning of your x- and y-variables. Solve the system by the

elimination method. Be sure to state your final answer in terms of the original question.

A lawyer has found 60 investors for a limited partnership to purchase an inner-city apartment building, with each contributing either $4,000 or $8,000. If the partnership

raised $320,000, then how many investors contributed $4,000 and how many contributed $8,000?

X =

$4,000 investors

y =

$8,000 investors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT