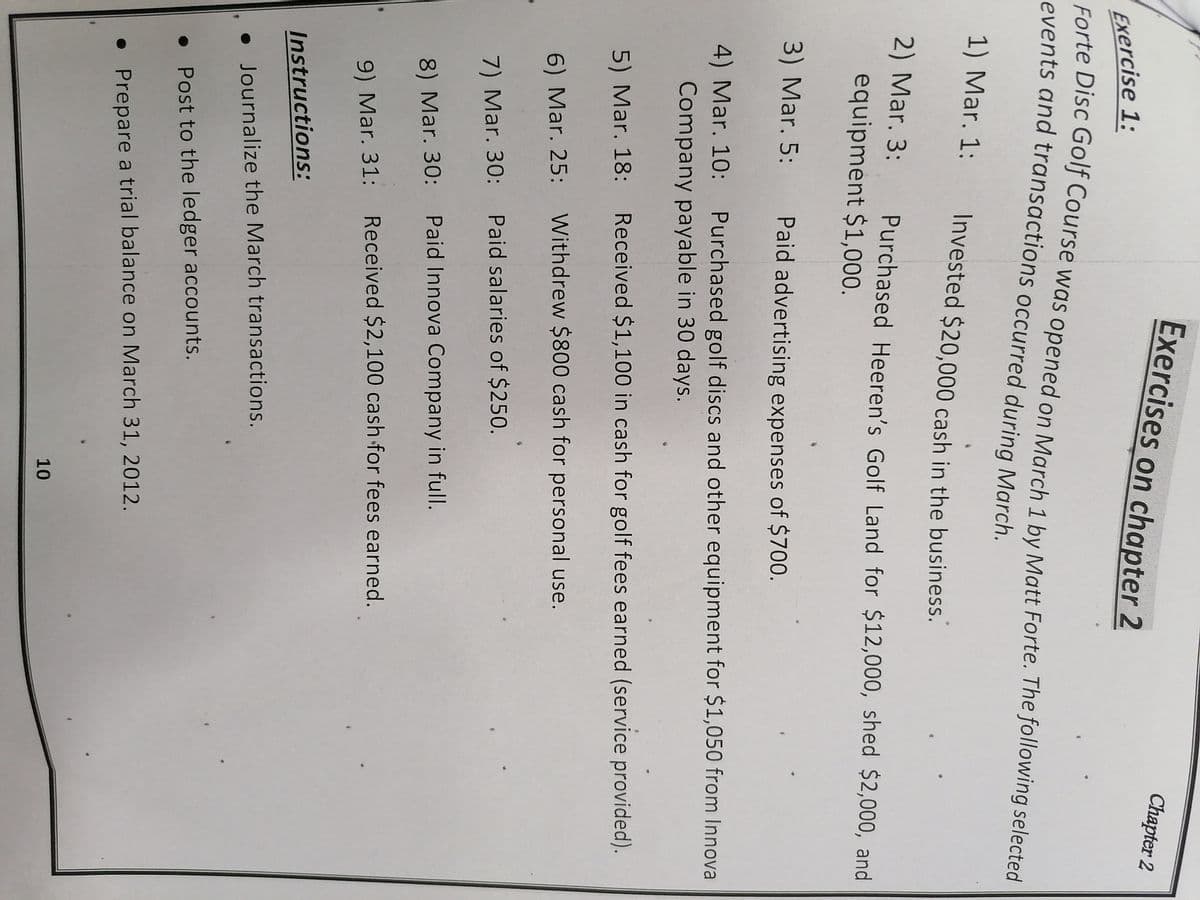

Forte Disc Golf Course was opened on March 1 by Matt Forte. The following selected events and transactions occurred during March. 1) Mar. 1: Invested $20,000 cash in the business. 2) Mar. 3: Purchased Heeren's Golf Land for $12,000, shed $2,000, and equipment $1,000. 3) Mar. 5: Paid advertising expenses of $700. 4) Mar. 10: Purchased golf discs and other equipment for $1,050 from Innova Company payable in 30 days. 5) Mar. 18: Received $1,100 in cash for golf fees earned (service provided). 6) Mar. 25: Withdrew $800 cash for personal use. 7) Mar. 30: Paid salaries of $250. 8) Mar. 30: Paid Innova Company in full. 9) Mar. 31: Received $2,100 cash for fees earned. Instructions: • Journalize the March transactions.

Q: Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus…

A: Net income is calculated after analysing the revenue and expenses of the organisation.

Q: For each of the following situations write the principle, assumption, or concept that justifies or…

A: Accounting principles are the set of rules and guidelines which helps the management in preparing…

Q: On April 1 Jiro Nozomi created a travel agency, Adventure Travel. The following transactions occured…

A:

Q: Carl Redmon completed the following transactions during December: Dec 2 Invested $25,000 to start a…

A: Since you have asked 3 questions under a single question. We have solved the first question of it.…

Q: Comprehensive Problem Set On July 1, Lula Plume created a new self-storage business, Safe Storage…

A: Journal is the recording of financial transactions, which is considered as the first step in…

Q: On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Marjorie Knaus, an architect, organized Knaus Architects on January 1, 20Y4. During the month, Knaus…

A: T-account: T-account refers to an individual account, where the increases or decreases in the value…

Q: On July 1, Lula Plume created a new self-storage business, Safe Storage Co. The following…

A: Unadjusted Trial Balance - Unadjusted Trial Balance is the trial balance before making adjustments.…

Q: On July1 1, 2016, Mr. Jan Jacob C. Solon opened the Hubbies Hair and Beauty Salon. The following…

A: T-Accounts are the general ledgers made for recording of all the financial transactions & which…

Q: Frontier Park was started on April 1 by M. Preston. The following selected events and transactions…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Bradley's Miniature Golf and Driving Range Inc. was opened on March 1 by Bob Dean. These selected…

A: Calculation of transactions till March 10:

Q: Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the…

A: 1. Accounting Equation - Accounting Equation is calculated using following equation - Assets =…

Q: Garwood Marine is a boat repair yard, During August its transactions included the following . 1. On…

A: Journal entry means the entry in prime book with chronological order. Journal entry should have…

Q: Leora Diamond began a professional practice on June 1 and plans to prepare financial statements at…

A: Since we answer up to 3 sub-parts, we'll answer the first 3. Please resubmit the question and…

Q: Abdullah Engineering completed the following transactions in the month of June. a. Amina Abdullah,…

A: 1. Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: pany purchased land worth $51,000 for an office by paying $9,100 cash and signing a long-term note…

A: Journal Entries record the business transaction in the company books. The journal entry is then…

Q: Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus…

A: T-accounts refer to the ledger accounts prepared to get the transactions and balance related to a…

Q: Gonzalez Engineering completed the following transactions in the month of June. Using the following…

A: Income statement is the financial statement which is prepared by the entity to determine the gross…

Q: Aracel Engineering completed the following transactions in the month of June. 1. J. Aracel, the…

A: A journal entry is used to record the day-to-day transactions of an organization by debiting and…

Q: Journalizing

A: Journal entries are as follows:

Q: For each adjustment, indicate the income statement and balance sheet account affected, and the…

A: The Adjustments entries are very much important for any company as it helps in showing the correct…

Q: Aracel Engineering completed the following transactions in the month of June. Using the following…

A: 1. Retained Earnings - Retained Earnings is the retained accumulated profit of the company over the…

Q: Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the…

A: Accounting equation refers to the equation which represents company's total assets are equal to the…

Q: The following transactions, among others, occurred during August. Which transaction represented an…

A: As per the accrual basis of accounting, the expenses are recorded in the month in which they occur.…

Q: Lita Lopez started Biz Consulting, a new business, and completed the following transactions during…

A: Accounting equation is given as follows:- Assets = Liabilities + Owner's Equity Where, closing…

Q: Using info from first to do trail balance

A: Trial balance is as follows:

Q: Al Ramos, a dentist, opened his own dental clinic on May 1 of the current year, During the first…

A: The ledger includes the posting of journal transaction accounts in order to prepare trial balances…

Q: Architects completed the following transactions: A. Issued common stock to Marjorie Knaus in…

A: Step 1 Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for…

Q: On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions…

A: Introduction:- A journal entry is the act of recording or keeping track of any financial or…

Q: During March, the activities of Evergreen Landscaping included the following transactions and…

A: We have the following information: Purchased a copying machine for $2,750 cash. Paid $192 for…

Q: Doris Stewart started her practice as a design consultant on September 1, 2012. During the first…

A: Journal entry is the process of recording the business transactions in the accounting books for the…

Q: Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the…

A: Journal entries are the primary step to record transactions in the books of accounts. The debit and…

Q: Neva Nadal started a new business, Nadal Computing, and completed the following transactions during…

A: According to an accounting equation, assets = Liabilities + owner's equity

Q: June, Ming Chen (the owner) completed these transactions. a. Owner invested $63,000 cash in the…

A: Each transaction shall affect at least 2 transactions in the accounting equation.

Q: on april 1 Jiro Nozomi created a new travel agency, adventure travel. the following transactions…

A: Post-closing trial balance: The post-closing trial balance is a summary of all ledger accounts, and…

Q: Aracel Engineering completed the following transactions in the month of June. Jenna Aracel,…

A: Ledgers - After recording transactions in the journal next step is to transfer them into ledgers.…

Q: Colon Transportation, Inc. was formed to provide bus services for a fee to public and private…

A: Journal Entry: It is the act of keeping or making records of any economic or non-economic…

Q: Ken Jones, an architect, organized Jones Architects on April 1, 20Y2. During the month, Jones…

A: T accounts: The 'T Account' is a graphic visual representation of any individual accounts in the…

Q: Mr. Leo Cruz opened a car rental business; transactions for the first month of the operation are the…

A: A company prepares these accounts in the following way:-

Q: Lita Lopez started Biz Consulting, a new business, and completed the following transactions during…

A: Accounting Equation :— It is the basic relationship between assets, liabilities and owner's equity.…

Q: L. Martin

A: solutions;

Q: Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the…

A: 1) Sl.no Particulars PR Debit Amount Credit Amount a Cash 101 $100,000…

Q: |Holz Disc Golf Course was opened on March 1 by lan Holz. The following selecte events and…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Leora Diamond began a professional practice on June 1 and plans to prepare financial statements at…

A: Accounting Equation is foundation of Double entry Accounting System . Simple Accounting equation is…

Q: Aracel Engineering completed the following transactions in the month of June. Using the following…

A: Journal entries shows the recording of the transactions during an accounting year and every…

Q: Business transactions completed by Hannah Venedict during the month of September are as follows. a.…

A: Journal in book keeping and accounting is a log book to keep record of the monetary transactions…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- Exercise 2-40 Transaction Analysis Amanda Webb opened a home health care business under the name Home Care Inc. During its first month of operations. the business had the following transactions: Issued common stock to Ms. Webb and other stockholders in exchange for $30,000 cash. Paid $18,500 cash for a parcel of land on which the business will eventually build an office building. Purchased supplies for $2350 on credit. Used the supplies purchased in Transaction c. Paid rent for the month on office space and equipment. $800 cash. Performed services for clients in exchange for $3,910 cash. Paid salaries for the month. $1,100. Paid $650 cash for advertising in the current month. Paid $1,900 on account for supplies purchased in Transaction c. Performed services for clients on credit in the amount of 51,050. Paid a $600 dividend to stockholders Required: Prepare an analysis of the effects of these transactions on the accounting equation of the business. Use the format below.Exercise 2-49 Journalizing Transactions Kauai Adventures rams and sells surfboards, snorkeling, and scuba equipment. During March, Kauai engaged in the following transactions: March 2 Received $51,500 cash from customers for rental, 3 Purchased on credit ten new surfboards (which Kauai classifies as inventory) for $180 each. 6 Paid wages to employees in the amount of $9,200. 9 Paid office rem for the month in L1]: amount of$l,000. 12 Purchased a new Ford truck for 340.800: paid 51,000 down in cash and secured a loan from Princeville Bank for the $39,800 balance. March 13 Collected a $1,050 account receivable. 16 Paid an account payable in the amount of $950. 23 Borrowed $10,000 on a 6-month, 8% note payable. 27 Paid the monthly telephone hill of $185. 30 Paid a monthly advertising bill of $1,550. Required: Prepare a journal entry for each of these transactions.Brief Exercise 2-30 Transaction Analysis Galle Inc. entered into the following transactions during January. Borrowed $50,000 from First Street Bank by signing a new payable. Purchased $25,000 of equipment for cash. (Continued) Paid $500 to landlord for rent for January. Performed services for customers on account, $10,000. Collected $31000 from customers for services performed in Transaction d. Paid salaries of $2,500 for the current month. Required: Show the effect of each transaction using the following model.

- Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.Continuing Problem 4.Total of Debit column: 40,750 The transactions completed by PS Music during June 20Y5 were described .it the end of Chapter 1. The following transactions were completed during July, the second month of businesss operations: July 1. Peyton Smith made an additional investment k PS Music in exchange for common stock by depositing 5,000 in PS Mu wet checking account. 1.Instead of continuing to share office space with a local real estate agency. Peyton decided to rent office space near a local musk store, Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft and fire. The policy covers a one year period. 2.Received 1,000 on account 3. On behalf of PS Musk, Peyton signed a contract with a local radio station. KXMD, to provide guest spots for the next three months. The contract requires PS Musk to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 2SO on account 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart. 7,500. 8.Paid for a newspaper advertisement 200. 11.Received 1.000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Pane 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account 850 21.Paid 620 to Upload Musk for use of its current musk demos in making various musk sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500 Received 750, with the remainder due August 4.20YS. 27.Paid electric Ml 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500, Received S00 with the remainder due on August 9. 20Y5. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1.400 royalties (musk expense) to National Musk Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts Receivable 1,000 14 Supplies 170 15 Prepaid Insurance 17 Office Equipment 21 Accounts Payable 250 23 Unearned Revenue 31 Common Stock 4.000 33 Dividends 500 41 Fees Earned 6,200 50 Wages Expense 400 51 Office Rent Expense 800 52 Equipment Rent Expense 67S 53 Utilities Expense 300 54 Music Expense 1.590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.Exercise 2-44 Transaction Analysis OBJECTIVE 9 During December, Cynthiana Refrigeration Service engaged in the following transactions: On December 3, Cynthiana sold a 1-year service contract to Cub Foods for $12,000 cash. On December 10, Cynthiana repaired equipment of the A liabilities, and stockholders equity using the formal below.

- Comprehensive Problem 1 8 Net income. 31,425 Kelly Pitney began her consulting business. Kelly Consulting, on April 1, 20Y8. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter During May, Kelly Consulting entered into the following transactions: May 3.Received cash from clients as an advance payment for services to be provided and recorded it as unearned tree 4,500 5.Received cash from clients on account 2,450. 9.Paid cash for a newspaper advertisement 225. 13.Raid Office Station Co for part of the debt incurred on April , 640. 15.Recorded services provided on account for the period May 1-15, 9,180. 16 Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17.Recorded cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the Journal 20.Purchased support on account 735. 21.Recorded services provided on account for the period May 1620. 4,820 25.Recorded cash from cash clients for fees earned for the period May 1723, 7,900 27.Received cash from clients on account 9,520. 28.Paid part-time receptionist for two weeks salary. 7S0. 30.Raid telephone bill for May. 260 31.Paid electricity bill for May, 810. 31.Recorded cash from cash clients tor lees earned for the period May 2031. 3,300. 31.Recorded services provided on account for the remainder of May, 2,650. 31.Paid dividends 10,500 Instructions 1.The chart of accounts foe Kelly Consulting is shown us Exhibit 9. and the post-closing trial balance as of April 30, 20Y8, is shown in Exhibit 17. for each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1. 20Y8. and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting cm Page of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 5.Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). (a)Insurance expired during May is 275. (b)Supplies on hand on May II are 715. (c)Depreciation of office equipment for May is 330. (d)Accrued receptionist salary on May 31 is 325. (e)Rent expired during May is 1600. (f)Unearned fees on May 31 are 3,210 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of stockholders equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.Exercise 2-50 Journalizing Transactions Remington Communications has been providing cellular phone service for several years. During November and December. the following transactions occurred: Nov. 2 Remington received S2,400 for November phone service from Enrico Company. 10 6 Remington purchased S4,750 of supplies from Technology Associates on 10 Remington paid S5,250 to its hourly employees for their weekly wages. 15 Remington paid S4, 750 to Technology Associates in full settlement Of its payable. 28 Remington paid S2, 150 for utilities used during November. 30 Remington received a bill from Monticello Construction for Sl,230 for repairs made to Remingtons loading dock on November I S. Remington plans to pay the bill in early December. Dec. 10 Remington paid S I ,230 to Monticello Construction to settle the repair bill received onProblem 2-603 Journalizing and Posting Transactions Findlay Testing Inc. provides water testing and maintenance services for owners of hot tubs and swimming pool. During September the following transactions occurred: Sept. 1 Issued common stock for $20,000. 2 Purchased chemical supplies for $1,880 cash. 5 Paid office rent for October, November, and December; the rent is $800 per month. 8 Purchased $12.90 of advertising for September on account. 13 Billed the city of Bellefontaine $2,100 for testing the water in the citys outdoor pools during September, 18 Received $3250 from Alexander Blanchard upon completion of overhaul of his swimming pool water circulation system. Since the job was completed and collected for on the same day, no bill was sent, to Blanchard. Sept. 25 Received $835 from the city of Bellefontaine for water testing that was previously billed. 30 Recorded and paid September salaries of $3,970. Required: 1. Prepare a journal entry for each transaction. 2. Post the journal entries to the appropriate T-accounts.

- Problem 1 Preparing journal entries: Abdullah Engineering completed the following transactions in the month of June. Amina Abdullah, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of drafting equipment to launch the company. The company purchased land worth $49,000 for an office by paying $6,300 cash and signing a long-term note payable for $42,700. The company purchased a portable building with $55,000 cash and moved it onto the land acquired in b. The company paid $3,000 cash for the premium on an 18-month insurance policy. The company completed and delivered a set of plans for a client and collected $6,200 cash. The company purchased $20,000 of additional drafting equipment by paying $9,500 cash and signing a long-term note payable for $10,500. The company completed $14,000 of engineering services for a client. This amount is to be received in 30 days. The company purchased $1,150 of additional office equipment on credit. The company…Problem 3. Raymond opened the Muscles Fitness Gym in August. The Following transactionsoccurred during the first month of the business:a) Raymond invested P100,000 in cash and 30,000 in gym equipment in the business.b) Paid P10,000 for the first month’s rent.c) Purchased supplies costing P4,000 on credit.d) Purchased exercise equipment costing P25,000 for 15,000 cash and the rest on account.e) Recorded income for the first half of the month of P6,500 in cash and P3,500 on account.f) Paid P2,750 to a creditor on account.g) Received payment from a customer on account for P1600.h) Raymond withdrew P500 for a graduation gift.i) Paid aerobics instructor her salary, P3,000.j) Paid miscellaneous expense P1,500k) Recorded income for the second half of the month of P5,600 in cash.Prepare a new accounting equation every time a transaction occurs.QUESTION ONEJuan Cruz began professional practice as a system analyst on July 1. He plans to prepare a monthly financial statement. During July, the owner completed these transactionsJuly 1. Owner invested sh 500,000 cash along with computer equipment that had a market value of php. 120,000July 2. Paid sh. 15,000 cash for the rent of office space for the month.July 4. Purchased sh 12,000 of additional equipment on credit (due within 30 days).July 8. He completed a work for Mr. Patrick and immediately he was paid the sh. 32,000 cash.July 10. Completed work for Mr. simon and sent a bill for sh. 27,000 to be paid within 30 days.July 12. Purchased additional equipment for sh. 8,000 in cash.July 15. Paid assistant sh. 6,200 cash as wages for 15 days.July 18. Collected sh. 15,000 on the amount owed by Mr. simon.July 25. Paid sh 12,000 cash to settle the liability on the equipment purchased.July 28. Owner withdrew sh. 500 cash for personal use.July 30. Completed work for Miss Akinyi who paid…