Francis Inc. has the following stockholders' equity section in its November 30, 2019, balance sheet: Paid-in capital: 12% preferred stock, $60 par value, 1,000 shares authorized, issued, and outstanding Common stock, $8 par value, 50,000 shares authorized, ? shares issued, ? shares outstanding Additional paid-in capital on common stock Additional paid-in capital from treasury stock Retained earnings Less: Treasury stock, at cost (1,000 shares of common) $ 120,000 270,000 6,500 48,500 (9,000) Total stockholders' equity $ ? Required: a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be shown on the balance sheet for preferred stock. c. Calculate the number of shares of common stock that are issued and the number of shares of common stock that are d. On January 1, 2019, the firm's balance sheet showed common stock of $105,000 and additional paid-in capital on con $234,375. The only transaction affecting these accounts during 2019 was the sale of common stock. Calculate the nu shares that were sold and the selling price per share. e. Choose the transaction that resulted in the additional paid-in capital from treasury stock. f. The retained earnings balance on January 1, 2019, was $45,150. Net income for the past 11 months was $12,000. Pref dividends for all of 2019 have been declared and paid. Calculate the amount of dividends on common stock during tl months of 2019. Complete this question by entering your answers in the tabs below. Req A and B Req C and D Req E Req F a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be shown on the balance sheet for preferred stock.

Francis Inc. has the following stockholders' equity section in its November 30, 2019, balance sheet: Paid-in capital: 12% preferred stock, $60 par value, 1,000 shares authorized, issued, and outstanding Common stock, $8 par value, 50,000 shares authorized, ? shares issued, ? shares outstanding Additional paid-in capital on common stock Additional paid-in capital from treasury stock Retained earnings Less: Treasury stock, at cost (1,000 shares of common) $ 120,000 270,000 6,500 48,500 (9,000) Total stockholders' equity $ ? Required: a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be shown on the balance sheet for preferred stock. c. Calculate the number of shares of common stock that are issued and the number of shares of common stock that are d. On January 1, 2019, the firm's balance sheet showed common stock of $105,000 and additional paid-in capital on con $234,375. The only transaction affecting these accounts during 2019 was the sale of common stock. Calculate the nu shares that were sold and the selling price per share. e. Choose the transaction that resulted in the additional paid-in capital from treasury stock. f. The retained earnings balance on January 1, 2019, was $45,150. Net income for the past 11 months was $12,000. Pref dividends for all of 2019 have been declared and paid. Calculate the amount of dividends on common stock during tl months of 2019. Complete this question by entering your answers in the tabs below. Req A and B Req C and D Req E Req F a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be shown on the balance sheet for preferred stock.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

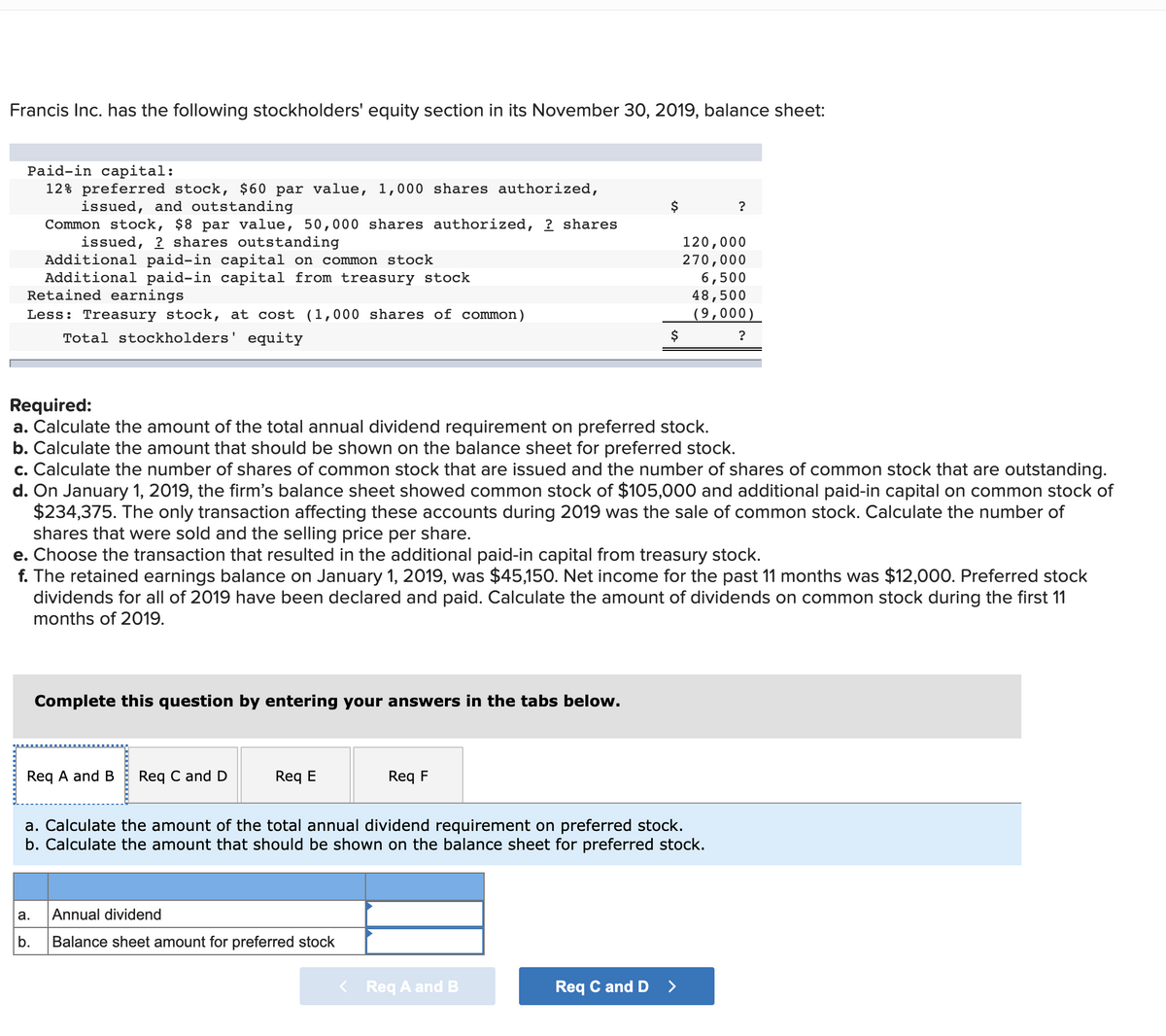

Transcribed Image Text:Francis Inc. has the following stockholders' equity section in its November 30, 2019, balance sheet:

Paid-in capital:

12% preferred stock, $60 par value, 1,000 shares authorized,

issued, and outstanding

Common stock, $8 par value, 50,000 shares authorized, ? shares

issued, ? shares outstanding

Additional paid-in capital on common stock

Additional paid-in capital from treasury stock

Retained earnings

$

120,000

270,000

6,500

48,500

Less: Treasury stock, at cost (1,000 shares of common)

(9,000)

Total stockholders' equity

$

Required:

a. Calculate the amount of the total annual dividend requirement on preferred stock.

b. Calculate the amount that should be shown on the balance sheet for preferred stock.

c. Calculate the number of shares of common stock that are issued and the number of shares of common stock that are outstanding.

d. On January 1, 2019, the firm's balance sheet showed common stock of $105,000 and additional paid-in capital on common stock of

$234,375. The only transaction affecting these accounts during 2019 was the sale of common stock. Calculate the number of

shares that were sold and the selling price per share.

e. Choose the transaction that resulted in the additional paid-in capital from treasury stock.

f. The retained earnings balance on January 1, 2019, was $45,150. Net income for the past 11 months was $12,000. Preferred stock

dividends for all of 2019 have been declared and paid. Calculate the amount of dividends on common stock during the first 11

months of 2019.

Complete this question by entering your answers in the tabs below.

Req A and B

Req C and D

Req E

Req F

a. Calculate the amount of the total annual dividend requirement on preferred stock.

b. Calculate the amount that should be shown on the balance sheet for preferred stock.

а.

Annual dividend

b.

Balance sheet amount for preferred stock

Reg A and B

Req C and D

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning