Frank Co. has the opportunity to introduce a new product. Frank expects the product to sell for P60 and to have p osts of P35 and annual cash fixed costs of P4,000,000. Expected annual sales volume is 275,000 units. The equ o bring out the new product costs P6,000,000, has a four-year life and no salvage value, and would be depreciate ne basis. Frank's cost of capital is 14% and its income tax rate is 40%. Required: 1 Compute the annual net cash flows for the investment. . Compute the NPV of the project. . Suppose that some of the 275,000 units expected to be sold would be to customers who currently buy and products, the X-10, which has a P12 per-unit contribution margin. Find the sales of X-10 that can Frank los still have the investment in the new product return at least the 14% cost of capital. 1. Suppose that selling the new product has no complementary effects but that Frank's production engineers a production problems in making the new product and are not confident of the P35 estimate of per-unit variab new product. Find the amount by which Frank's estimate of per-unit variable cost could be in error and the have a retum at least equal to the 14% cost of capital.

Frank Co. has the opportunity to introduce a new product. Frank expects the product to sell for P60 and to have p osts of P35 and annual cash fixed costs of P4,000,000. Expected annual sales volume is 275,000 units. The equ o bring out the new product costs P6,000,000, has a four-year life and no salvage value, and would be depreciate ne basis. Frank's cost of capital is 14% and its income tax rate is 40%. Required: 1 Compute the annual net cash flows for the investment. . Compute the NPV of the project. . Suppose that some of the 275,000 units expected to be sold would be to customers who currently buy and products, the X-10, which has a P12 per-unit contribution margin. Find the sales of X-10 that can Frank los still have the investment in the new product return at least the 14% cost of capital. 1. Suppose that selling the new product has no complementary effects but that Frank's production engineers a production problems in making the new product and are not confident of the P35 estimate of per-unit variab new product. Find the amount by which Frank's estimate of per-unit variable cost could be in error and the have a retum at least equal to the 14% cost of capital.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 10E: Roberts Company is considering an investment in equipment that is capable of producing more...

Related questions

Question

100%

Please help me, thank you

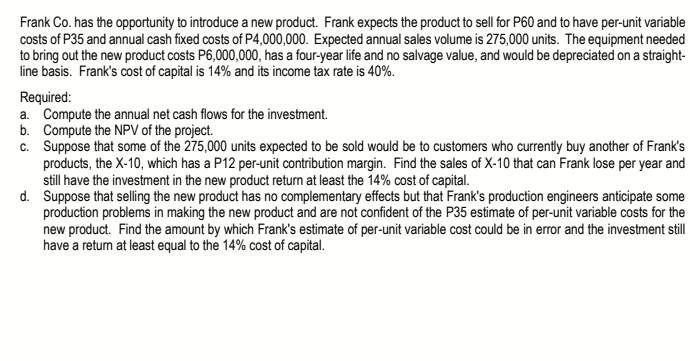

Transcribed Image Text:Frank Co. has the opportunity to introduce a new product. Frank expects the product to sell for P60 and to have per-unit variable

costs of P35 and annual cash fixed costs of P4,000,000. Expected annual sales volume is 275,000 units. The equipment needed

to bring out the new product costs P6,000,000, has a four-year life and no salvage value, and would be depreciated on a straight-

line basis. Frank's cost of capital is 14% and its income tax rate is 40%.

Required:

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Suppose that some of the 275,000 units expected to be sold would be to customers who currently buy another of Frank's

products, the X-10, which has a P12 per-unit contribution margin. Find the sales of X-10 that can Frank lose per year and

still have the investment in the new product return at least the 14% cost of capital.

d. Suppose that selling the new product has no complementary effects but that Frank's production engineers anticipate some

production problems in making the new product and are not confident of the P35 estimate of per-unit variable costs for the

new product. Find the amount by which Frank's estimate of per-unit variable cost could be in error and the investment still

have a return at least equal to the 14% cost of capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning