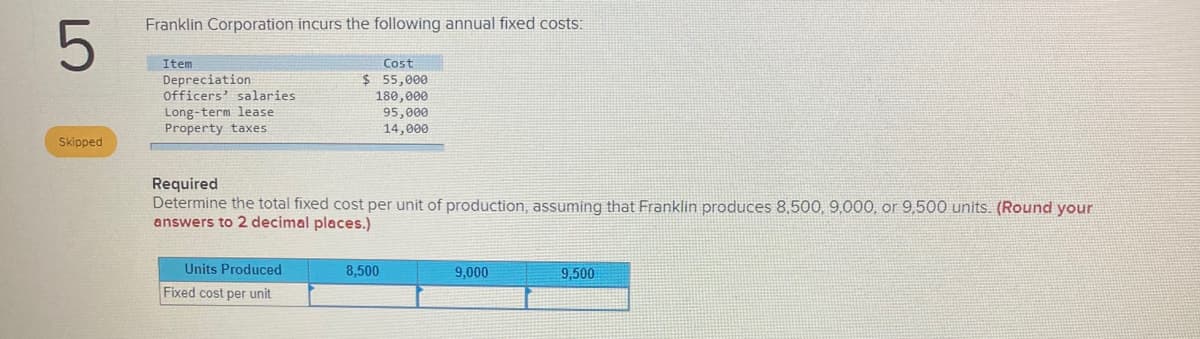

Franklin Corporation incurs the following annual fixed costs: Item Depreciation Officers' salaries Long-term lease Property taxes Cost $ 55,000 180,000 95,000 14,000 Required Determine the total fixed cost per unit of production, assuming that Franklin produces 8,500, 9,000, or 9,500 units. (Round your answers to 2 decimal places.) Units Produced 8,500 9,000 9,500 Fixed cost per unit

Q: UPSILON CO can produce any one of its three product lines with its present equipment set up. Base…

A: Here in this question, we are required to choose between three alternatives. When there is various…

Q: A company is planning to purchase a machine that will cost $42,000 with a six-year life and no…

A: Introduction Payback Period The acceptability of a project is determined by a variety of factors,…

Q: Krishna Gems Ltd has just installed Equip.-R at a cost of Rs 2,00,000. The machine has a five year…

A: Net present value (NPV): It is the difference of discounted cash inflows and outflows.

Q: In a plant operating at 80% of its annual production capacity, gross profit is 2.35M. Cost of raw…

A: Calculation of Depreciable value of assets and annual operating capacity is as follows: Depreciable…

Q: Sales was estimated at 80,000 pieces annually with a rate of 6 pu. Its variable mfg costs are 2.50…

A: Net income can be computed by subtracting various expenses of manufacturing from cost of goods sold…

Q: Rawabi Company incurred the following costs and machine hours during the last three months of the…

A: 1) Computation of the Cost formula for electricity cost using the high-low method is as follows:…

Q: Krishna Gems Ltd has just installed Equip.-R at a cost of Rs 2,00,000. The machine has a five year…

A: To understand if the replacement is worth or not, the DIFFERENCE of Present value of cash inflows…

Q: A machine generates $500,000 of gross income during its tax year and incurs operating expenses of…

A: The present worth method is an important method of the time value of money. The present worth is the…

Q: Find the yearly depreciation (units of Production methods)

A: Given; Machine cost = 9250, Salvage value = 710 depreciable value = 8540 (9250-710) Depreciation…

Q: Under the absorption costing, the total product costs should be:

A: The calculation of total product costs under the absorption costing is shown hereunder : Absorption…

Q: Munoz Corporation incurs the following annual fixed costs: Item Cost $ 62,000 Depreciation Officers'…

A: In order to compute the fixed cost per unit, the total annual fixed cost needs to be determined. The…

Q: Destiny Apartments Inc. (DA Inc.) is building a luxury condominium for a contract price of…

A: Solution Gross profit is the profit a business make after substracting all costs that are related to…

Q: The table Top Model corp. produces three products, Tic, Tac, Toc. The owner desires to reduce…

A: Contribution means the difference between the sale and variable cost. Net operating income means the…

Q: Clean-U, Inc., expects to receive $65,000 each year of its newest soap, ÔnGuard. There will be an…

A: In this we have to determine the after tax cash flow and from that we can get NPV.

Q: Close A truck costs $302,000 and is expected to be driven 115,000 miles during its five - year life.…

A: Depreciation under units - of - production method = Depreciation per mile × Actual activity…

Q: Vernon Corporation incurs the following annual fixed costs. Item Cost $ 52,000 120,000 85,000 9,000…

A: Given, Depreciation = $52,000 Officer's salaries = $120,000 Long-term lease = $85,000 Property…

Q: A company with a MARR = 10% expects the costs to operate and maintain a particular piece of…

A: Equivalent annual cost (EAC) is the annual cost of owning, operating, and maintaining an asset over…

Q: Fanning Corp. incurs the following annual fixed costs: Depreciation $80,000 Officers' salaries…

A: Lets understand the basics. Costs are divided into three types. (1) Variable cost (2) Fixed cost (3)…

Q: Finch Company began its operations on March 31 of the current year. Finch has the following…

A: Formula: Insurance expense = Per month amount x Number of months.

Q: XYZ Company spends 300,000 dollars on raw materials, 100,000 dollars on a fixed cost, and 150,000…

A: Percentage of the profit change = (Profit after discount - Profit before discount) / Profit before…

Q: Gregor's Gewgaws provides the following income statement information for this fiscal year: Revenues…

A: Return on investment is one of the profitability ratio which shows how much net income has been…

Q: Zest Corporation can provide the part to ABC for P19 per unit. ABC Company has determined that 60…

A: Make or Buy Decision is the analysis which is done by the management to decide whether the company…

Q: Romex Corp sales of its product which was estimated at 75,000 pieces annually with a rate of pu. Its…

A: Net income of an entity can be calculated by subtracting sales revenue with cost of goods sold,…

Q: Warmuplang Corporation showed the following costs for 2020 Warehouse depreciation P 300,000 Salaries…

A:

Q: The cost of a machine is 9400 RO with a residual value of 400 RO. The estimated units machine will…

A: Depreciation (units of production) = (Original cost - Residual value) x (Units produced / Total…

Q: expected to cost $369,600 with a 8-year life and no salvage value. It will be depreciated on a…

A: Net present value is the present value of cash flow and initial investment of the project and it…

Q: A lessor made an investment of ₱550,000 in equipment with an expected life of 5 years. He determined…

A: Given: Year = 5 Cost of investment = ₱550,000 Cost of sales = ₱120,000 Maintenance cost = ₱150,000…

Q: Sales of a product toy named Scooby estimated at 80,000 pieces annually with a rate of 6 pu. Its…

A: The firm's net income will be sales revenue minus cost of goods sold, expenses, taxes, interest,…

Q: Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. The…

A: Calculate the cash outlay.

Q: A special power tool for plastic products costs $400,000 and has a 4year useful life, no salvage…

A: Rate of return A net profit/loss of the investment over the specified period is denoted in terms of…

Q: Finch Company began its operations on March 31 of the current year. Finch has the following…

A: The cash payments in April are basically the manufacturing costs and the insurance expenses. Non…

Q: Steel drums manufacturer incurs a yearly operating cost of P 200,000. Each drum manufactured cost P…

A: Breakeven sales is that level of sales revenue at which business is only recovering total fixed…

Q: Model Company manufactures a single electronic product called Lastik. Lastik sells for P900 per…

A: The sales volume at break even is such sales volume at which the company is at no profit no loss…

Q: The following schedule reflects the incremental costs and revenues for acapital project. The company…

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: KrishnaGems Ltd has just installed Equip.-R at a cost of Rs 2,00,000. Themachine has a five yearlife…

A: Net Present Value(NPV) of the project is equivalent to the difference between the present value of…

Q: A lessor made an investment of ₱550,000 in equipment with an expected life of 5 years. He determined…

A:

Q: Determine the total depreciation during the year.Determine the depreciation cost chargeable to each…

A: Given information is: An asphalt and aggregate mixing plant having a capacity of 50 cu.m every hour…

Q: Munoz Corporation incurs the following annual fixed costs: Item Cost Depreciation Officers' salaries…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Product A is produced with the following costs: 1) Paper material P20 per unit 2)…

A: Answer: As per Q/A guidelines, we have answered first 3 subparts of question. 1) Paper material…

Q: Harbor Division has total assets (net of accumulated depreciation) of $630,000 at the beginning of…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: A company uses a machine to manufacture its product. The operating results of the company for a…

A: Lets understand the basics. When management have more than one alternative then management need to…

Q: 828 Company is considering the purchase of equipment that would allow the company to add a new…

A: Payback period is the number of years or period in which original investment amount can be…

Q: 1. In 2021 ABC company will produce 2,700 units of the product. Each unit of product requires 4 kg…

A: The question is related to Inventory Management. The Economic Order Quantity is that level of…

Q: The following is information for Prisma products issued by Tekun Sdn. Bhd. (TSB) RM Sales (3,000…

A: SOLUTION CALCULATION OF REVISED FIXED COST = 249600+72000. = 321600. CALCULATION OF REVISED VARIABLE…

Q: A manufacturer has been offered a contract to manufacture a certain product that will utilize the…

A: (1) New product will use 0.3 kg of waste Materials for 1 unit Manufacturing => 1 kg of Waste…

Q: Stuart Corporation incurs the following annual fixed costs. Item Depreciation. Officers' salaries.…

A: Fixed Cost :— It is the cost that does not depends on units and does not changes with change in…

Q: Sales of a product was estimated at 80,000 pieces annually with a rate of 6 pu. Its variable mfg.…

A: Depreciation as per Straight Line Method = Cost Of Equipment - Salvage value of EquipmentLife of…

Q: A general manager wants to know the economic service life of currently owned machines. The market…

A: Annual worth of project consist of equivalent annual cost of annual cost, equivalent annual cost of…

Q: KrishnaGems Ltd has just installed Equip.-R at a cost of Rs 2,00,000. Themachine has a five yearlife…

A: If the project generates a negative net present value then, the project should not be accepted. On…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Sony Inc. is a lessor-manufacturer of expensive machinery. On January 1,2011, amachinery is leased to another entity with the following information:Annual rental payable at the end of each year P200,000Lease term 4 yearsUseful life of machinery 5 yearsCost of Machinery 300,000Estimated residual value 50,000Initial direct cost paid by lessor 20,000Incremental borrowing rate of lessee 14%Implicit interest rate of lessor known to lessee 12%Note: At the end of the lease term on December 31,2014, the machinery will revert to lessor.Problem 17. Except from the fact that the leased machinery will not revert to lesser because there is bargain purchase option of P50,000 at the end of lease term.Required: Based on the result of your audit, determine the following:____________1. Gross Lease Receivable____________2. Sales or Net Investment____________3. Unearned Interest____________4. Profit on saleDirect Finance Lease – Lessor (PAS 17 and PFRSA lessor made an investment of ₱550,000 in equipment with an expected life of 5 years. He determined that he will incur the following annual costs: Costs of sales₱120,000; Marketing, admin, and maintenance ₱150,000. Tax rate is 25%. Annual depreciation is ₱110,000. Cost of capital is 11%. The breakeven lease per year would be? ₱ 460,000 ₱ 503,717 ₱ 521,756 ₱ 468,203 ₱ 436,127 ₱ 324,846Eminem Company recognized gross profit of P720,000 on its long-term project which has accumulated costs of P2,880,000. To finish the project, the company estimates that it has to incur additional costs of P1,920,000. Determine the contract price.

- A lessor made an investment of ₱550,000 in equipment with an expected life of 5 years. He determined that he will incur the following annual costs: Costs of sales₱120,000; Marketing, admin, and maintenance ₱150,000. Tax rate is 25%. Annual depreciation is ₱110,000. Cost of capital is 11%. The breakeven lease per year would be?a. ₱ 460,000 b. ₱ 503,717 c. ₱ 521,756d. ₱ 468,203 e. ₱ 436,127 f. ₱ 324,846A piece of machinery is on a {A}-month lease at {B}% compounded annually. Beginning-of-month payments are $397.95, and a $5,000 down payment was made. The residual value is $5,525.00. What was the purchase price of the product? {A}40 {B}6.99% {C}$334.52 {D} $7,000 {E} $5,350Canada M. manufactures special equipment with an estimated economic life of 12 years and leases it to Phranka for a period of 10 years commencing January 1, 2021. The unguaranteed residual value at the end of the lease term is estimated to be $15,000. Phranka will make annual payments of $25,000 at the beginning of each year and pay for all maintenance and insurance costs. Canada M. incurred costs of $105,000 in manufacturing the equipment but is looking to make a profit on the sale of equipment. In addition, Phranka incurred $7000 in costs tied to negotiating and closing the lease. Canada M. has determined that the collectability of the lease payments is reasonably predictable, that no additional costs will be incurred, and that the implicit interest rate is 8%. Phranka has a borrowing rate of 8%. How should Canada M. classify this lease transaction? a. Classify as an operating lease. b. Classify as a capital, sales type lease. c. Classify as a capital, direct finance type lease.…

- George Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $299,140, and its unguaranteed residual value at the end of the lease term is estimated to be $20,000. National will pay annual payments of $40,000 at the beginning of each year. George incurred costs of $180,000 in manufacturing the equipment and $4,000 in sales commissions in closing the lease. George has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 8%. Instructions a. Discuss the nature of this lease in relation to the lessor and compute the amount of each of the following items. 1. Lease receivable. 2. Sales price. 3. Cost of goods sold. b. Prepare a 10-year lease amortization schedule for George, the lessor. c. Prepare all of the lessor's journal entries for the first year.On January 1, 2021, ABC Co. purchased 50,000 units at P100 per unit.During 2021, the entity sold 40,000 units at P180 per unit. The entity paidP700,000 for operating expenses. The current replacement cost of theinventory on December 31, 2021 is P150 per unit. What is the net incomeunder current cost accounting for the year 2021?Grouper Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to National Airlines for a period of 10 years. The normal selling price of the equipment is $260,015, and its unguaranteed residual value at the end of the lease term is estimated to be $20,500. National will pay annual payments of $37,300 at the beginning of each year. Grouper incurred costs of $195,000 in manufacturing the equipment and $4,100 in sales commissions in closing the lease. Grouper has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 10%.

- Stowe Construction Company is considering selling excess machinery with a book value of $281,500 (original cost of $400,300 less accumulated depreciation of $118,800) for $274,900, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $285,500 for 5 years, after which it is expected to have no residual value. During the period of the lease, Stowe Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $24,900. Question Content Area a. Prepare a differential analysis dated March 21 to determine whether Stowe Construction Company should lease (Alternative 1) or sell (Alternative 2) the machinery. If required, use a minus sign to indicate a loss. Differential AnalysisLease (Alt. 1) or Sell (Alt. 2) MachineryMarch 21 Line Item Description LeaseMachinery(Alternative 1) SellMachinery(Alternative 2) DifferentialEffects(Alternative 2) Revenues $Revenues $Revenues $Revenues Costs Costs Costs Costs…Excess Construction Corp. has a $16 million contract to construct a building. The company estimates $10.4 million in costs to construct the building and an expected gross profit of $5.6 million. During the current year, the company incurred $3,120,000 of costs on the contract. Under the percentage-of-completion method, how much will Excess Construction Corp. report as revenue in the current year?Bridgeport Company manufactures a check-in kiosk with an estimated economic life of 12 years and leases it to Indigo Airlines for a period of 10 years. The normal selling price of the equipment is $281,987, and its unguaranteed residual value at the end of the lease term is estimated to be $21,100. Indigo will pay annual payments of $42,000 at the beginning of each year. Bridgeport incurred costs of $193,400 in manufacturing the equipment and $3,800 in sales commissions in closing the lease. Bridgeport has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 11%. Indigo Airlines has an incremental borrowing rate of 11%.