Frieden Company's contribution format income statement for the most recent month is given below: Sales (41,000 units) Variable expenses Contribution margin Fixed expenses Net operating income. $ 820,000 574,000 246,000 196,800 $ 49,200 The industry in which Frieden Company operates is quite sensitive to cyclical movements in the economy. Thus, profits considerably from year to year according to general economic conditions. The company has a large amount of unused studying ways of improving profits. Required: 1. New equipment has come on the market that would allow Frieden Company to automate a pation of its operations. V expenses would be reduced by $6.00 per unit. However, fixed expenses would increase to a total of $442,800 each mc two contribution format income statements: one showing present operations, and one showing how operations would a new equipment were purchased. (Input all amounts as positive values except losses which should be indicated by mi Round your "Per unit" answers to 2 decimal places.) Amount Present Per Unit Percentage Amount Proposed Per Unit Perc

Frieden Company's contribution format income statement for the most recent month is given below: Sales (41,000 units) Variable expenses Contribution margin Fixed expenses Net operating income. $ 820,000 574,000 246,000 196,800 $ 49,200 The industry in which Frieden Company operates is quite sensitive to cyclical movements in the economy. Thus, profits considerably from year to year according to general economic conditions. The company has a large amount of unused studying ways of improving profits. Required: 1. New equipment has come on the market that would allow Frieden Company to automate a pation of its operations. V expenses would be reduced by $6.00 per unit. However, fixed expenses would increase to a total of $442,800 each mc two contribution format income statements: one showing present operations, and one showing how operations would a new equipment were purchased. (Input all amounts as positive values except losses which should be indicated by mi Round your "Per unit" answers to 2 decimal places.) Amount Present Per Unit Percentage Amount Proposed Per Unit Perc

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 40P

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

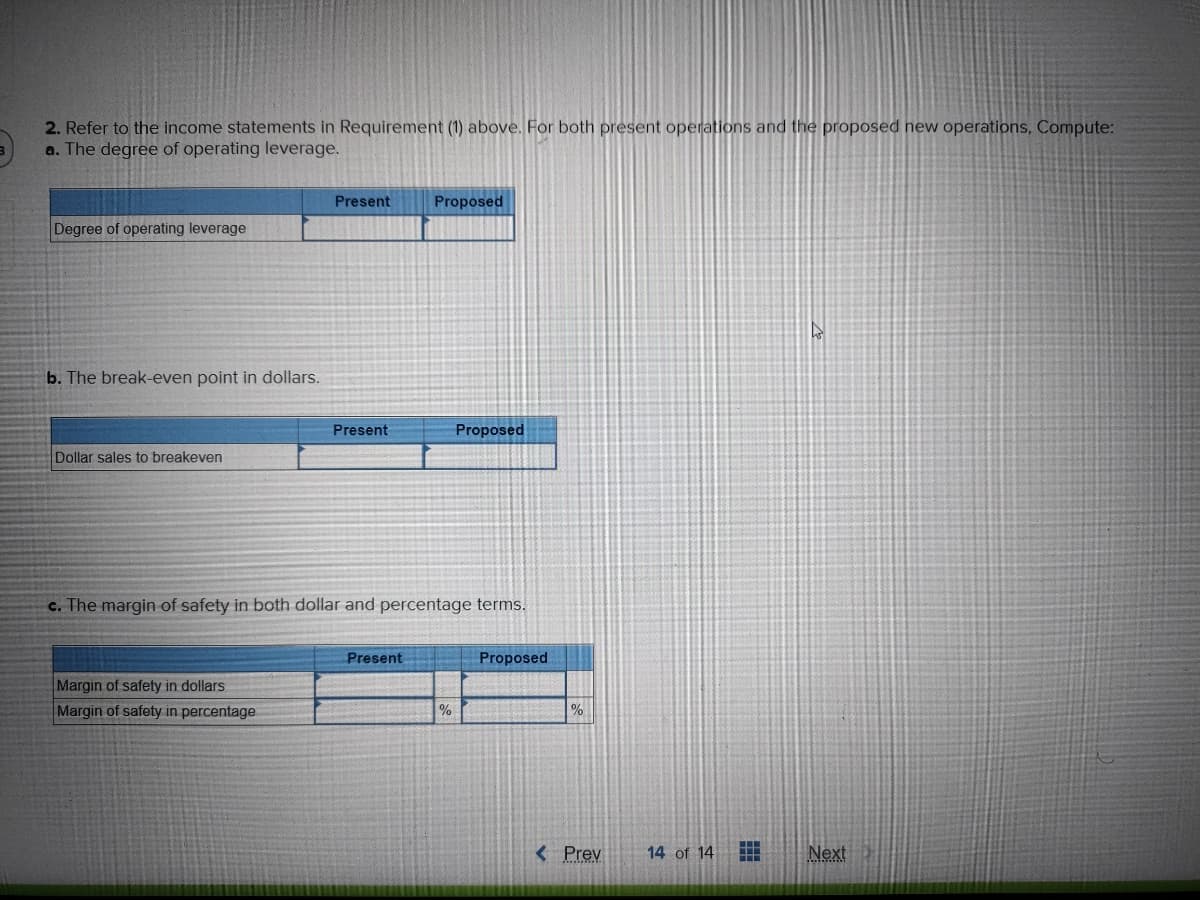

Transcribed Image Text:2. Refer to the income statements in Requirement (1) above. For both present operations and the proposed new operations, Compute:

a. The degree of operating leverage.

Degree of operating leverage

b. The break-even point in dollars.

Dollar sales to breakeven

Present

Margin of safety in dollars

Margin of safety in percentage

Present

Proposed

c. The margin of safety in both dollar and percentage terms.

Present

Proposed

%

Proposed

%

< Prev

14 of 14 8:0

28

Next >

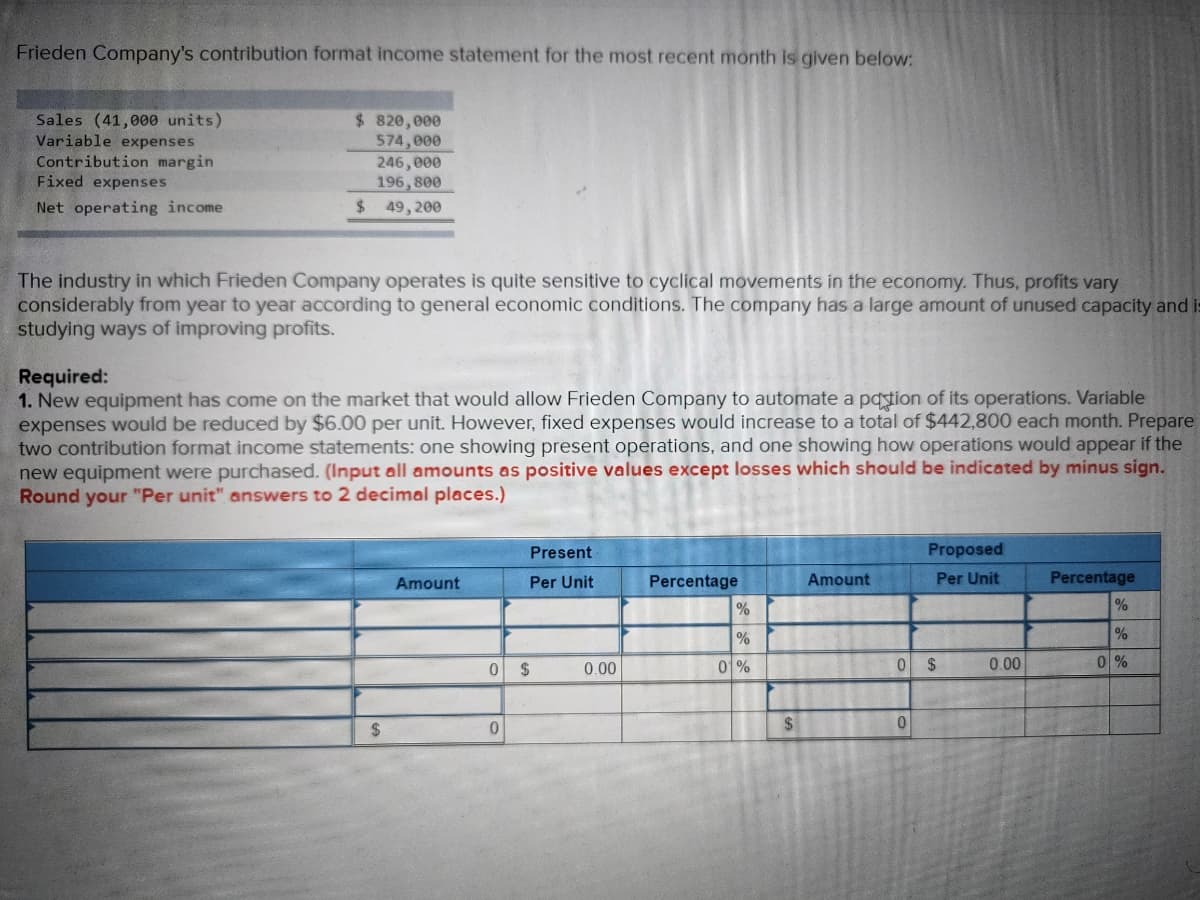

Transcribed Image Text:Frieden Company's contribution format income statement for the most recent month is given below:

Sales (41,000 units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income.

$ 820,000

574,000

246,000

196,800

$ 49,200

The industry in which Frieden Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary

considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is

studying ways of improving profits.

Required:

1. New equipment has come on the market that would allow Frieden Company to automate a pation of its operations. Variable

expenses would be reduced by $6.00 per unit. However, fixed expenses would increase to a total of $442,800 each month. Prepare

two contribution format income statements: one showing present operations, and one showing how operations would appear if the

new equipment were purchased. (Input all amounts as positive values except losses which should be indicated by minus sign.

Round your "Per unit" answers to 2 decimal places.)

$

Amount

0

0

Present

Per Unit

$

0.00

Percentage

%

%

0%

$

Amount

0

0

Proposed

Per Unit

$

0.00

Percentage

%

%

0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,