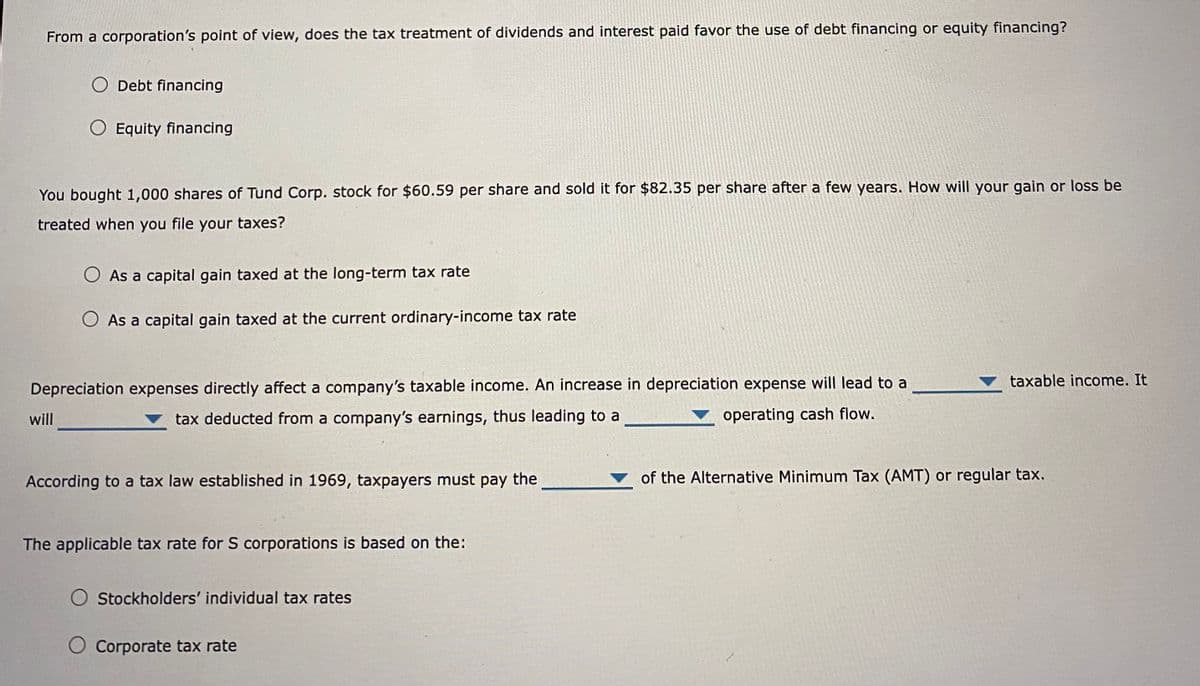

From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing? O Debt financing O Equity financing You bought 1,000 shares of Tund Corp. stock for $60.59 per share and sold it for $82.35 per share after a few years. How will your gain or loss be treated when you file your taxes? O As a capital gain taxed at the long-term tax rate O As a capital gain taxed at the current ordinary-income tax rate

From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing? O Debt financing O Equity financing You bought 1,000 shares of Tund Corp. stock for $60.59 per share and sold it for $82.35 per share after a few years. How will your gain or loss be treated when you file your taxes? O As a capital gain taxed at the long-term tax rate O As a capital gain taxed at the current ordinary-income tax rate

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing?

O Debt financing

Equity financing

You bought 1,000 shares of Tund Corp. stock for $60.59 per share and sold it for $82.35 per share after a few years. How will your gain or loss be

treated when you file your taxes?

will

O As a capital gain taxed at the long-term tax rate

O As a capital gain taxed at the current ordinary-income tax rate

Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a

tax deducted from a company's earnings, thus leading to a

operating cash flow.

According to a tax law established in 1969, taxpayers must pay the

The applicable tax rate for S corporations is based on the:

Stockholders' individual tax rates

O Corporate tax rate

taxable income. It

of the Alternative Minimum Tax (AMT) or regular tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT