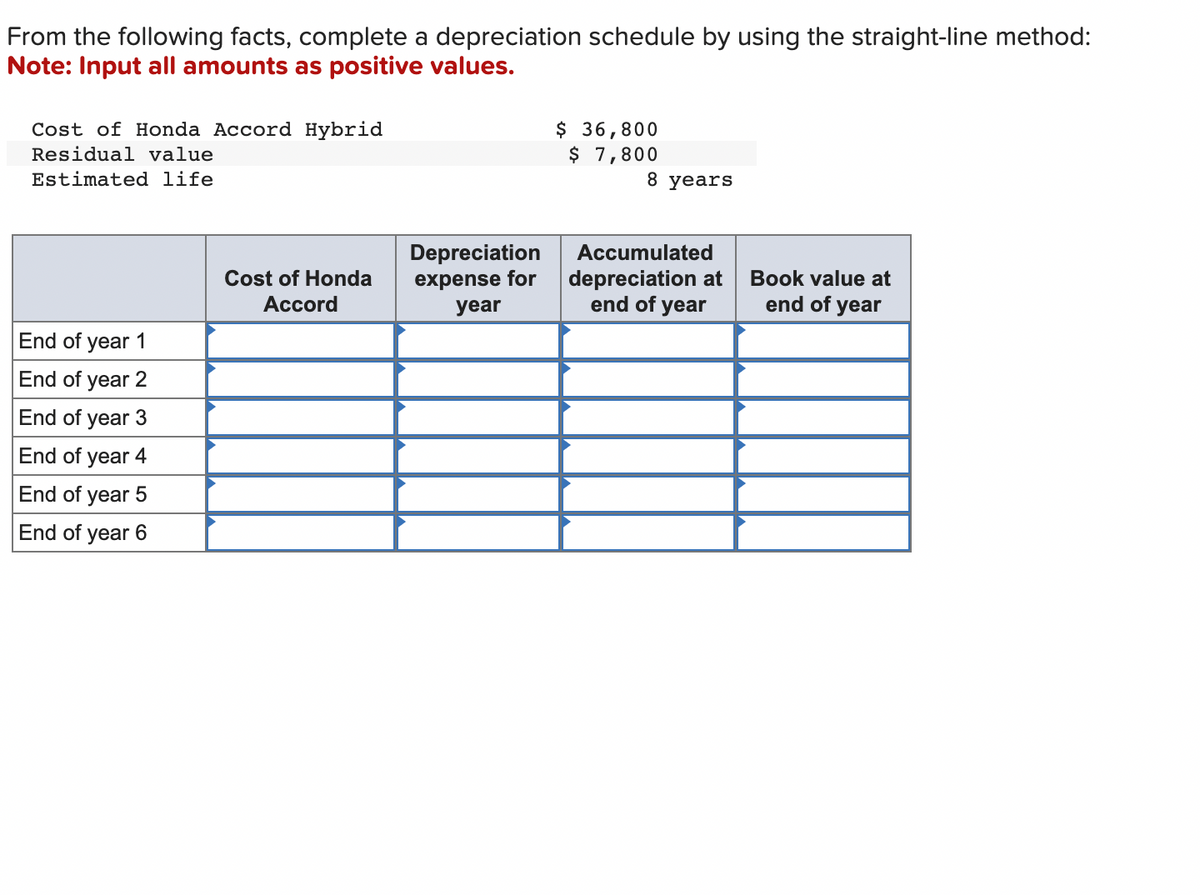

From the following facts, complete a depreciation schedule by using the straight-line method: Note: Input all amounts as positive values. Cost of Honda Accord Hybrid Residual value Estimated life End of year 1 Cost of Honda Accord Depreciation expense for year $36,800 $ 7,800 8 years Accumulated depreciation at end of year Book value at end of year

Q: Medwig Corporation has a DSO of 32 days. The company averages $8,000 in sales each day (all…

A: Ratio analysis is the method of checking the company's operational efficiency, liquidity, and…

Q: Statements When the Fed increases the money supply, short-term interest rates tend to decline. When…

A: Interest rates are a powerful tool to manage an economy. When economy is going through a certain…

Q: You complete a runs test on daily data for a thinly traded stock and the Z statistic is -5.13. If…

A: Analytics have been performed on the return of the stocks to get the Z statistic and the intraday…

Q: A stock has an expected return of 15.9 percent and a beta of 1.70, and the expected return on the…

A: The Capital Asset Pricing Model (CAPM) refers to the model which tells us how the financial markets…

Q: Assume that as of today, the annualized interest rate for a twelve-year bond is 8 percent. Today’s…

A: Interest rates of various maturities have been provided. We have to find a forward rate.

Q: Navel County Choppers, Incorporated, is experiencing rapid growth. The compa expects dividends to…

A: We will use the dividend discount model here. As per the dividend discount model the intrinsic value…

Q: ind the value of the annuity and the interest. round to the nearest dollar. Periodic deposit:…

A: Annuity is a constant stream of fixed cash flows occurring periodically. Here we need to find the…

Q: Strange Manufacturing Company is purchasing a production facility at a cost of $12 million. The…

A: Net present value = Present value of cash flows - Initial investment Present value of cash flows =…

Q: Periodic deposit-$? at the end of the year Rate-5% compounded annually Time-19 years Financial…

A: Financial goal The goals that an individual or business sets when dealing with money are called…

Q: The measures of risk include Geometric Mean Arithmetic Mean Median Variance

A: The risk is very important in the stock market and we must quantify the risk so that it can be…

Q: Given the indicated maturities listed in the following table, assume the following yields for US…

A: Data given: Maturity Years Yield Curve 1 3.60% 5 5.5% 10 5.5% 20 4.20% 30 4.00%

Q: To save for retirement, Karla Harby put $425 each month into an ordinary annuity for 11 years.…

A: Data given: pmt=$425 N=11 years Interest compounded monthly fv=$84,933

Q: is the book value of equipment purchased 7 years ago for $20,009 if it is depreciated using the sum…

A: In this method of depreciation that sume of digits method we find the sum of digits and number of…

Q: A stock's returns have the following distribution: Demand for the Company's Products Weak Below…

A: Data given: Demand for the company's product Probability of this demand occurring Rate of return…

Q: What is the forward rate from 13 months to 17 months? You observe two spot rates. The 17 month spot…

A: We have two spot rate. We need the forward rate for the period in between them.

Q: Security Returns if State Occurs State of Economy Probability of State of Economy Roll Ross Bust .40…

A: Data given: State of Economy Probability of State of Economy Security Returns if State Occurs…

Q: Mr. Aldrin Pereda and family however, only has a total of P130,000.00 in the bank. If you are the…

A: Van Cost P 8,13,000.00 Time Period 5 Interest Rate 10.93% Down Payment on Bank of…

Q: Value = $325,000 Current balance = $245,580 Current payment = $1,890 Taxes = $205 Homeowners…

A: As per the given information: Value = $325,000Current balance = $245,580Current payment =…

Q: In analyzing the financial statements which are given can you please compute the following ratios:…

A: The receivables turnover ratio is used by the company to calculate its efficiency in collecting…

Q: Erica was glad to be one of the first stockholders when her friend Mike's business went public. She…

A: Erica has made an investment of $2 for 100 shares. Hence, investment is: Investment=$2×100=$200

Q: nominal interest rates are listed as follows. Identify the components (determinants) and the symbols

A: This is a premium added to the real risk free rate to compensate for a decreased in purchasing power…

Q: Siesta Incorporated is looking at a project and has the appropriate cash flow. However there is much…

A: In a typical capital budgeting project, timing and quantum of cash flows emanating from a project…

Q: The following loan is a simple interest amortized loan with monthly payments. $5000, 9%, 4 years (a)…

A: Given, The loan amount is $5,000 Rate is 9.50% Term of loan is 4 years

Q: your credit card has a balance of $3000 in an annual interest rate of 17% with no further purchase…

A: We have to compare two amortized loan payments.

Q: Consider a bank policy to hold reserves equal to 15% of bank deposits. The bank currently has $25…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: The Washington Post By Steve Mufson March 29, 2017 Westinghouse, one of the most storied names in…

A: Based on the article, we have to identify the reasons affecting the negative NPV of AP1000 project…

Q: The real risk-free rate is 3.00%. Inflation is expected to be 2.25% this year and 3.50% during the…

A: Treasury securities refer to investments in the money market for a short period of time. These…

Q: Happy Valley Homecare Suppliers, Incorporated (HVHS), had $11.7 million in sales in 2015. Its cost…

A: a)Inventory days Outstanding refers to number of days the company holds Inventory before it is sold…

Q: This morning, you observe in the markets that the nominal interest rate is 6%, which includes…

A: This is a case of nominal rates, inflation rates and real rates. Hence Fisher equation will be used…

Q: if X = 13725, Y= 12064, Z=15696 and nominal rate is 15% per year, find the equivalent lump-sum value…

A: Now first let us explain the diagram. The arrows pointing upward are the cash inflows and arrow…

Q: man borrowed some money from a private at 5 % simple interest per annum. He landed this money to…

A: Simple interest is very simple that means there is only interest on the principal amount and there…

Q: Year Earnings and FCF Forecast ($ million) 1 Sales 2 Growth vs. Prior Year 3 Cost of Goods Sold 4…

A: Calculation of stock and change in value of stock.

Q: A man made a year-end payment of P100, 000 to an account earning 7% annually for 10 years. How…

A: Here, Annual Payment = P100,000 Interest rate =7% Total no. of payments = 10 years Total no. of…

Q: ASSETS Current Assets: Mayo Manufacturing Corp. Balance Sheet December 31 2020 2021

A: Different financial ratios are calculated to measure the financial performance of the company. Some…

Q: Use the formula PV = FV × (1/(1+i)n) to find the present value of $9,600 received three years from…

A: Present Value refers to a concept that states the discounted value or say value at today's time of…

Q: How can a good credit score help you obtain the job you want?

A: Credit scores are given by the credit agencies based on the credit habits of the borrower and how he…

Q: One year from today, the U.S. government will spend roughly $850 (in billions) on Medicare and…

A: Information provided: Government spending next year "S1"= $850 billions Discount rate "r" = 5%…

Q: Jackson borrowe $25,00 10, 2011. He repaid $8,000 on November 1, 2011, $5,350 on December 15, 2011,…

A: Simple interest is simple in interest and there is no compounding of interest means that there is no…

Q: idilabs Limited issued a dividend of $9.60 yesterday. It expects dividends to grow at a steady rate…

A: Prices of stock can be found out from the dividend growth discount model assuming the constant…

Q: The credit card with the transactions described on the right uses the average daily balance method…

A: A credit card billing statement has to be prepared. For that we need the average daily balance,…

Q: A firm has a float of 300 million shares and 10 million restricted shares. It has a total of 1…

A: Market capitalization is the total value of shares in the market. The float of shares represents the…

Q: Investigate the effect of the term on simple interest amortized auto loans by finding the monthly…

A: Given, The loan amount is $13,000 Rate is 8 7/8%

Q: a. What is the equation for the Security Market Line (SML)? (Hint: First determine the expected…

A: Information Provided: Risk free rate = 3% Total capital = $500 million

Q: Ch9) You are in need of a replacement water heater and are deciding betwee xpensive option (A) with…

A: When the equipments have different life spans than each equipment can be compared with other on the…

Q: What should be the price of a bond that has a 14% coupon rate (semiannual payments), par value =…

A: Information provided: Par value "FV" = $1000 Annual coupon rate = 14% Semi-annual coupon payment…

Q: Explain risk - reward analysis

A: Risk and return The benefit received from the investment is known as a return and the uncertainties…

Q: Assume that as of today, the annualized interest rate for a seven-year bond is 10 percent, while the…

A: We have annualized yield for a 7 year bond and a 3 year bond. We have to find the annualized…

Q: 3. The most I can afford to pay for my mortgage payment is $950 a month. The bank is offering a 20…

A: Information Provided: Monthly payment = $950 Interest rate = 4.30% Period = 20 years NOTE: As…

Q: Basic bond valuation Complex Systems has an outstanding issue of $1,000-par-value bonds with a 9%…

A: Bonds are debt securities issued by governments and corporations. The bonds carry a fixed interest…

Q: If you deposit $45,000 into an account earning 4% interest compounded quarterly, how much would you…

A: Here, Present value (PV) = $45,000 Interest rate (RATE) = 4% No. of compounding periods = 4 Time…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- From the following facts, complete a depreciation schedule by using the straight-line method: (Input all amounts as positive values.) Cost of Honda Accord Hybrid $ 36,800 Residual value $ 7,800 Estimated life 8 yearsFrom the following facts, complete a depreciation schedule by using the straight-line method: (Input all amounts as positive values.) Cost of Honda Accord Hybrid $ 40,000 Residual value $ 10,000 Estimated life 6 years End of year Cost of Honda Accord Depreciation expense for year Accumulated depreciation at end of year Book value at end of year 1 2 3 4 5 6. Convert each of the following estimates of useful life to a straight-line depreciation rate, stated as a percentage: (a) 4 years, (b) 8 years, (c) 10 years, (d) 16 years, (e) 25 years, (f) 40 years, (g) 50 years. Equipment with a cost of $200,000 has an estimated residual value of $10,000, has an estimated useful life of 19 years, and is depreciated by the straight-line method. (a) Determine the amount of the annual depreciation. (b) Determine the book value at the end of the tenth year of use. (c) Assuming that at the start of the eleventh year the remaining life is estimated to be eight years and the residual value is estimated to be $10,500, determine the depreciation expense for each of the remaining eight years.

- Acton, Inc., uses the double-declining-balance method for depreciation on itscomputers. Which item is not needed to compute depreciation for the first year?a. Estimated residual valueb. Expected useful life in yearsc. Original costd. All the items listed are needed.A financial analyst is studying the income statement eff ect of two alternative depreciationmethods for a recently acquired piece of equipment. She gathers the following information about the equipment’s expected production life and use:Year 1 Year 2 Year 3 Year 4 Year 5 TotalUnits of production 2,000 2,000 2,000 2,000 2,500 10,500Compared with the units-of-production method of depreciation, if the company uses thestraight-line method to depreciate the equipment, its net income in Year 1 will most likely be:A. lower.B. higher.C. the sameGiven the data, prepare a depreciation table (Depreciation Expense, Accumulated Depreciation, Carrying Amount) for the following methods: 1. Straight line 2. Service hours 3. Production method Also, identify the Gain or Loss for each year and every deprecation method if the machine is sold at: End of 1st Yr - 500,000 End of 2nd Yr - 360,000 End of 3rd Yr - 260,000 End of 4th Yr - 165,000 End of 5th Yr - 40,000

- A truck acquired at a cost of $445,000 has an estimated residual value of $26,500, has an estimated useful life of 45,000 miles, and was driven 4,100 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The depreciable cost $fill in the blank 1 (b) The depreciation rate $fill in the blank 2 per mile (c) The units-of-activity depreciation for the year $fill in the blank 3 Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $32,000 in cash and giving a short-term note for $337,000. Legal fees paid were $1,620, delinquent taxes assumed were $11,900, and fees paid to remove an old building from the land were $18,900. Materials salvaged from the demolition of the building were sold for $5,500. A contractor was paid $1,121,800 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet.$fill in the…Calculate depreciation in the following case La Rosa del Monte has a moving truck that performs large removals in the Miami area and at the end of the year has a balance of $88,250 with a cumulative depreciation of $12,230. It also has a small truck that it uses in the Orlando area for $43,760 with a cumulative depreciation of $7,120. Determine what the depreciation is for each truck using the depreciation by units of activity method. Truck Cost Estimated residual value Estimated service lifetime Accumulated depreciation at the beginning of the year Miles used in the year Large truck $88,250 $17,000 230,000 millas $12,230 32,000 Small truck 43,760 6,500 280,000 millas 7,120 27,300A truck acquired at a cost of $130,000 has an estimated residual value of $7,600, has an estimated useful life of 34,000 miles, and was driven 3,400 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. Line Item Description Amount (a) The depreciable cost $fill in the blank 1 (b) The depreciation rate $fill in the blank 2 per mile (c) The units-of-activity depreciation for the year $fill in the blank 3

- Consider the following data on an asset:Cost of the asset, I $38,000Useful life. N 6 YearsSalvage value. S $0 Compute the annual depreciation allowances and the resulting book values by using the DOB method and then switching to the SL method.Use the straight-line method to complete the first row of the depreciation table for an SUV that costs $41,000, has a residual value of $5,000 and an estimated life of six years. Year Annual depreciation Accumulated depreciation End-of-year book value 1 Complete the table below. Year Annual depreciation Accumulated depreciation End-of-year book value 1 $enter your response here $enter your response here $enter your response hereWhich of the following is true? a.If using the units-of-output method, it is possible to depreciate more than the depreciable cost. b.If using the double-declining-balance method, the total amount of depreciation expense during the life of the asset will be the highest. c.If using the straight-line method, the amount of depreciation expense during the first year is higher than that of the double-declining-balance. d.Regardless of the depreciation method, the amount of total depreciation expense during the life of the asset will be the same.