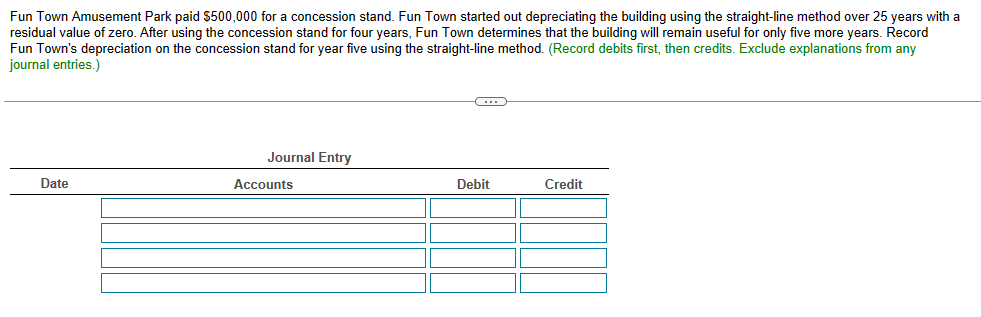

Fun Town Amusement Park paid $500,000 for a concession stand. Fun Town started out depreciating the building using the straight-line method over 25 years with a residual value of zero. After using the concession stand for four years, Fun Town determines that the building will remain useful for only five more years. Record Fun Town's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any journal entries.) -C

Fun Town Amusement Park paid $500,000 for a concession stand. Fun Town started out depreciating the building using the straight-line method over 25 years with a residual value of zero. After using the concession stand for four years, Fun Town determines that the building will remain useful for only five more years. Record Fun Town's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any journal entries.) -C

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

Question attchedi n ss below thanks

dnkfqnkor2gn2origno

gnrg

aprpeicated

Transcribed Image Text:Fun Town Amusement Park paid $500,000 for a concession stand. Fun Town started out depreciating the building using the straight-line method over 25 years with a

residual value of zero. After using the concession stand for four years, Fun Town determines that the building will remain useful for only five more years. Record

Fun Town's depreciation on the concession stand for year five using the straight-line method. (Record debits first, then credits. Exclude explanations from any

journal entries.)

Date

Journal Entry

Accounts

C

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,