sale of Mad Company ordinary shares on July 18, 2023? A. P4,500 B. P3,000 C. P1,500 D. P0 5. What is the amount transferred to retained earnings if Jam Company opted to transfer the unrealized gain or loss relating to the shares sold? A. P11,100 B. P5,500

sale of Mad Company ordinary shares on July 18, 2023? A. P4,500 B. P3,000 C. P1,500 D. P0 5. What is the amount transferred to retained earnings if Jam Company opted to transfer the unrealized gain or loss relating to the shares sold? A. P11,100 B. P5,500

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 23E

Related questions

Question

4. How much is the gain (loss) on the sale of Mad Company ordinary shares on July 18, 2023?

A. P4,500

B. P3,000

C. P1,500

D. P0

5. What is the amount transferred to

A. P11,100

B. P5,500

C. P5,100

D. P1,500

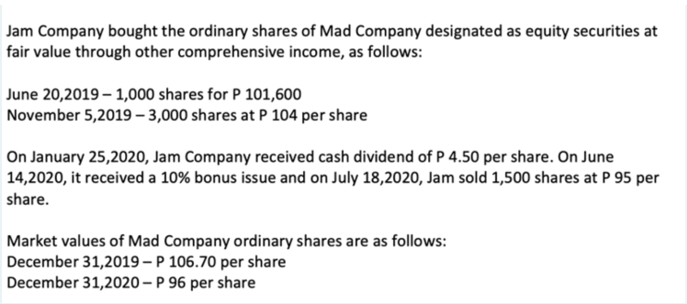

Transcribed Image Text:Jam Company bought the ordinary shares of Mad Company designated as equity securities at

fair value through other comprehensive income, as follows:

June 20,2019-1,000 shares for P 101,600

November 5,2019-3,000 shares at P 104 per share

On January 25,2020, Jam Company received cash dividend of P 4.50 per share. On June

14,2020, it received a 10% bonus issue and on July 18,2020, Jam sold 1,500 shares at P 95 per

share.

Market values of Mad Company ordinary shares are as follows:

December 31,2019-P 106.70 per share

December 31,2020-P 96 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning