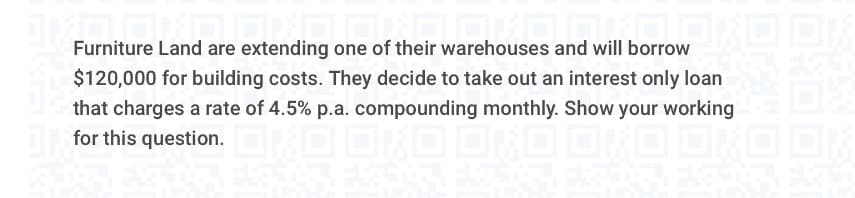

Furniture Land are extending one of their warehouses and will borrow $120,000 for building costs. They decide to take out an interest only loan that charges a rate of 4.5% p.a. compounding monthly. Show your working for this question.

Furniture Land are extending one of their warehouses and will borrow $120,000 for building costs. They decide to take out an interest only loan that charges a rate of 4.5% p.a. compounding monthly. Show your working for this question.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 2P: Cost of Bank Loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for...

Related questions

Question

part D E F

Transcribed Image Text:Furniture Land are extending one of their warehouses and will borrow

$120,000 for building costs. They decide to take out an interest only loan

that charges a rate of 4.5% p.a. compounding monthly. Show your working

for this question.

KOOK

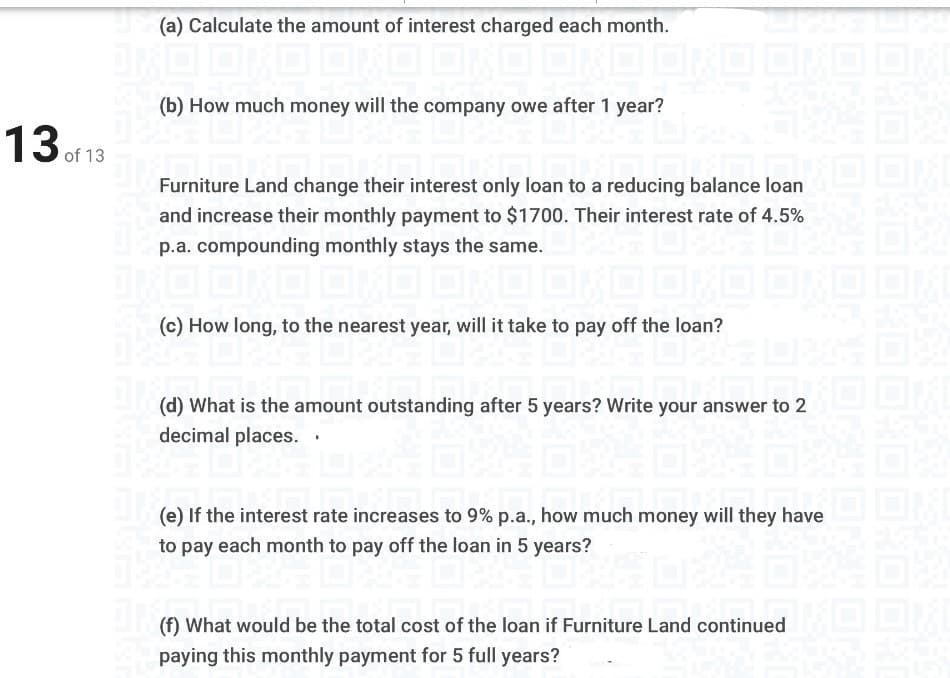

Transcribed Image Text:(a) Calculate the amount of interest charged each month.

(b) How much money will the company owe after 1 year?

13 of 13

Furniture Land change their interest only loan to a reducing balance loan

and increase their monthly payment to $1700. Their interest rate of 4.5%

p.a. compounding monthly stays the same.

(c) How long, to the nearest year, will it take to pay off the loan?

(d) What is the amount outstanding after 5 years? Write your answer to 2

decimal places.

(e) If the interest rate increases to 9% p.a., how much money will they have

to pay each month to pay off the loan in 5 years?

(f) What would be the total cost of the loan if Furniture Land continued L

paying this monthly payment for 5 full years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College