going to remodel the dental reception area and add two new workstations. He has contacted A-Dec, and the new equipment and cabinetry will cost $22,000. The Present value with periodic rates Sam Hinds, a local dentist, purchase will be financed with an interest rate of 9.5% loan over 9 years. What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year) and weekly payments (52 per year)? Compare the annual cash outflows of the two payments. Why does the weekly payment plan have less total cash outflow each year? What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year)? SI (Round to the nearest cent.)

going to remodel the dental reception area and add two new workstations. He has contacted A-Dec, and the new equipment and cabinetry will cost $22,000. The Present value with periodic rates Sam Hinds, a local dentist, purchase will be financed with an interest rate of 9.5% loan over 9 years. What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year) and weekly payments (52 per year)? Compare the annual cash outflows of the two payments. Why does the weekly payment plan have less total cash outflow each year? What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year)? SI (Round to the nearest cent.)

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 16P

Related questions

Question

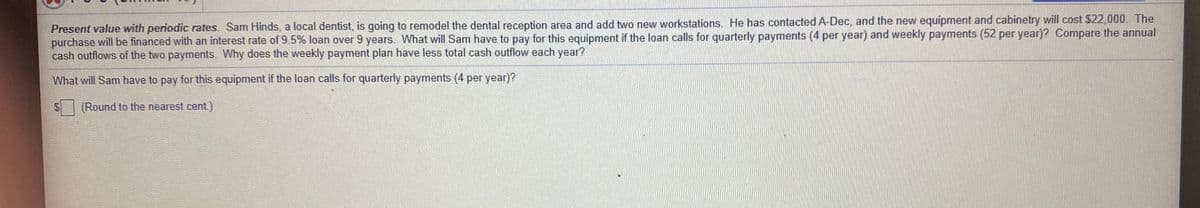

Transcribed Image Text:Present value with periodic rates. Sam Hinds, a local dentist, is going to remodel the dental reception area and add two new workstations. He has contacted A-Dec, and the new equipment and cabinetry will cost $22,000. The

purchase will be financed with an interest rate of 9.5% loan over 9 years. What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year) and weekly payments (52 per year)? Compare the annual

cash outflows of the two payments. Why does the weekly payment plan have less total cash outflow each year?

What will Sam have to pay for this equipment if the loan calls for quarterly payments (4 per year)?

$4

(Round to the nearest cent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College