Q: Present Value Years Interest Rate Future Value 600 8% 24 1,393 850 12 2,330 18,800 18 367,247 21,900…

A: year=logfuture valuepresent valuelog 1+rate

Q: 4. Calculating Interest Rates. Solve for the unknown interest rate in each of the following: 3…

A: ACCORDING TO TIME VAUE OF MONEY, FUTURE VALUE=PRESENT VALUE×1+ratetime

Q: Present Value of Annuity Annuity Years Interest Rate Compounding Due $100.00 37 20.00% Weekly O a.…

A: Given:

Q: Find the PW, AW and FW of the following cashflow if the interest rate compound semiannually. P-7…

A: The question is based on the concept for calculating Present worth(PW), Annual Worth (AW), and…

Q: As shown in Table, $1,000 invested at 10 percent compound interest will grow into $1,331 after three…

A: Present Value is the current value of a cash flow that can be occurred in future. To find the…

Q: Maturity Value (F) Principal (P) Rate (r) Time (t) Interest (I,) P 60,000.00 4% 15 (1) (2) (3) 12% P…

A: Interest = Principal x Rate x Time 1) Interest = 60,000 x 4% x 15 =36,000 2) Maturity Value =…

Q: Number of Annual Payments or Present Value Annuity Future Value Interest Rate Years 10 8% $324.85 ?…

A: A study that proves that the value of money today is higher than the future value of money is term…

Q: Which one is the approximate periodic interest rate % on a Treasury bill that you purchase for 4,908…

A: A risk-free short-term debt that is issued by the government, and supported by the treasury…

Q: 2. Calculating Future Välues ture value: L01 Present Value Years Interest Rate Future Value 13% $…

A: Future value can be calculated using the formula given below Future Value = P0 x (1+r)^n Here P0 =…

Q: Finding the Interest Rate per Compound Period Principal Future Value Term Interest Interest Rate per…

A: Principal (P) = P 50,000 Future value (F) = P 114,860 Term = 2.5 Years Number of compounding periods…

Q: Investment deposit made over a four-year period are R200, R100, R150 and R200. The real interest…

A: As, the interest rate (real) is given, which means the rate of inflation is already included in the…

Q: Determine the future value of the following single amounts: No. of Periods Invested Amount Interest…

A: Future Value of Investment can be computed using the below formula:

Q: Reznik Inc provided a significant amount of legal services to Spaces Inc during March of 2020. At…

A: The answer provided below has been developed in a clear step by step manner. Date Account Dr…

Q: 8) Face value: $4,000 Interest rate: 12% Term: 6 months Discount period: 3 months find: maturity…

A: Calculation of the maturity value is as follows: Hence, the maturity value of $4,240.

Q: Loan Basics nputs Present value nterest rate/year Number of years 325,000 4.00% 30 Present Value…

A: given, loan amount (P)= $325000 r=4% m=12 n = 30

Q: Question 15 A bank offers an APR of 3.25% compounded semiannually.Find the annual percentage yield…

A: An annual percentage yield is referred to as the real rate of return, which helps in obtaining the…

Q: Determine the nominal interest rate compounded continuously corresponding to an effective interest…

A: Effective interest rate (EAR) = 12% Mathematics constant (e) = 2.7182818284590452353602874713527…

Q: $3300 8% compounded quarterly $1200 1 4 5 6 7 8 Quarters

A: a) Effective rate can be computed in excel as follows: Answer would be:

Q: (15) 00 (11) quarterly (12) (13) 6. (14) 8,8 Semi- D00 11% (16) (17) (18) (19) 10,000 (2 annually…

A: More is the compounding more is the effective interest rate and hence future value increases with…

Q: ETT End of Year Annuity X Annuity Y 1-10 1 K 11-20 21-30 1 K Annuities X and Y have equal present…

A: Here V10 is 1/2 Present Value of X is equal to Present Value of Y

Q: Compound Amount Term of Investment Nominal Rate (%) Interest Compounded Present Value…

A: Compound amount (FV) = $ 300,000 Annual interest rate (r) = 4% Period (n) = 10 Years PVF(4%,10…

Q: Number of Annual Payments or Years Interest Rate Present Value Annuity Future Value 6. 10% $183.67…

A: An annuity is a contract between you and an insurance company in which you make a lump-sum payment…

Q: Maturity Value (in $) Rate Time Interest Principal Interest (%) (days) Method $3,100 % 167 Exact…

A: Interest expense: It is the interest which is incurred by the organization on the debt taken by it.…

Q: Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round your…

A: Lets understand the basics. Present value is a value in present of the future amount. For…

Q: An investment earning 16% simple interest has a maturity value of $9440.00 after eight months. What…

A: The term simple interest refers to the type in which the interest is only charged on the amount of…

Q: When compounded quarterly P12,000 becomes P 20,415.23 after 4 yrs. What is the nominal rate of…

A: Present value (PV) = P12000 Future value (FV) = P20,415.23 Period (t) = 4 Year Number of compounding…

Q: Present Value Years Interest Rate Future Value 8. 7% $ 13,827 43,852 725,380 13 15 17 26 18 590,710

A: Present value=Future value(1+r)n where r=interest rate n=number of years or Present value= Future…

Q: hat is the present value of a $2,800 deposit in year 4 and another $3,300 deposit at the end of year…

A: Present value refers to the present or current value of a desired sum of money which is evaluated on…

Q: 10. If P 11 200 is the present value of P 13 700 due at the end of 16 months, find a. discount…

A: compounding formula: fv = pv×1+rn fv = future value pv = present value r=rate n = number of years…

Q: Present Value $ 610 940 26,350 43,500 Years Interest Rate -7% 8% 9% 11 % $ Future Value 1,389 1,821…

A: calculation of number of years by using excel function NPER NPER functions syntax is…

Q: # 1 Interest Amount Present Value $16,775.00 Interest Rate Time 0.5% per month 6 months Future Value

A: Future Value: The future value is the amount that will be received at the end of a certain period.…

Q: calculating present values for each of the following, compute the present value Year interest…

A: A theory that helps to compute the present or future value of the cash flows is term as the TVM…

Q: Question 10 3-month SA treasury bill rate 2% beta coefficient 0,491289463 market risk premium 8 %…

A: Risk free rate = 2% Market return = 8% Beta = 0.491289463

Q: Present Value Years Interest Rate Future Value $ 242 $4 345 410 927 51,700 152,184 18,750 27 538,600…

A: Formula used to compute the interest rate is as follows: A=P(1+r/100)^nwhere,A = Future valueP…

Q: ns: Complete the table below: Show your solution on a separate sheet. Maturity Value (P) Principal…

A: We will use the concept of simple interest to fill this table. Simple interest = principal * rate…

Q: Accounting rate of return Payback period Net present value 8.60 4.35 years Net present val

A: Net Present Value It is difference of present value of cash inflows and cash outflow. When the NPV…

Q: Tate borrowing rate of 11% per year. 1 4,000 Year 4 Cash Flow, $ -3,000 -4,000 3,000 -1,300 4,500 al…

A: MIRR is modified internal rate of return.

Q: 21.Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round…

A: Present value is the sum of the current value of money of future cash flows. It is also known as a…

Q: Calculating Interest Rate. Find the interest rate implied by the following combinations of present…

A:

Q: för Co. its selected financial statements items are given as following. Total assets equals to the…

A: Nominal growth = Increase in sales / initial sales

Q: Find the present value of the given future amount. $183,714 for 321 days at 5.6% simple interest.…

A: The simple interest is interest without compounding that means there is no interest on interest and…

Q: 1) Find the PW, AW and FW of the following cashflow if the interest rate compound semiannually. P-7…

A: Present worth(PW), Annual Worth (AW) , and Future Worth (FW) are based on the concept of the time…

Q: 5.0 4.0 Nominal Interest Rate 3.0 2.0 Real Interest Rate 1.0 -1.0 2.0 -3.0 2003 2004 2005 2006 2007…

A:

Q: Determine the present value of the following single amounts: Future Amount Interest Rate No. of…

A: Present value is the current value of a future amount that is to be received or paid out.Future…

Q: 20.Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round…

A: The present value and interest figure can be calculated as per principle of time value of money

Q: 22.Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round…

A: Compound amount (FV) = $26,500 Period = 18 Months Semi annual period (n) = 18/6 = 3 Interest rate =…

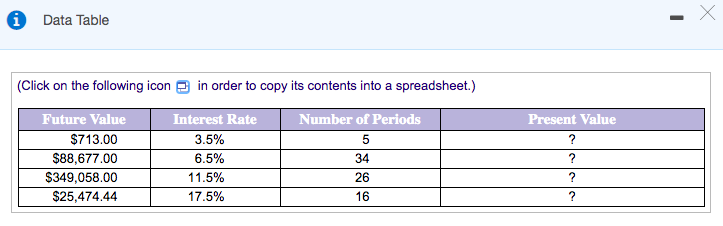

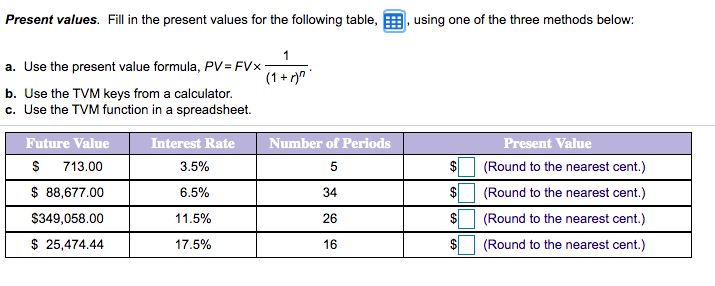

See attached images below for question

Step by step

Solved in 2 steps with 2 images

- Consider the following information: Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected returnSuppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.7 percent and the standard deviation was 18.3 percent. a. What is the probability that your return on this asset will be less than –4.1 percent in a given year? Use the NORMDIST function in Excel® to answer this question. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What range of returns would you expect to see 95 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What range of returns would you expect to see 99 percent of the time? (Enter your answers for the range from lowest to highest. A negative answer should be indicated by a minus sign. Do not round intermediate calculations…Look up the numerical value for the following factors from the compound interest factor tables. 1. (F∕P,10%,7) 2. (A∕P,12%,10) 3. (P∕G,15%,20) 4. (F∕A,2%,50) 5. (P∕G,35%,15)

- Please fill out the parts in the above table that are shaded in yellow. You will notice that there are nine line items Please answer : Covariance with MP Correlation with Market Index Beta CAPM Req. Returnomplete the table below using CAPM model Case Expected return RF RM Beta B 9% 8% 10% ?nd the present value of the following ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press PV, and find the PV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 12%. $ $300 per year for 5 years at 6%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made at the beginning of each year; that is, they are annuities due. Present value of $600…

- 1.) On a single chart, plot the value of $1 invested in each of the five indexes over time. I.e., for all ??, plot the cumulative return series for each index: ?????? = (1 + ?��1)(1 + ?��2)...(1 + ????) What patterns do you observe? (10 points) 2.) Plot a histogram of only the Global index returns. Does the distribution look normal? (5 points) 3.) Estimate the following for each of the indices. In calculating the statistics, “monthly” can be interpreted as “not annualized”. (30 points) a. Arithmetic average of monthly returns, and annualized arithmetic return using the APR method b. Geometric average of monthly returns, and annualized geometric return using the EAR method. Why does the geometric average differ from the arithmetic average? c. Standard deviation of monthly returns, and annualized standard deviation d. Sharpe Ratio of monthly returns, and annualized Sharpe Ratio e. Skewness of monthly returns f. Kurtosis of monthly returns g. 5% Value at Risk (VaR) of…Suppose the returns on an asset are normally distributed. The historical average annual return for the asset was 5.2 percent and the standard deviation was 10.6 percent. a. What is the probability that your return on this asset will be less than –9.7 percent in a given year? Use the NORMDIST function in Excel® to answer this question. b. What range of returns would you expect to see 95 percent of the time? c. What range of returns would you expect to see 99 percent of the time?The NPV is? Round to nearest dollar

- The single sum, present worth factor: a. Can be depicted as (1 + i)−n b. Can be depicted as (P|F i%,n) c. Is represented as PV using the Excel® financial function with −1 inserted for the fv parameter d. All of the above.Don't use chatgpt, I will 5 upvotes The probability distribution of returns of Stutson Gheegi Manufacturing is presented below. what is the standard deviation of returns of Stutson Gheegi? (recurring content question) \table[[Probability,Return],[10%,28%By using only those factors given in interesttables, find the values of the factors that follow,which are not given in your tables. Show the relationship between the factors by using factor notation, andcalculate the value of the factor. Then compare thesolution you obtained by using the factor formulaswith a direct calculation of the factor values.For example, (F/P, 8%, 38) =(F/P, 8%, 30) (F/P, 8%, 8) = 18.6253.(a) (P/F, 8%, 67)(b) (A/P, 8%, 42)(c) (P/A, 8%, 135)