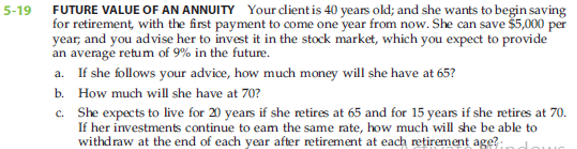

FUTURE VALUE OF AN ANNUITY Your client is 40 years old; and she wants to begin saving for retirement, with the first payment to come one year from now. She can save $5,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average retum of 9% in the future. 5-19 a. If she follows your advice, how much money will she have at 65? b. How much will she have at 70? c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to eam the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age?:

FUTURE VALUE OF AN ANNUITY Your client is 40 years old; and she wants to begin saving for retirement, with the first payment to come one year from now. She can save $5,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average retum of 9% in the future. 5-19 a. If she follows your advice, how much money will she have at 65? b. How much will she have at 70? c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to eam the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age?:

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 19P

Related questions

Question

Transcribed Image Text:FUTURE VALUE OF AN ANNUITY Your client is 40 years old; and she wants to begin saving

for retirement, with the first payment to come one year from now. She can save $5,000 per

year, and you advise her to invest it in the stock market, which you expect to provide

an average retum of 9% in the future.

5-19

a. If she follows your advice, how much money will she have at 65?

b. How much will she have at 70?

c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70.

If her investments continue to eam the same rate, how much will she be able to

withdraw at the end of each year after retirement at each retirement age?:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning