GAI Insurance Inc. is interested in investing in the shares of SSC Inc. SSC's common shares are currently selling at $51.22 per share and its free cash flows (FCF) for the most recent fiscal year are $0.60 per share. The required rate of return on the shares is 5%. Based on its extensive investigation, GAI believes that SSC will generate free cash flows of $1.10 per share next year, $1.40 per share the following year, and $1.75 per share in three years, following which SSC's FCF are expected to grow at an average rate of 2% per year. Based on this information, which of the following statements is correct? O 1. GAI should not invest because the shares are currently overpriced O 2. GAI should invest because the shares are currently underpriced O 3. GAI should invest because the shares are currently overpriced O 4. GAI should not invest because the shares are currently underpriced

GAI Insurance Inc. is interested in investing in the shares of SSC Inc. SSC's common shares are currently selling at $51.22 per share and its free cash flows (FCF) for the most recent fiscal year are $0.60 per share. The required rate of return on the shares is 5%. Based on its extensive investigation, GAI believes that SSC will generate free cash flows of $1.10 per share next year, $1.40 per share the following year, and $1.75 per share in three years, following which SSC's FCF are expected to grow at an average rate of 2% per year. Based on this information, which of the following statements is correct? O 1. GAI should not invest because the shares are currently overpriced O 2. GAI should invest because the shares are currently underpriced O 3. GAI should invest because the shares are currently overpriced O 4. GAI should not invest because the shares are currently underpriced

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter15: Distributions To Shareholders:dividends And Share Repurchases

Section: Chapter Questions

Problem 8P: ALTERNATIVE DIVIDEND POLICIES Rubenstein Bros. Clothing is expecting to pay an annual dividend per...

Related questions

Question

answer only 23 but with explanation

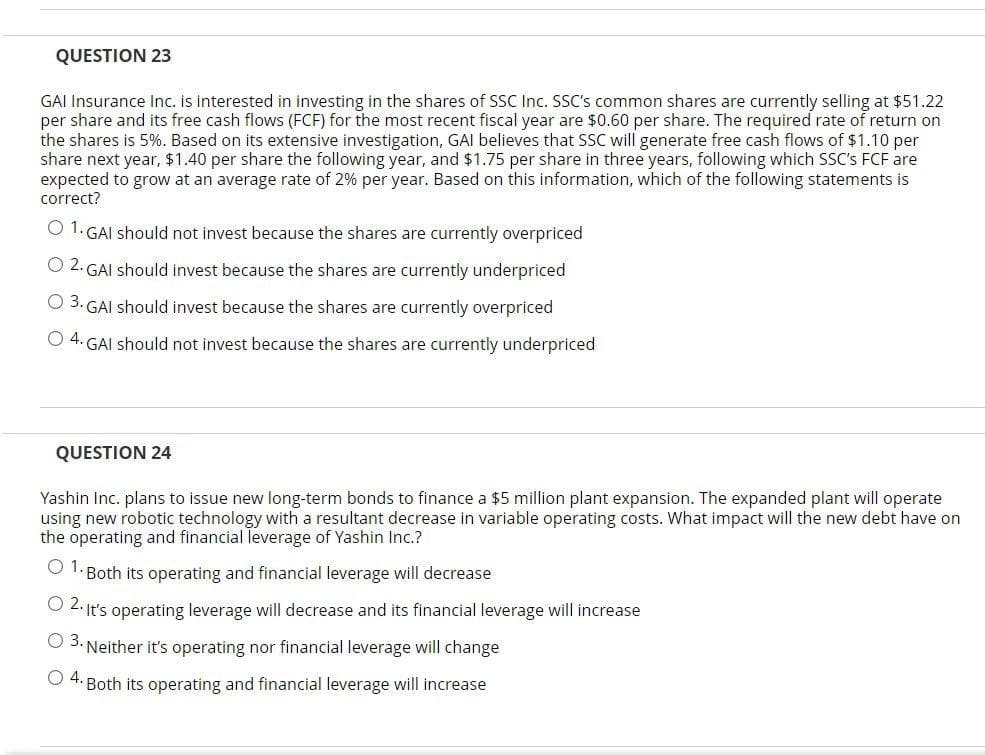

Transcribed Image Text:QUESTION 23

GAI Insurance Inc. is interested in investing in the shares of SSC Inc. SSC's common shares are currently selling at $51.22

per share and its free cash flows (FCF) for the most recent fiscal year are $0.60 per share. The required rate of return on

the shares is 5%. Based on its extensive investigation, GAI believes that SSC will generate free cash flows of $1.10 per

share next year, $1.40 per share the following year, and $1.75 per share in three years, following which SSC's FCF are

expected to grow at an average rate of 2% per year. Based on this information, which of the following statements is

correct?

O 1. GAI should not invest because the shares are currently overpriced

O 2. GAI should invest because the shares are currently underpriced

O 3. GAI should invest because the shares are currently overpriced

O 4. GAI should not invest because the shares are currently underpriced

QUESTION 24

Yashin Inc. plans to issue new long-term bonds to finance a $5 million plant expansion. The expanded plant will operate

using new robotic technology with a resultant decrease in variable operating costs. What impact will the new debt have on

the operating and financial leverage of Yashin Inc.?

O 1. Both its operating and financial leverage will decrease

O 2. It's operating leverage will decrease and its financial leverage will increase

O 3. Neither it's operating nor financial leverage will change

O 4. Both its operating and financial leverage will increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning