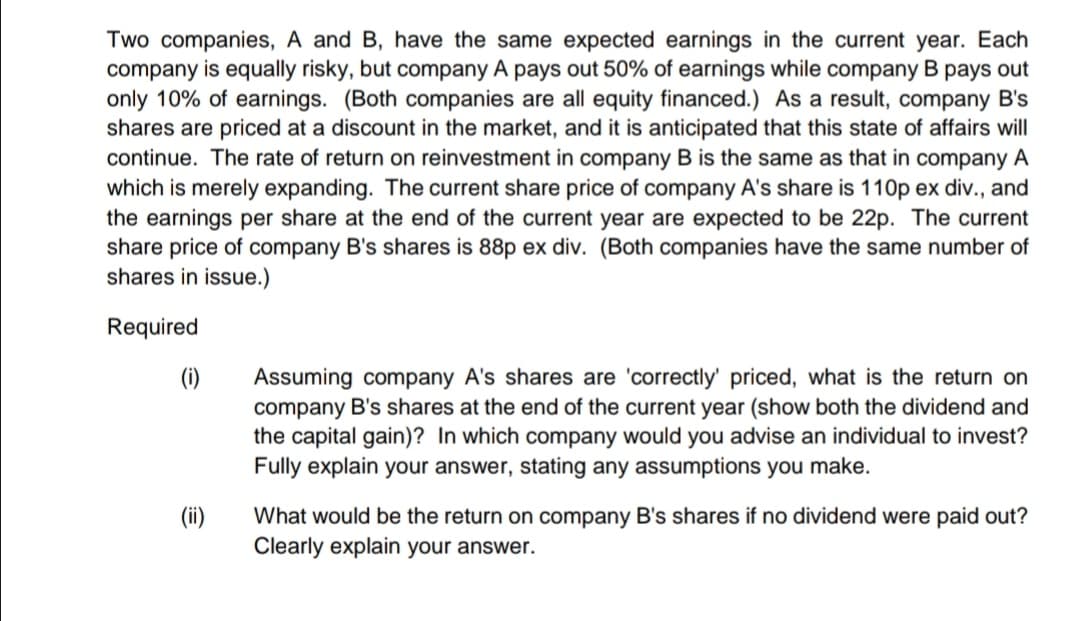

Two companies, A and B, have the same expected earnings in the current year. Each company is equally risky, but company A pays out 50% of earnings while company B pays out only 10% of earnings. (Both companies are all equity financed.) As a result, company B's shares are priced at a discount in the market, and it is anticipated that this state of affairs will continue. The rate of return on reinvestment in company B is the same as that in company A which is merely expanding. The current share price of company A's share is 110p ex div., and the earnings per share at the end of the current year are expected to be 22p. The current share price of company B's shares is 88p ex div. (Both companies have the same number of shares in issue.) Required (i) Assuming company A's shares are 'correctly' priced, what is the return on company B's shares at the end of the current year (show both the dividend and the capital gain)? In which company would you advise an individual to invest? Fully explain your answer, stating any assumptions you make. (ii) What would be the return on company B's shares if no dividend were paid out? Clearly explain your answer.

Two companies, A and B, have the same expected earnings in the current year. Each company is equally risky, but company A pays out 50% of earnings while company B pays out only 10% of earnings. (Both companies are all equity financed.) As a result, company B's shares are priced at a discount in the market, and it is anticipated that this state of affairs will continue. The rate of return on reinvestment in company B is the same as that in company A which is merely expanding. The current share price of company A's share is 110p ex div., and the earnings per share at the end of the current year are expected to be 22p. The current share price of company B's shares is 88p ex div. (Both companies have the same number of shares in issue.) Required (i) Assuming company A's shares are 'correctly' priced, what is the return on company B's shares at the end of the current year (show both the dividend and the capital gain)? In which company would you advise an individual to invest? Fully explain your answer, stating any assumptions you make. (ii) What would be the return on company B's shares if no dividend were paid out? Clearly explain your answer.

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Two companies, A and B, have the same expected earnings in the current year. Each

company is equally risky, but company A pays out 50% of earnings while company B pays out

only 10% of earnings. (Both companies are all equity financed.) As a result, company B's

shares are priced at a discount in the market, and it is anticipated that this state of affairs will

continue. The rate of return on reinvestment in company B is the same as that in company A

which is merely expanding. The current share price of company A's share is 110p ex div., and

the earnings per share at the end of the current year are expected to be 22p. The current

share price of company B's shares is 88p ex div. (Both companies have the same number of

shares in issue.)

Required

(i)

Assuming company A's shares are 'correctly' priced, what is the return on

company B's shares at the end of the current year (show both the dividend and

the capital gain)? In which company would you advise an individual to invest?

Fully explain your answer, stating any assumptions you make.

(ii)

What would be the return on company B's shares if no dividend were paid out?

Clearly explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning