Gail Trevino expects to receive a $500,000 cash benefit when she retires five years from today. Ms. Trevino’s employer has offered an early retirement incentive by agreeing to pay her $325,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a rate of return of 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required Calculate the present value of the $500,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

Gail Trevino expects to receive a $500,000 cash benefit when she retires five years from today. Ms. Trevino’s employer has offered an early retirement incentive by agreeing to pay her $325,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a rate of return of 8 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required Calculate the present value of the $500,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

Business/Professional Ethics Directors/Executives/Acct

8th Edition

ISBN:9781337485913

Author:BROOKS

Publisher:BROOKS

Chapter6: Professional Accounting In The Public Interest

Section: Chapter Questions

Problem 3.2EC

Related questions

Question

Gail Trevino expects to receive a $500,000 cash benefit when she retires five years from today. Ms. Trevino’s employer has offered an early retirement incentive by agreeing to pay her $325,000 today if she agrees to retire immediately. Ms. Trevino desires to earn a

Required

-

Calculate the present value of the $500,000 future cash benefit. Assuming that the retirement benefit is the only consideration in making the retirement decision, should Ms. Trevino accept her employer’s offer? (Round your final answer to the nearest whole dollar value.)

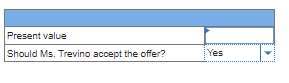

Transcribed Image Text:Present value

Should Ms. Trevino accept the offer?

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College