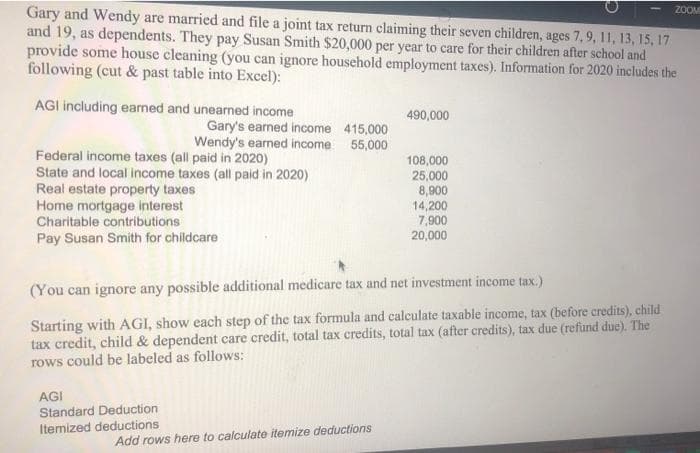

Gary and Wendy are married and file a joint tax return claiming their seven children, ages 7,9, 11, 13, 15, 17 and 19, as dependents. They pay Susan Smith $20,000 per year to care for their children after school and provide some house cleaning (you can ignore household employment taxes). Information for 2020 includes the following (cut & past table into Excel): AGI including earned and unearned income 490,000 Gary's earned income 415,000 Wendy's earned income 55,000 Federal income taxes (all paid in 2020) State and local income taxes (all paid in 2020) Real estate property taxes Home mortgage interest Charitable contributions 108,000 25,000 8,900 14,200 7,900 20,000 Pay Susan Smith for childcare (You can ignore any possible additional medicare tax and net investment income tax.) Starting with AGI, show each step of the tax formula and calculate taxable income, tax (before credits), child tax credit, child & dependent care credit, total tax credits, total tax (after credits), tax due (refund due). The rows could be labeled as follows: AGI Standard Deduction Itemized deductions Add ows here to calculate itemize deductions

Gary and Wendy are married and file a joint tax return claiming their seven children, ages 7,9, 11, 13, 15, 17 and 19, as dependents. They pay Susan Smith $20,000 per year to care for their children after school and provide some house cleaning (you can ignore household employment taxes). Information for 2020 includes the following (cut & past table into Excel): AGI including earned and unearned income 490,000 Gary's earned income 415,000 Wendy's earned income 55,000 Federal income taxes (all paid in 2020) State and local income taxes (all paid in 2020) Real estate property taxes Home mortgage interest Charitable contributions 108,000 25,000 8,900 14,200 7,900 20,000 Pay Susan Smith for childcare (You can ignore any possible additional medicare tax and net investment income tax.) Starting with AGI, show each step of the tax formula and calculate taxable income, tax (before credits), child tax credit, child & dependent care credit, total tax credits, total tax (after credits), tax due (refund due). The rows could be labeled as follows: AGI Standard Deduction Itemized deductions Add ows here to calculate itemize deductions

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 64P: Leroy and Amanda are married and have three dependent children. During the current year, they have...

Related questions

Question

Transcribed Image Text:Gary and Wendy are married and file a joint tax return claiming their seven children, ages 7,9, 11, 13, 15, 17

and 19, as dependents. They pay Susan Smith $20,000 per year to care for their children after school and

provide some house cleaning (you can ignore household employment taxes). Information for 2020 includes the

following (cut & past table into Excel):

ZOOM

AGI including earned and unearned income

490,000

Gary's earned income 415,000

Wendy's earned income 55,000

Federal income taxes (all paid in 2020)

State and local income taxes (all paid in 2020)

Real estate property taxes

Home mortgage interest

Charitable contributions

108,000

25,000

8,900

14,200

7,900

Pay Susan Smith for childcare

20,000

(You can ignore any possible additional medicare tax and net investment income tax.)

Starting with AGI, show each step of the tax formula and calculate taxable income, tax (before credits), child

tax credit, child & dependent care credit, total tax credits, total tax (after credits), tax due (refund due). The

rows could be labeled as follows:

AGI

Standard Deduction

Itemized deductions

Add rows here to calculate itemize deductions

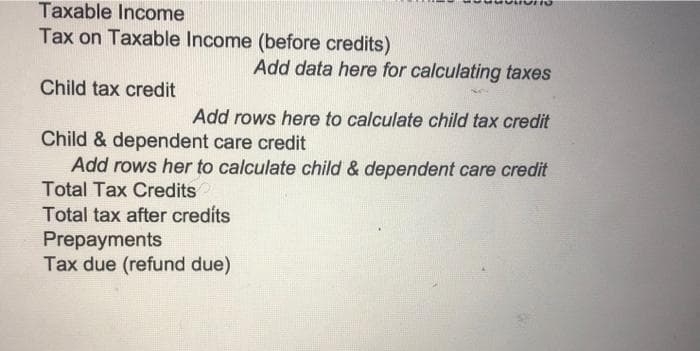

Transcribed Image Text:Taxable Income

Tax on Taxable Income (before credits)

Add data here for calculating taxes

Child tax credit

Add rows here to calculate child tax credit

Child & dependent care credit

Add rows her to calculate child & dependent care credit

Total Tax Credits

Total tax after credíts

Prepayments

Tax due (refund due)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT