Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.75%. Her current balance owing on November 1 is $14,500.00 and she is required to make interest-only payments on the first of every month. The prime rate is set at 3.5%. She makes one payment of $2,750.00 on January 19. Create three months of her repayment schedule. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, -$149.63") (Give all "Number of Days" quantities as fractions with denominator 365.) Date Balance before Transaction Annual Interest Rate Number Interest Accrued Interest of Days Charged Payment (+) or Advance (-) Principal Balance after Amount Transaction Nov 1 $14,500.00 Dec 1 6.25% Jan 1 6.25% Jan 19 6.25% $2,750.00 Feb 1 6.25%

Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.75%. Her current balance owing on November 1 is $14,500.00 and she is required to make interest-only payments on the first of every month. The prime rate is set at 3.5%. She makes one payment of $2,750.00 on January 19. Create three months of her repayment schedule. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, -$149.63") (Give all "Number of Days" quantities as fractions with denominator 365.) Date Balance before Transaction Annual Interest Rate Number Interest Accrued Interest of Days Charged Payment (+) or Advance (-) Principal Balance after Amount Transaction Nov 1 $14,500.00 Dec 1 6.25% Jan 1 6.25% Jan 19 6.25% $2,750.00 Feb 1 6.25%

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

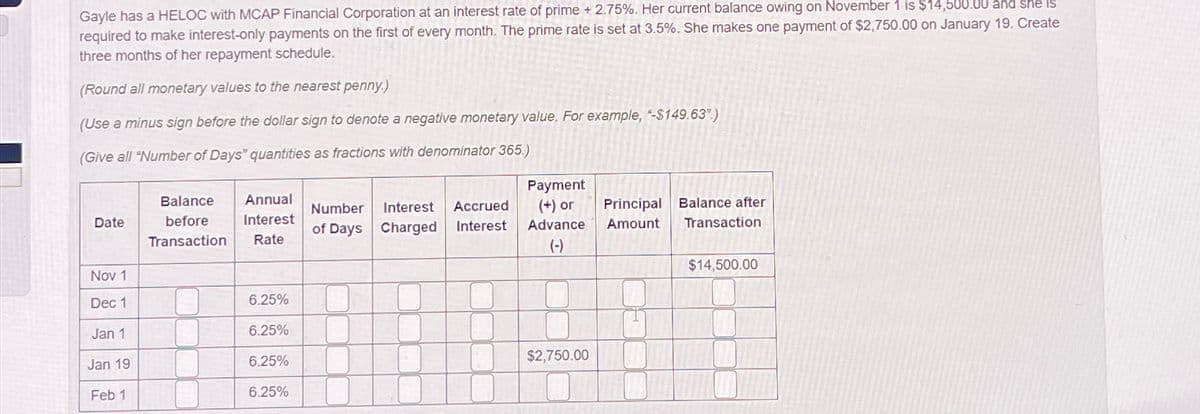

Transcribed Image Text:Gayle has a HELOC with MCAP Financial Corporation at an interest rate of prime +2.75%. Her current balance owing on November 1 is $14,500.00 and she is

required to make interest-only payments on the first of every month. The prime rate is set at 3.5%. She makes one payment of $2,750.00 on January 19. Create

three months of her repayment schedule.

(Round all monetary values to the nearest penny.)

(Use a minus sign before the dollar sign to denote a negative monetary value. For example, -$149.63")

(Give all "Number of Days" quantities as fractions with denominator 365.)

Date

Balance

before

Transaction

Annual

Interest

Rate

Number Interest Accrued

Interest

of Days Charged

Payment

(+) or

Advance

(-)

Principal Balance after

Amount Transaction

Nov 1

$14,500.00

Dec 1

6.25%

Jan 1

6.25%

Jan 19

6.25%

$2,750.00

Feb 1

6.25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT