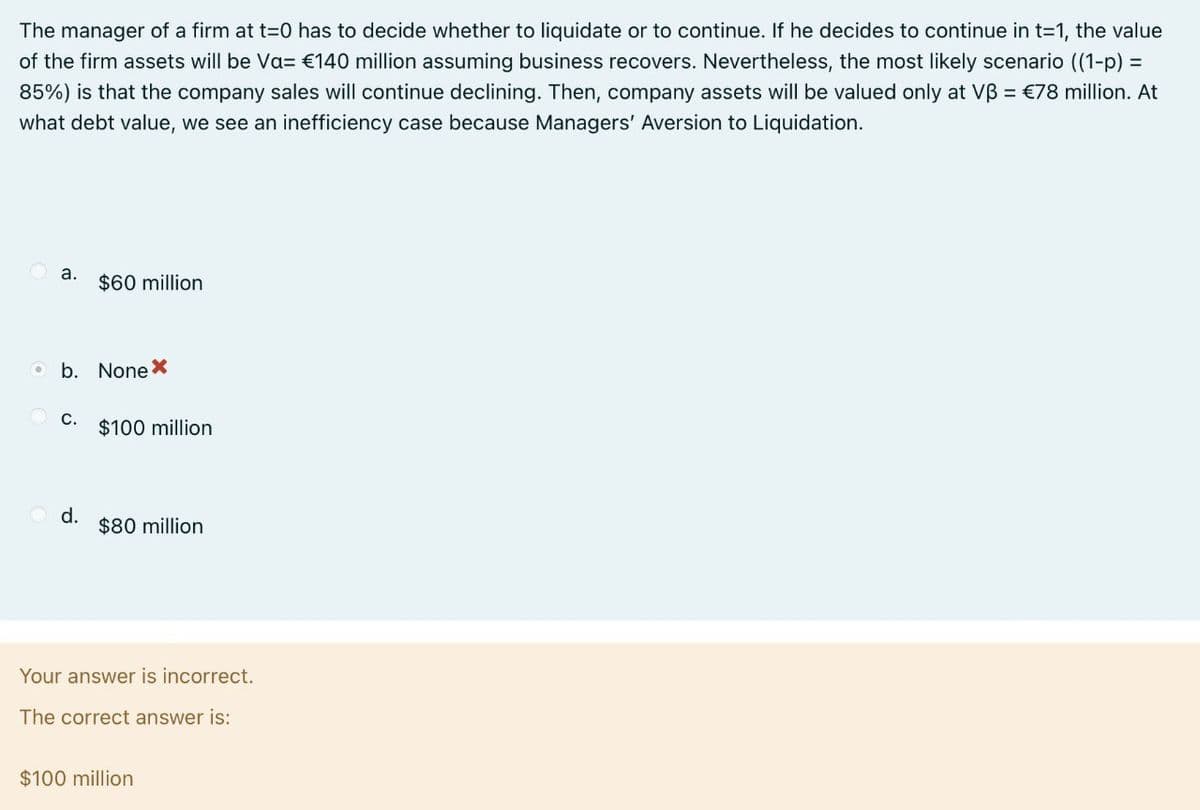

The manager of a firm at t=0 has to decide whether to liquidate or to continue. If he decides to continue in t=1, the value of the firm assets will be Va= €140 million assuming business recovers. Nevertheless, the most likely scenario ((1-p) = 85%) is that the company sales will continue declining. Then, company assets will be valued only at Vẞ = €78 million. At what debt value, we see an inefficiency case because Managers' Aversion to Liquidation. a. $60 million O b. None * C. $100 million d. $80 million Your answer is incorrect. The correct answer is: $100 million

The manager of a firm at t=0 has to decide whether to liquidate or to continue. If he decides to continue in t=1, the value of the firm assets will be Va= €140 million assuming business recovers. Nevertheless, the most likely scenario ((1-p) = 85%) is that the company sales will continue declining. Then, company assets will be valued only at Vẞ = €78 million. At what debt value, we see an inefficiency case because Managers' Aversion to Liquidation. a. $60 million O b. None * C. $100 million d. $80 million Your answer is incorrect. The correct answer is: $100 million

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 11P: The Rivoli Company has no debt outstanding, and its financial position is given by the following...

Related questions

Question

Transcribed Image Text:The manager of a firm at t=0 has to decide whether to liquidate or to continue. If he decides to continue in t=1, the value

of the firm assets will be Va= €140 million assuming business recovers. Nevertheless, the most likely scenario ((1-p) =

85%) is that the company sales will continue declining. Then, company assets will be valued only at Vẞ = €78 million. At

what debt value, we see an inefficiency case because Managers' Aversion to Liquidation.

a.

$60 million

O b. None *

C.

$100 million

d.

$80 million

Your answer is incorrect.

The correct answer is:

$100 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT