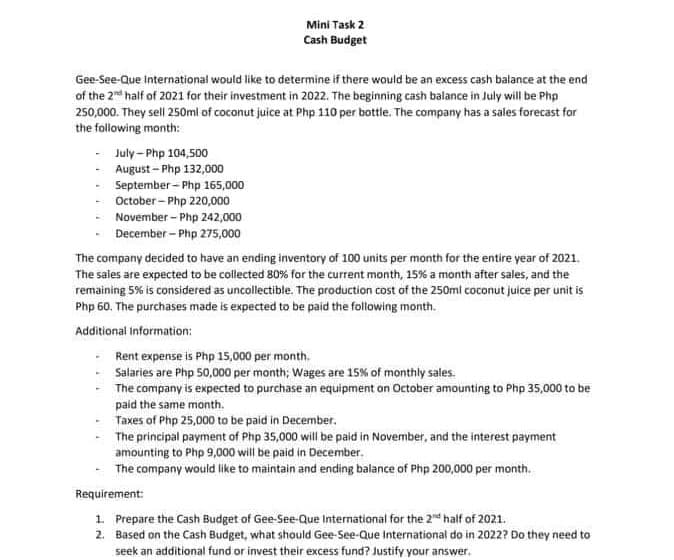

Gee-See-Que International would like to determine if there would be an excess cash balance at the end of the 2d half of 2021 for their investment in 2022. The beginning cash balance in July will be Php 250,000. They sell 250ml of coconut juice at Php 110 per bottle. The company has a sales forecast for the following month: - July - Php 104,500 August - Php 132,000 September - Php 165,000 October - Php 220,000 November - Php 242,000 December - Php 275,000 The company decided to have an ending inventory of 100 units per month for the entire year of 2021. The sales are expected to be collected 80% for the current month, 15% a month after sales, and the remaining 5% is considered as uncollectible. The production cost of the 250ml coconut juice per unit is Php 60. The purchases made is expected to be paid the following month. Additional Information: Rent expense is Php 15,000 per month. Salaries are Php 50,000 per month; Wages are 15% of monthly sales. The company is expected to purchase an equipment on October amounting to Php 35,000 to be paid the same month. Taxes of Php 25,000 to be paid in December. The principal payment of Php 35,000 will be paid in November, and the interest payment amounting to Php 9,000 will be paid in December. The company would like to maintain and ending balance of Php 200,000 per month. Requirement: 1. Prepare the Cash Budget of Gee-See-Que International for the 2d half of 2021. 2. Based on the Cash Budget, what should Gee-See-Que International do in 2022? Do they need to seek an additional fund or invest their excess fund? Justify your answer.

Gee-See-Que International would like to determine if there would be an excess cash balance at the end of the 2d half of 2021 for their investment in 2022. The beginning cash balance in July will be Php 250,000. They sell 250ml of coconut juice at Php 110 per bottle. The company has a sales forecast for the following month: - July - Php 104,500 August - Php 132,000 September - Php 165,000 October - Php 220,000 November - Php 242,000 December - Php 275,000 The company decided to have an ending inventory of 100 units per month for the entire year of 2021. The sales are expected to be collected 80% for the current month, 15% a month after sales, and the remaining 5% is considered as uncollectible. The production cost of the 250ml coconut juice per unit is Php 60. The purchases made is expected to be paid the following month. Additional Information: Rent expense is Php 15,000 per month. Salaries are Php 50,000 per month; Wages are 15% of monthly sales. The company is expected to purchase an equipment on October amounting to Php 35,000 to be paid the same month. Taxes of Php 25,000 to be paid in December. The principal payment of Php 35,000 will be paid in November, and the interest payment amounting to Php 9,000 will be paid in December. The company would like to maintain and ending balance of Php 200,000 per month. Requirement: 1. Prepare the Cash Budget of Gee-See-Que International for the 2d half of 2021. 2. Based on the Cash Budget, what should Gee-See-Que International do in 2022? Do they need to seek an additional fund or invest their excess fund? Justify your answer.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 5PB: Cash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for...

Related questions

Question

Transcribed Image Text:Mini Task 2

Cash Budget

Gee-See-Que international would like to determine if there would be an excess cash balance at the end

of the 2 half of 2021 for their investment in 2022. The beginning cash balance in July will be Php

250,000. They sell 250ml of coconut juice at Php 110 per bottle. The company has a sales forecast for

the following month:

July - Php 104,500

August – Php 132,000

September - Php 165,000

October - Php 220,000

November - Php 242,000

December - Php 275,000

The company decided to have an ending inventory of 100 units per month for the entire year of 2021.

The sales are expected to be collected 80% for the current month, 15% a month after sales, and the

remaining 5% is considered as uncollectible. The production cost of the 250ml coconut juice per unit is

Php 60. The purchases made is expected to be paid the following month.

Additional Information:

Rent expense is Php 15,000 per month.

Salaries are Php 50,000 per month; Wages are 15% of monthly sales.

The company is expected to purchase an equipment on October amounting to Php 35,000 to be

paid the same month.

Taxes of Php 25,000 to be paid in December.

The principal payment of Php 35,000 will be paid in November, and the interest payment

amounting to Php 9,000 will be paid in December.

The company would like to maintain and ending balance of Php 200,000 per month.

Requirement:

1. Prepare the Cash Budget of Gee-See-Que International for the 2d half of 2021.

2. Based on the Cash Budget, what should Gee-See-Que International do in 2022? Do they need to

seek an additional fund or invest their excess fund? Justify your answer,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning