GENERAL COMPANY Bank Reconciliation: 1st National Bank September 30 A. Balance per bank $28,375 B. Deposits in transit Sept 29 $ 4,500 Sept 30 1,525 6,025 34,400 C. Outstanding checks: 988 Aug 31 $ 2,200 1281 Sept 26 675 1285 Sept 27 850 1289 Sept 29 2,500 1292 Sept 30 7,255 (11,450) 20,950 D. Customer note collected by the bank: (3,000) E. Error: Check #1282, written on Sept. 26 for $270, was erroneously charged by bank as $720; bank was notified Oct. 2 450 F. Balance per books $20,400

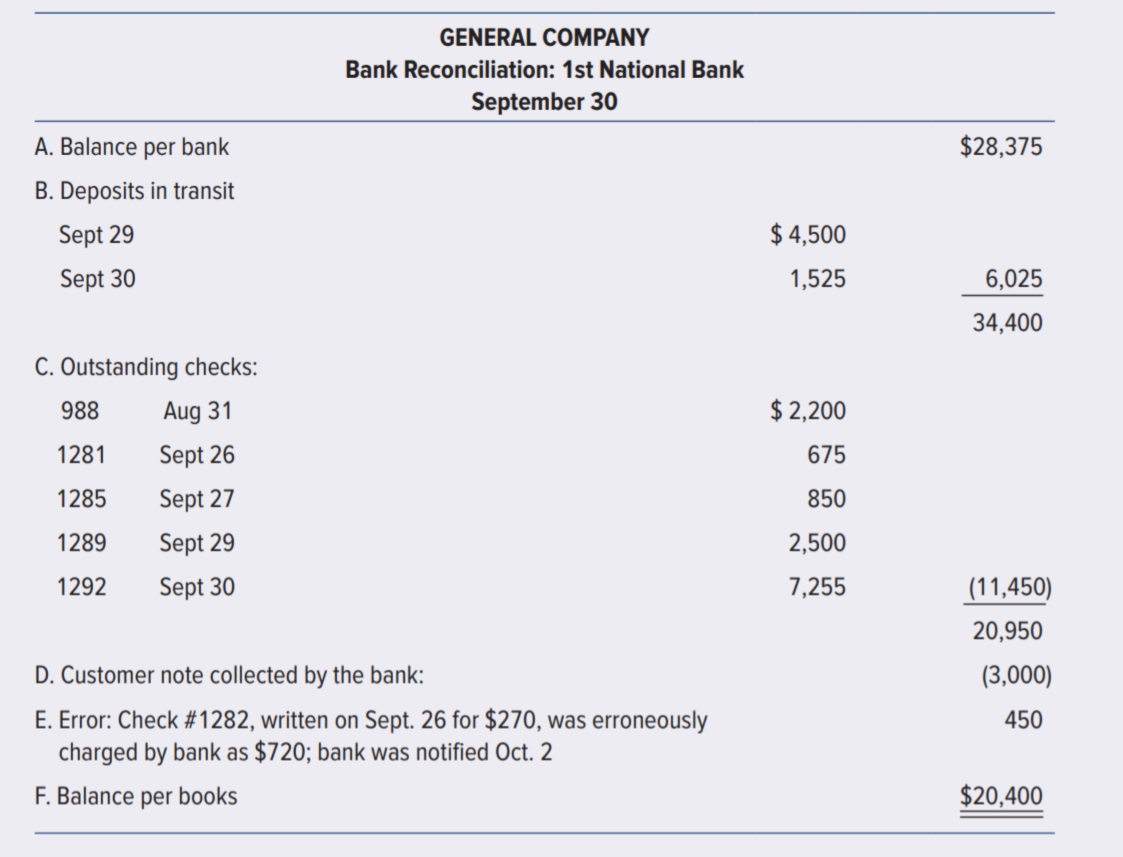

Auditors typically will find the items lettered A–F in a client-prepared bank reconciliation.

Check the below image for client-prepared bank reconciliation -

Required:

Assume these facts: On October 11, the auditor received a cutoff bank statement dated October 7. The September 30 deposit in transit; the outstanding checks 1281, 1285, 1289, and 1292; and the correction of the bank error regarding check 1282 appeared on the cutoff bank statement.

a. For each of the preceding lettered items A–F, select one or more of the following procedures 1–10 that you believe the auditor should perform to obtain evidence about the item. These procedures may be selected once, more than once, or not at all. Be prepared to explain the reasons for your choices.

1. Trace to cash receipts journal.

2. Trace to cash disbursements journal.

3. Compare to the September 30 general ledger.

4. Confirm directly with the bank.

5. Inspect bank credit memo.

6. Inspect bank debit memo.

7. Ascertain reason for unusual delay, if any.

8. Inspect supporting documents for reconciling items that do not appear on the cutoff bank statement.

9. Trace items on the bank reconciliation to the cutoff bank statement.

10. Trace items on the cutoff bank statement to the bank reconciliation.

b. Auditors ordinarily foot a client-prepared bank reconciliation. If the auditors had performed this recalculation on the preceding bank reconciliation, what might they have found? Be prepared to discuss any findings.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps