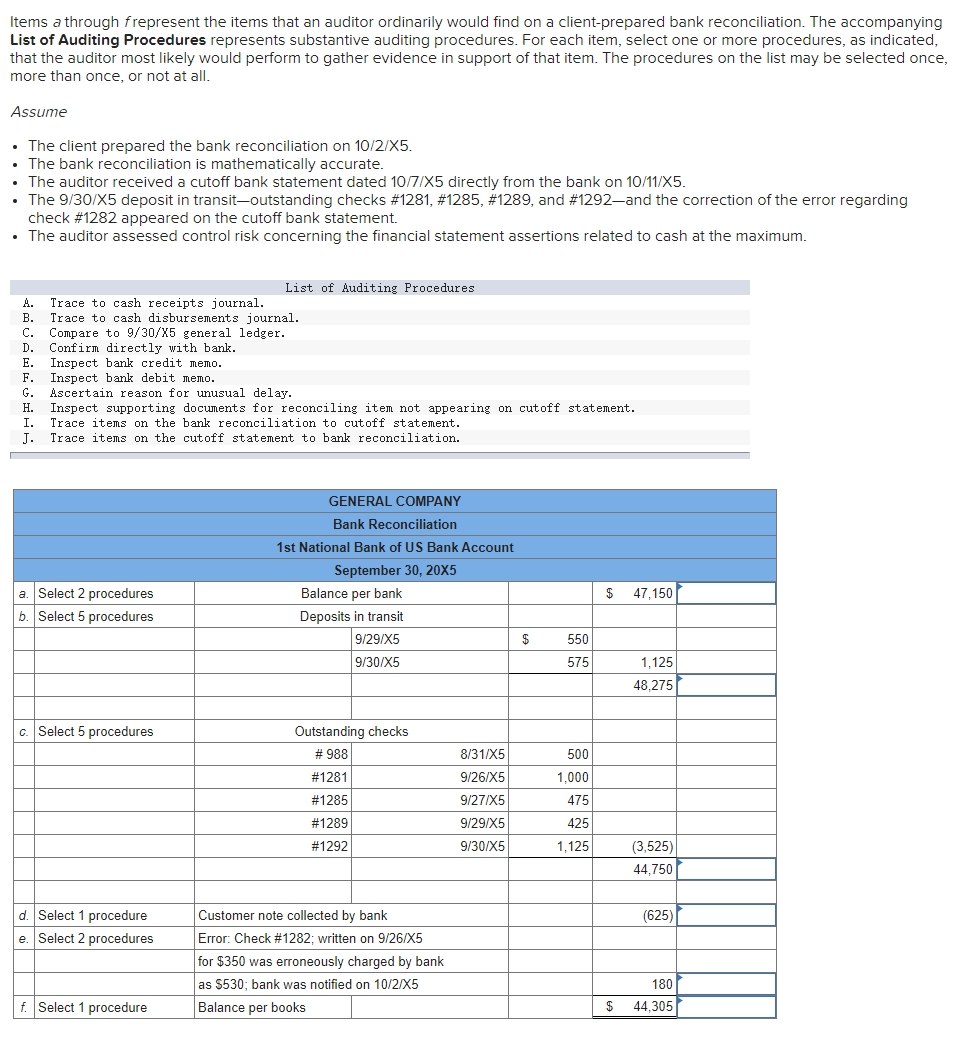

Items a through frepresent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying List of Auditing Procedures represents substantive auditing procedures. For each item, select one or more procedures, as indicated, that the auditor most likely would perform to gather evidence in support of that item. The procedures on the list may be selected once, more than once, or not at all. Assume • The client prepared the bank reconciliation on 10/2/X5. . The bank reconciliation is mathematically accurate. • The auditor received a cutoff bank statement dated 10/7/X5 directly from the bank on 10/11/X5. • The 9/30/X5 deposit in transit-outstanding checks # 1281, #1285, #1289, and #1292-and the correction of the error regarding check # 1282 appeared on the cutoff bank statement. • The auditor assessed control risk concerning the financial statement assertions related to cash at the maximum. A. Trace to cash receipts journal. B. C. D. E. Trace to cash disbursements journal. Compare to 9/30/X5 general ledger. Confirm directly with bank. Inspect bank credit memo. F. Inspect bank debit memo. G. Ascertain reason for unusual delay. H. Inspect supporting documents for reconciling item not appearing on cutoff statement. Trace items on the bank reconciliation to cutoff statement. I. J. Trace items on the cutoff statement to bank reconciliation. a. Select 2 procedures b. Select 5 procedures List of Auditing Procedures c. Select 5 procedures d. Select 1 procedure e. Select 2 procedures f. Select 1 procedure GENERAL COMPANY Bank Reconciliation 1st National Bank of US Bank Account September 30, 20X5 Balance per bank Deposits in transit 9/29/X5 9/30/X5 Outstanding checks # 988 #1281 #1285 #1289 #1292 Customer note collected by bank Error: Check #1282; written on 9/26/X5 for $350 was erroneously charged by bank as $530; bank was notified on 10/2/X5 Balance per books 8/31/X5 9/26/X5 9/27/X5 9/29/X5 9/30/X5 $ 550 575 500 1,000 475 425 1,125 $ 47,150 1,125 48.275 leal (3,525) 44,750 (625) 180 $ 44,305

Items a through frepresent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying List of Auditing Procedures represents substantive auditing procedures. For each item, select one or more procedures, as indicated, that the auditor most likely would perform to gather evidence in support of that item. The procedures on the list may be selected once, more than once, or not at all. Assume • The client prepared the bank reconciliation on 10/2/X5. . The bank reconciliation is mathematically accurate. • The auditor received a cutoff bank statement dated 10/7/X5 directly from the bank on 10/11/X5. • The 9/30/X5 deposit in transit-outstanding checks # 1281, #1285, #1289, and #1292-and the correction of the error regarding check # 1282 appeared on the cutoff bank statement. • The auditor assessed control risk concerning the financial statement assertions related to cash at the maximum. A. Trace to cash receipts journal. B. C. D. E. Trace to cash disbursements journal. Compare to 9/30/X5 general ledger. Confirm directly with bank. Inspect bank credit memo. F. Inspect bank debit memo. G. Ascertain reason for unusual delay. H. Inspect supporting documents for reconciling item not appearing on cutoff statement. Trace items on the bank reconciliation to cutoff statement. I. J. Trace items on the cutoff statement to bank reconciliation. a. Select 2 procedures b. Select 5 procedures List of Auditing Procedures c. Select 5 procedures d. Select 1 procedure e. Select 2 procedures f. Select 1 procedure GENERAL COMPANY Bank Reconciliation 1st National Bank of US Bank Account September 30, 20X5 Balance per bank Deposits in transit 9/29/X5 9/30/X5 Outstanding checks # 988 #1281 #1285 #1289 #1292 Customer note collected by bank Error: Check #1282; written on 9/26/X5 for $350 was erroneously charged by bank as $530; bank was notified on 10/2/X5 Balance per books 8/31/X5 9/26/X5 9/27/X5 9/29/X5 9/30/X5 $ 550 575 500 1,000 475 425 1,125 $ 47,150 1,125 48.275 leal (3,525) 44,750 (625) 180 $ 44,305

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash And Marketable Securities

Section: Chapter Questions

Problem 33MCQ

Related questions

Question

Transcribed Image Text:Items a through frepresent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying

List of Auditing Procedures represents substantive auditing procedures. For each item, select one or more procedures, as indicated,

that the auditor most likely would perform to gather evidence in support of that item. The procedures on the list may be selected once,

more than once, or not at all.

Assume

• The client prepared the bank reconciliation on 10/2/X5.

• The bank reconciliation is mathematically accurate.

• The auditor received a cutoff bank statement dated 10/7/X5 directly from the bank on 10/11/X5.

• The 9/30/X5 deposit in transit-outstanding checks # 1281, #1285, # 1289, and #1292-and the correction of the error regarding

check # 1282 appeared on the cutoff bank statement.

• The auditor assessed control risk concerning the financial statement assertions related to cash at the maximum.

A. Trace to cash receipts journal.

B.

C.

D.

E.

F.

G.

H.

Trace to cash disbursements journal.

Compare to 9/30/X5 general ledger.

Confirm directly with bank.

Inspect bank credit memo.

Inspect bank debit memo.

Ascertain reason for unusual delay.

Inspect supporting documents for reconciling item not appearing on cutoff statement.

I. Trace items on the bank reconciliation to cutoff statement.

J. Trace items on the cutoff statement to bank reconciliation.

a. Select 2 procedures

b. Select 5 procedures

c. Select 5 procedures

List of Auditing Procedures

d. Select 1 procedure

e. Select 2 procedures

f. Select 1 procedure

GENERAL COMPANY

Bank Reconciliation

1st National Bank of US Bank Account

September 30, 20X5

Balance per bank

Deposits in transit

9/29/X5

9/30/X5

Outstanding checks

# 988

#1281

#1285

# 1289

#1292

Customer note collected by bank

Error: Check # 1282; written on 9/26/X5

for $350 was erroneously charged by bank

as $530; bank was notified on 10/2/X5

Balance per books

8/31/X5

9/26/X5

9/27/X5

9/29/X5

9/30/X5

$

550

575

500

1,000

475

425

1,125

$ 47,150

1,125

48,275

(3,525)

44,750

(625)

180

$ 44,305

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning