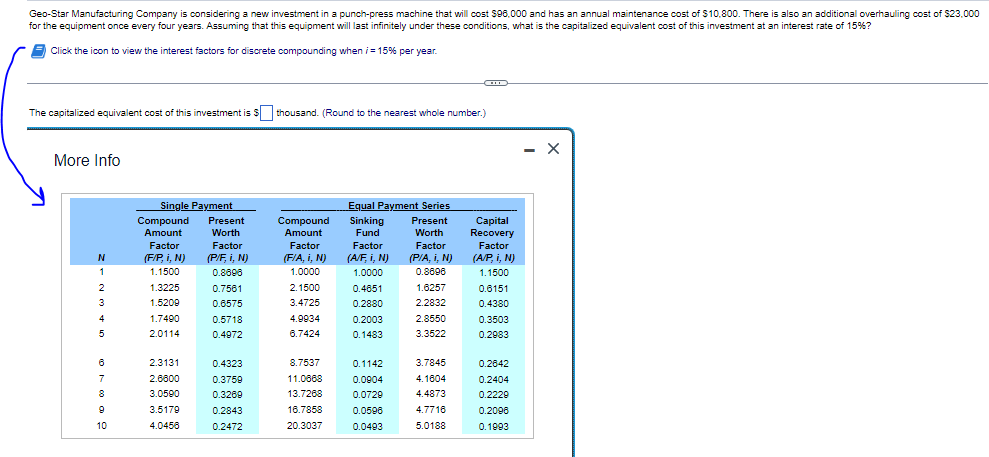

Geo-Star Manufacturing Company is considering a new investment in a punch-press machine that will cost $98,000 and has an annual maintenance cost of $10,800. There is also an additional overhauling cost of $23,000 for the equipment once every four years. Assuming that this equipment will last infinitely under these conditions, what is the capitalized equivalent cost of this investment at an interest rate of 15%? Click the icon to view the interest factors for discrete compounding when /=15% per year.

Geo-Star Manufacturing Company is considering a new investment in a punch-press machine that will cost $98,000 and has an annual maintenance cost of $10,800. There is also an additional overhauling cost of $23,000 for the equipment once every four years. Assuming that this equipment will last infinitely under these conditions, what is the capitalized equivalent cost of this investment at an interest rate of 15%? Click the icon to view the interest factors for discrete compounding when /=15% per year.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

100%

Transcribed Image Text:Geo-Star Manufacturing Company is considering a new investment in a punch-press machine that will cost $96,000 and has an annual maintenance cost of $10,800. There is also an additional overhauling cost of $23,000

for the equipment once every four years. Assuming that this equipment will last infinitely under these conditions, what is the capitalized equivalent cost of this investment at an interest rate of 15%?

Click the icon to view the interest factors for discrete compounding when i=15% per year.

The capitalized equivalent cost of this investment is $ thousand. (Round to the nearest whole number.)

More Info

Single Payment

Compound

Amount

Factor

Equal Payment Series

Sinking Present

Fund

Compound

Amount

Factor

(F/A, i, N)

Capital

Recovery

Worth

Factor

Factor

Factor

N

(F/P, i, N)

(A/F, i, N)

(P/A, i, N)

(A/P, i, N)

1

1.1500

1.0000

1.0000

0.8696

1.1500

2

1.3225

2.1500

0.4651

1.6257

0.6151

3

1.5209

3.4725

0.2880

2.2832

0.4380

4

1.7490

4.9934

0.2003

2.8550

0.3503

5

2.0114

6.7424

0.1483

3.3522

0.2983

6

2.3131

8.7537

0.1142

3.7845

0.2642

7

2.6800

11.0668

0.0904

4.1604

0.2404

8

3.0590

13.7268

0.0729

4.4873

0.2229

9

3.5179

16.7858

0.0596

4.7716

0.2098

10

4.0456

20.3037

0.0493

5.0188

0.1993

Present

Worth

Factor

(P/F, i, N)

0.8698

0.7561

0.6575

0.5718

0.4972

0.4323

0.3759

0.3269

0.2843

0.2472

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College