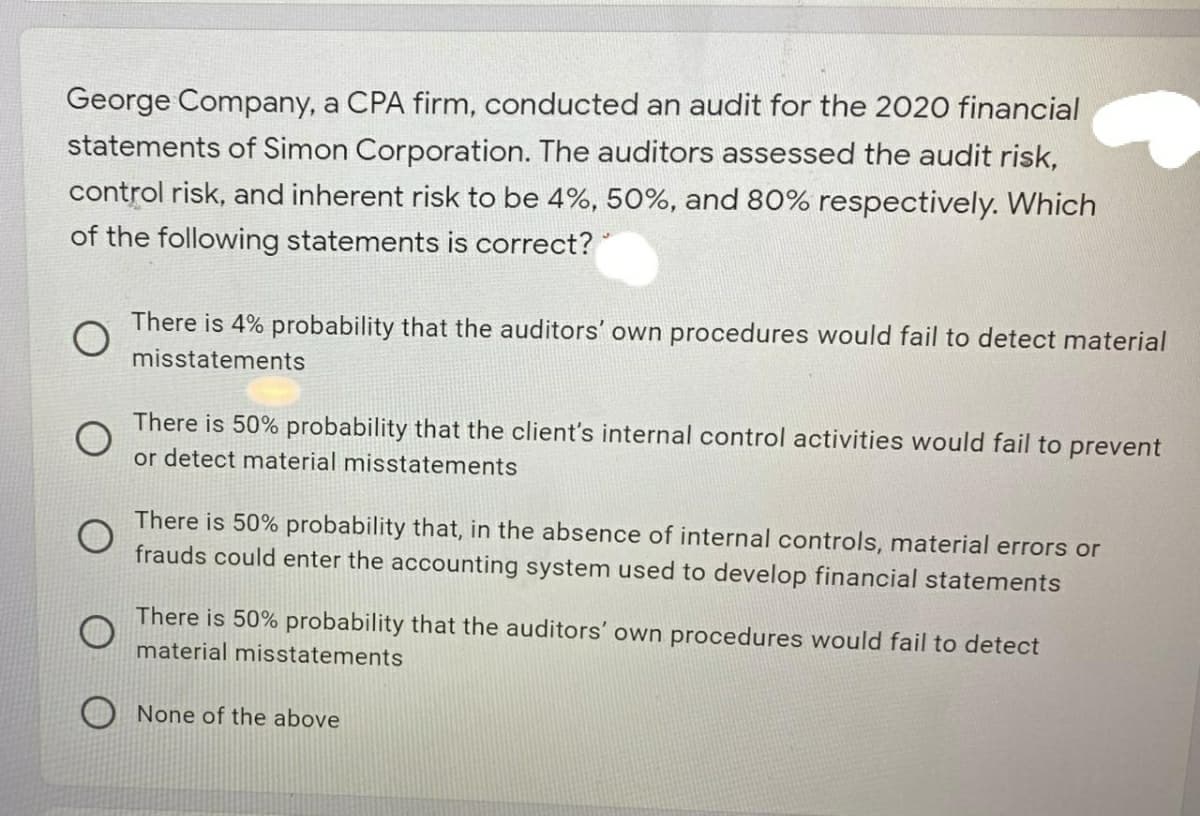

George Company, a CPA firm, conducted an audit for the 2020 financial statements of Simon Corporation. The auditors assessed the audit risk, control risk, and inherent risk to be 4%, 50%, and 80% respectively. Which of the following statements is correct?" There is 4% probability that the auditors' own procedures would fail to detect material misstatements There is 50% probability that the client's internal control activities would fail to prevent or detect material misstatements There is 50% probability that, in the absence of internal controls, material errors or frauds could enter the accounting system used to develop financial statements There is 50% probability that the auditors' own procedures would fail to detect material misstatements None of the above

George Company, a CPA firm, conducted an audit for the 2020 financial statements of Simon Corporation. The auditors assessed the audit risk, control risk, and inherent risk to be 4%, 50%, and 80% respectively. Which of the following statements is correct?" There is 4% probability that the auditors' own procedures would fail to detect material misstatements There is 50% probability that the client's internal control activities would fail to prevent or detect material misstatements There is 50% probability that, in the absence of internal controls, material errors or frauds could enter the accounting system used to develop financial statements There is 50% probability that the auditors' own procedures would fail to detect material misstatements None of the above

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle.

Section: Chapter Questions

Problem 23CYBK

Related questions

Question

Transcribed Image Text:George Company, a CPA firm, conducted an audit for the 2020 financial

statements of Simon Corporation. The auditors assessed the audit risk,

control risk, and inherent risk to be 4%, 50%, and 80% respectively. Which

of the following statements is correct?

There is 4% probability that the auditors' own procedures would fail to detect material

misstatements

There is 50% probability that the client's internal control activities would fail to prevent

or detect material misstatements

There is 50% probability that, in the absence of internal controls, material errors or

frauds could enter the accounting system used to develop financial statements

There is 50% probability that the auditors' own procedures would fail to detect

material misstatements

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub