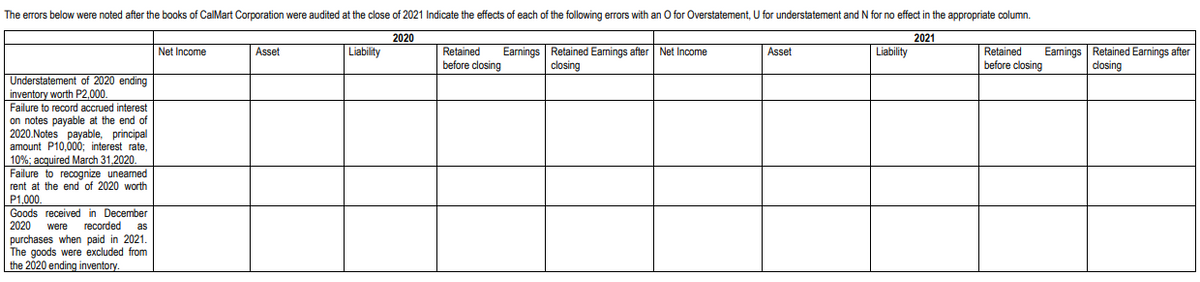

The errors below were noted after the books of CalMart Corporation were audited at the close of 2021 Indicate the effects of each of the following errors with an O for Overstatement, U for understatement and N for no effect in the appropriate column.

The errors below were noted after the books of CalMart Corporation were audited at the close of 2021 Indicate the effects of each of the following errors with an O for Overstatement, U for understatement and N for no effect in the appropriate column.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11P: A review of Anderson Corporations books indicates that the errors and omissions pertaining to the...

Related questions

Question

100%

Transcribed Image Text:The errors below were noted after the books of CalMart Corporation were audited at the close of 2021 Indicate the effects of each of the following errors with an O for Overstatement, U for understatement and N for no effect in the appropriate column.

2020

2021

Retained

before closing

Eamings Retained Earnings after

closing

Net Income

Asset

Liability

Retained

before closing

Earnings Retained Eamings after

closing

Net Income

Asset

Liability

Understatement of 2020 ending

inventory worth P2,000.

Failure to record accrued interest

on notes payable at the end of

2020.Notes payable, principal

amount P10,000; interest rate,

10%; acquired March 31,2020.

Failure to recognize unearned

rent at the end of 2020 worth

P1,000.

Goods received in December

2020

recorded

purchases when paid in 2021.

The goods were excluded from

the 2020 ending inventory.

were

as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub