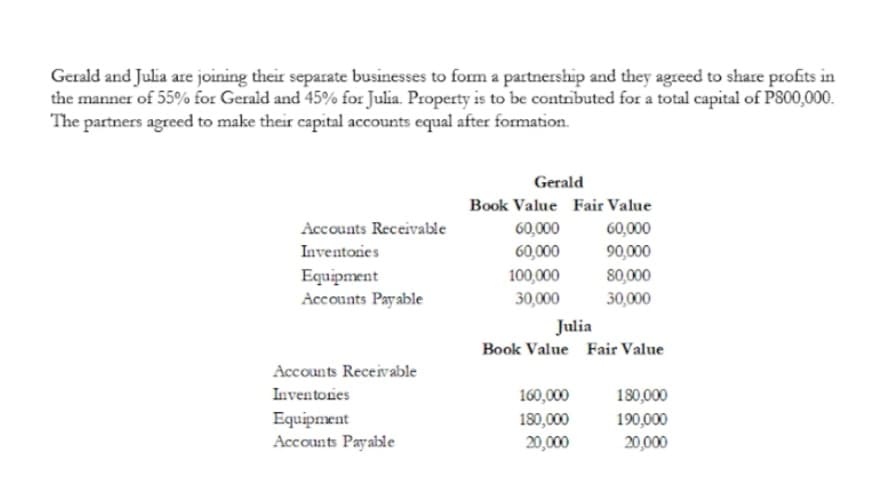

Gerald and Julia are joining their separate businesses to form a partnership and they agreed to share profits in the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000. The partners agreed to make their capital accounts equal after formation. Gerald Book Value Fair Value Accounts Receivable 60,000 60,000 Inventories 60,000 90,000 Equipment Accounts Payable 80,000 30,000 100,000 30,000

Gerald and Julia are joining their separate businesses to form a partnership and they agreed to share profits in the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000. The partners agreed to make their capital accounts equal after formation. Gerald Book Value Fair Value Accounts Receivable 60,000 60,000 Inventories 60,000 90,000 Equipment Accounts Payable 80,000 30,000 100,000 30,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

Show the solution in good accounting form.

How much cash must be contributed by each of the partners after they contributed thier properties?

Transcribed Image Text:Gerald and Julia are joining their separate businesses to form a partnership and they agreed to share profits in

the manner of 55% for Gerald and 45% for Julia. Property is to be contributed for a total capital of P800,000.

The partners agreed to make their capital accounts equal after formation.

Gerald

Book Value Fair Value

Accounts Receivable

60,000

60,000

60,000

90,000

80,000

Inventories

Equipment

Accounts Payable

100,000

30,000

30,000

Julia

Book Value Fair Value

Accounts Receivable

180,000

190,000

Inventories

160,000

Equipment

Accounts Payable

180,000

20,000

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT