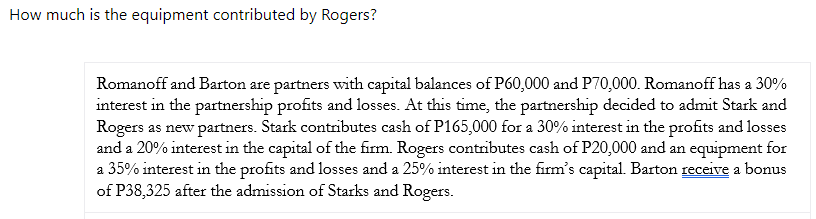

How much is the equipment contributed by Rogers? Romanoff and Barton are partners with capital balances of P60,000 and P70,000. Romanoff has a 30% interest in the partnership profits and losses. At this time, the partnership decided to admit Stark and Rogers as new partners. Stark contributes cash of P165,000 for a 30% interest in the profits and losses and a 20% interest in the capital of the firm. Rogers contributes cash of P20,000 and an equipment for a 35% interest in the profits and losses and a 25% interest in the firm's capital. Barton receive a bonus of P38,325 after the admission of Starks and Rogers.

How much is the equipment contributed by Rogers? Romanoff and Barton are partners with capital balances of P60,000 and P70,000. Romanoff has a 30% interest in the partnership profits and losses. At this time, the partnership decided to admit Stark and Rogers as new partners. Stark contributes cash of P165,000 for a 30% interest in the profits and losses and a 20% interest in the capital of the firm. Rogers contributes cash of P20,000 and an equipment for a 35% interest in the profits and losses and a 25% interest in the firm's capital. Barton receive a bonus of P38,325 after the admission of Starks and Rogers.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 45P

Related questions

Question

Please explain it properly

Transcribed Image Text:How much is the equipment contributed by Rogers?

Romanoff and Barton are partners with capital balances of P60,000 and P70,000. Romanoff has a 30%

interest in the partnership profits and losses. At this time, the partnership decided to admit Stark and

Rogers as new partners. Stark contributes cash of P165,000 for a 30% interest in the profits and losses

and a 20% interest in the capital of the firm. Rogers contributes cash of P20,000 and an equipment for

a 35% interest in the profits and losses and a 25% interest in the firm's capital. Barton receive a bonus

of P38,325 after the admission of Starks and Rogers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you