Give a critical account of the Governance issues impacting a business enterprise. Use your own examples to substantiate your answer

Give a critical account of the Governance issues impacting a business enterprise. Use your own examples to substantiate your answer

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

Give a critical account of the Governance issues impacting a business enterprise. Use your own examples to substantiate your answer.

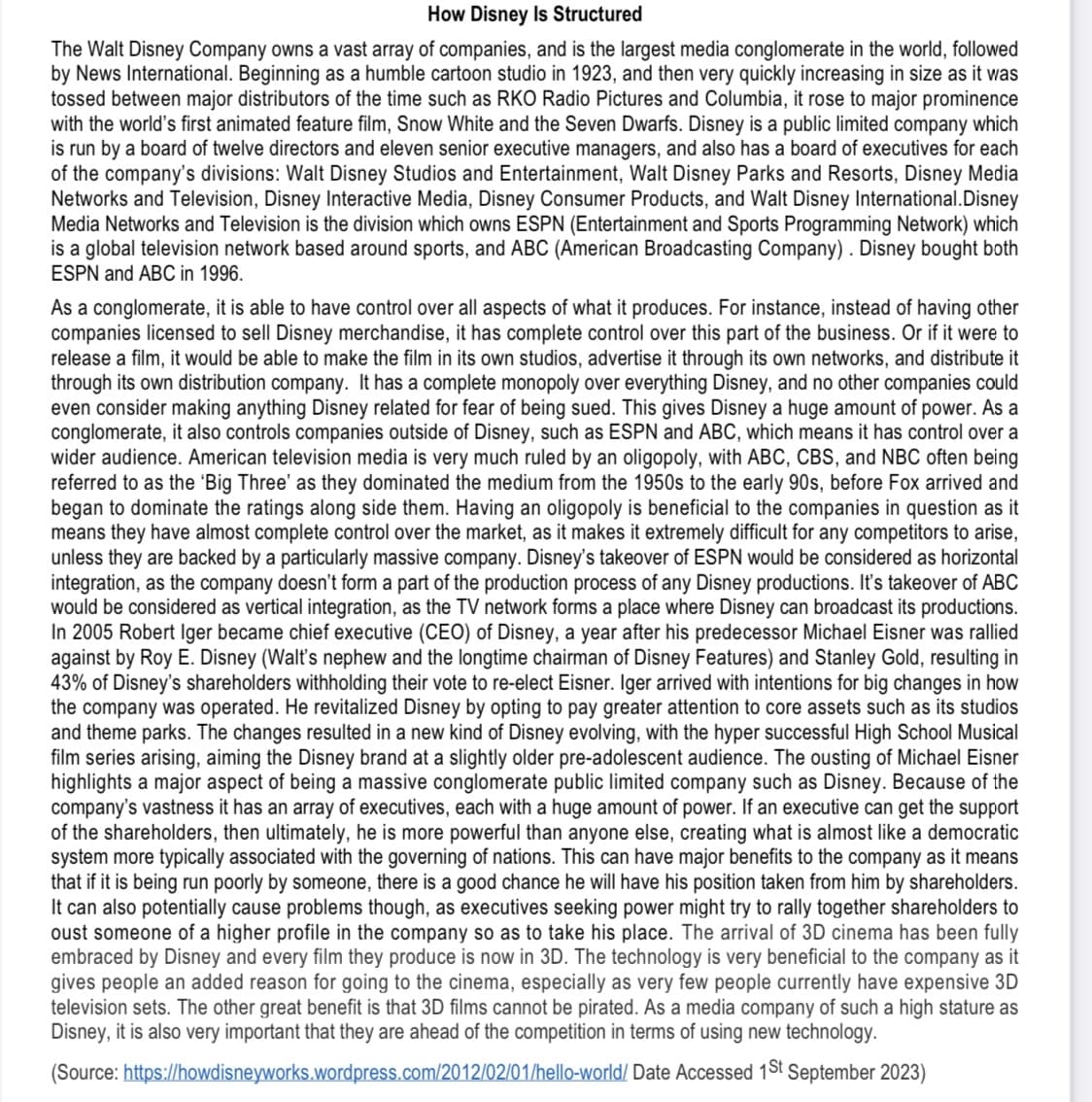

Transcribed Image Text:How Disney Is Structured

The Walt Disney Company owns a vast array of companies, and is the largest media conglomerate in the world, followed

by News International. Beginning as a humble cartoon studio in 1923, and then very quickly increasing in size as it was

tossed between major distributors of the time such as RKO Radio Pictures and Columbia, it rose to major prominence

with the world's first animated feature film, Snow White and the Seven Dwarfs. Disney is a public limited company which

is run by a board of twelve directors and eleven senior executive managers, and also has a board of executives for each

of the company's divisions: Walt Disney Studios and Entertainment, Walt Disney Parks and Resorts, Disney Media

Networks and Television, Disney Interactive Media, Disney Consumer Products, and Walt Disney International.Disney

Media Networks and Television is the division which owns ESPN (Entertainment and Sports Programming Network) which

is a global television network based around sports, and ABC (American Broadcasting Company). Disney bought both

ESPN and ABC in 1996.

As a conglomerate, it is able to have control over all aspects of what it produces. For instance, instead of having other

companies licensed to sell Disney merchandise, it has complete control over this part of the business. Or if it were to

release a film, it would be able to make the film in its own studios, advertise it through its own networks, and distribute it

through its own distribution company. It has a complete monopoly over everything Disney, and no other companies could

even consider making anything Disney related for fear of being sued. This gives Disney a huge amount of power. As a

conglomerate, it also controls companies outside of Disney, such as ESPN and ABC, which means it has control over a

wider audience. American television media is very much ruled by an oligopoly, with ABC, CBS, and NBC often being

referred to as the 'Big Three' as they dominated the medium from the 1950s to the early 90s, before Fox arrived and

began to dominate the ratings along side them. Having an oligopoly is beneficial to the companies in question as it

means they have almost complete control over the market, as it makes it extremely difficult for any competitors to arise,

unless they are backed by a particularly massive company. Disney's takeover of ESPN would be considered as horizontal

integration, as the company doesn't form a part of the production process of any Disney productions. It's takeover of ABC

would be considered as vertical integration, as the TV network forms a place where Disney can broadcast its productions.

In 2005 Robert Iger became chief executive (CEO) of Disney, a year after his predecessor Michael Eisner was rallied

against by Roy E. Disney (Walt's nephew and the longtime chairman of Disney Features) and Stanley Gold, resulting in

43% of Disney's shareholders withholding their vote to re-elect Eisner. Iger arrived with intentions for big changes in how

the company was operated. He revitalized Disney by opting to pay greater attention to core assets such as its studios

and theme parks. The changes resulted in a new kind of Disney evolving, with the hyper successful High School Musical

film series arising, aiming the Disney brand at a slightly older pre-adolescent audience. The ousting of Michael Eisner

highlights a major aspect of being a massive conglomerate public limited company such as Disney. Because of the

company's vastness it has an array of executives, each with a huge amount of power. If an executive can get the support

of the shareholders, then ultimately, he is more powerful than anyone else, creating what is almost like a democratic

system more typically associated with the governing of nations. This can have major benefits to the company as it means

that if it is being run poorly by someone, there is a good chance he will have his position taken from him by shareholders.

It can also potentially cause problems though, as executives seeking power might try to rally together shareholders to

oust someone of a higher profile in the company so as to take his place. The arrival of 3D cinema has been fully

embraced by Disney and every film they produce is now in 3D. The technology is very beneficial to the company as it

gives people an added reason for going to the cinema, especially as very few people currently have expensive 3D

television sets. The other great benefit is that 3D films cannot be pirated. As a media company of such a high stature as

Disney, it is also very important that they are ahead of the competition in terms of using new technology.

(Source:

https://howdisneyworks.wordpress.com/2012/02/01/hello-world/ Date Accessed 1st September 2023)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON