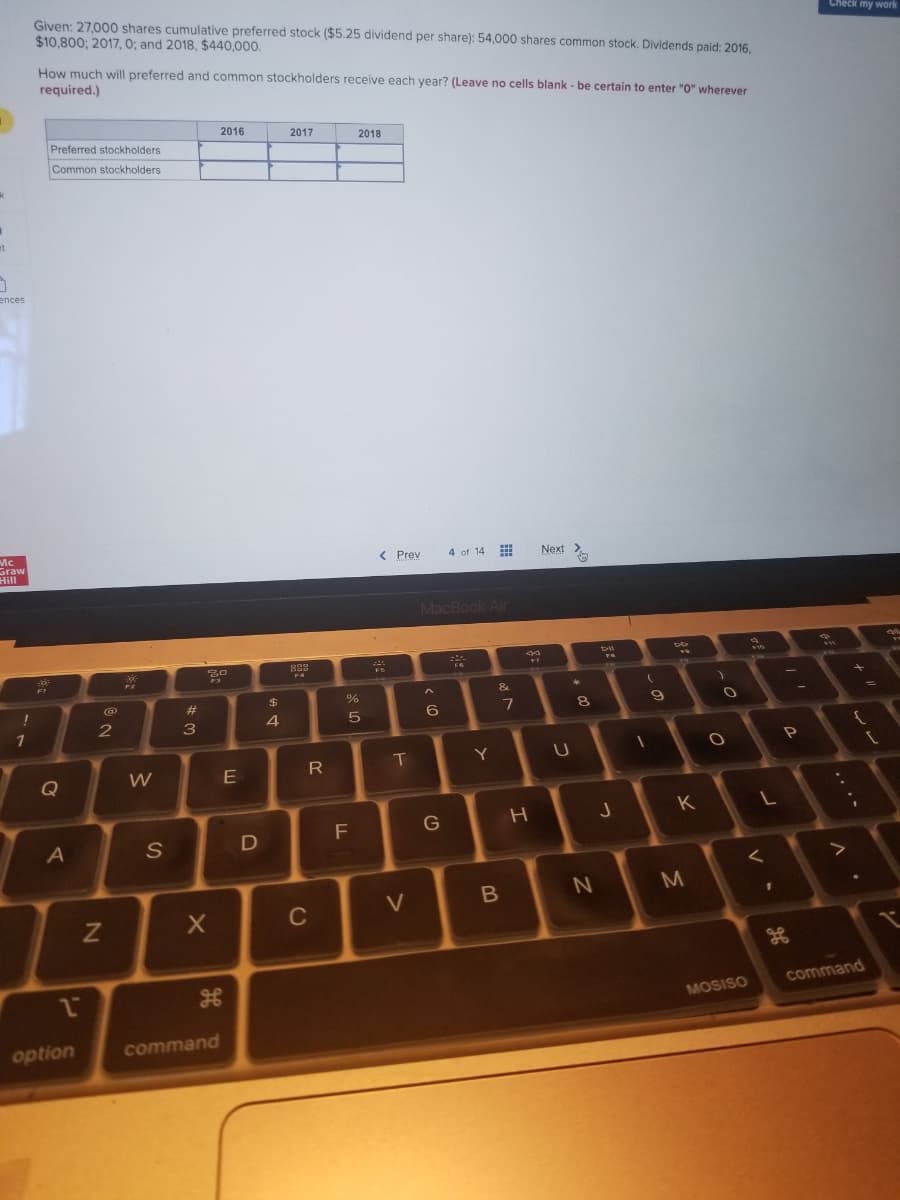

Given: 27,000 shares cumulative preferred stock ($5.25 dividend per share): 54,000 shares common stock. Dividends paid: 2016, $10,800; 2017, 0; and 2018, $440,000. How much will preferred and common stockholders receive each year? (Leave no cells blank - be certain to enter "0" wherever required.) 2016 2017 2018 Preferred stockholders Common stockholders

Given: 27,000 shares cumulative preferred stock ($5.25 dividend per share): 54,000 shares common stock. Dividends paid: 2016, $10,800; 2017, 0; and 2018, $440,000. How much will preferred and common stockholders receive each year? (Leave no cells blank - be certain to enter "0" wherever required.) 2016 2017 2018 Preferred stockholders Common stockholders

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.9E

Related questions

Question

100%

Transcribed Image Text:5.

nt

1

ences

Mc

Graw

Hill

!

1

Given: 27,000 shares cumulative preferred stock ($5.25 dividend per share): 54,000 shares common stock. Dividends paid: 2016,

$10,800; 2017, 0; and 2018, $440,000.

How much will preferred and common stockholders receive each year? (Leave no cells blank - be certain to enter "0" wherever

required.)

2016

2017

2018

Preferred stockholders

Common stockholders

Next

$11

F1

Q

A

2

option

2

N

W

S

#

3

80

PS

X

भ

command

E

D

$

4

828

F4

R

C

%

er de

5

F

< Prev

224

T

4 of 14

www

www

***

MacBook Air

^

6

V

10

G

Y

&

B

7

494

H

U

★

8

N

DI

FR

J

(

1

9

bb

K

M

)

O

O

MOSISO

$10

L

1

P

ܩܘ

Check my work

ob

^.

+

{

command

1

✓

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT