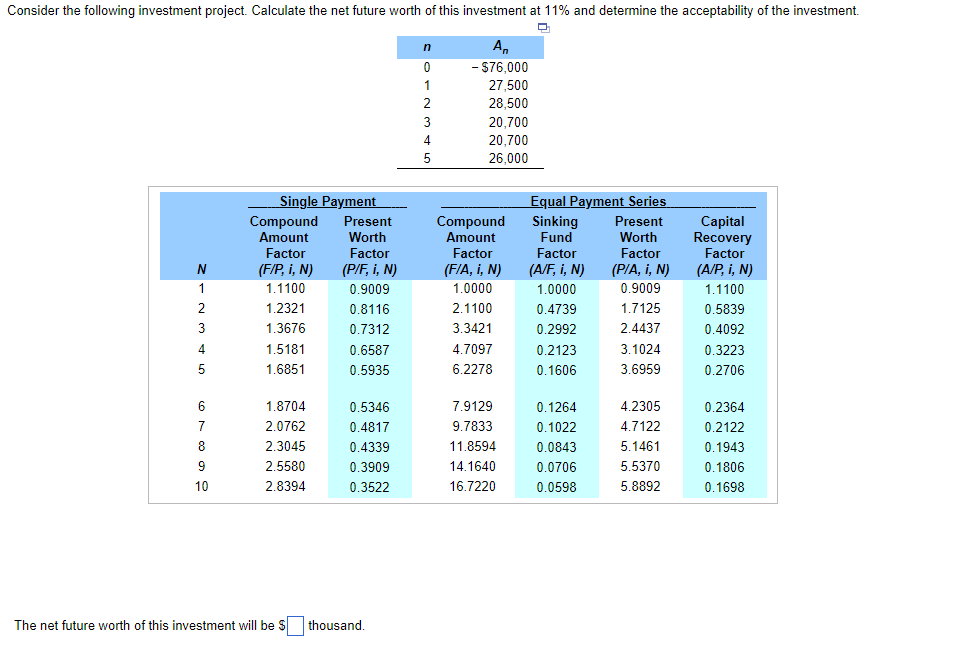

Consider the following investment project. Calculate the net future worth of this investment at 11% and determine the acceptability of the investment. n An 0 - $76,000 1 27,500 28,500 20,700 20,700 26,000 Single Payment Compound Present Equal Payment Series Sinking Present Fund Factor Amount Worth Worth Capital Recovery Factor Factor Factor Factor (F/P, i, N) (P/F, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1.1100 0.9009 1.0000 0.9009 1.1100 1.2321 0.8116 0.4739 1.7125 0.5839 1.3676 0.7312 0.2992 2.4437 0.4092 1.5181 0.6587 0.2123 3.1024 0.3223 1.6851 0.5935 0.1606 3.6959 0.2706 1.8704 0.5346 0.1264 4.2305 0.2364 0.4817 0.1022 4.7122 0.2122 2.0762 2.3045 0.4339 0.0843 5.1461 0.1943 2.5580 0.3909 0.0706 5.5370 0.1806 10 2.8394 0.3522 0.0598 5.8892 0.1698 The net future worth of this investment will be $ thousand. GAWNIN 2 3 4 5 6789 2345 Compound Amount Factor (F/A, i, N) 1.0000 2.1100 3.3421 4.7097 6.2278 7.9129 9.7833 11.8594 14.1640 16.7220

Consider the following investment project. Calculate the net future worth of this investment at 11% and determine the acceptability of the investment. n An 0 - $76,000 1 27,500 28,500 20,700 20,700 26,000 Single Payment Compound Present Equal Payment Series Sinking Present Fund Factor Amount Worth Worth Capital Recovery Factor Factor Factor Factor (F/P, i, N) (P/F, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1.1100 0.9009 1.0000 0.9009 1.1100 1.2321 0.8116 0.4739 1.7125 0.5839 1.3676 0.7312 0.2992 2.4437 0.4092 1.5181 0.6587 0.2123 3.1024 0.3223 1.6851 0.5935 0.1606 3.6959 0.2706 1.8704 0.5346 0.1264 4.2305 0.2364 0.4817 0.1022 4.7122 0.2122 2.0762 2.3045 0.4339 0.0843 5.1461 0.1943 2.5580 0.3909 0.0706 5.5370 0.1806 10 2.8394 0.3522 0.0598 5.8892 0.1698 The net future worth of this investment will be $ thousand. GAWNIN 2 3 4 5 6789 2345 Compound Amount Factor (F/A, i, N) 1.0000 2.1100 3.3421 4.7097 6.2278 7.9129 9.7833 11.8594 14.1640 16.7220

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Consider the following investment project. Calculate the net future worth of this investment at 11% and determine the acceptability of the investment.

Q

n

An

0

- $76,000

27,500

28,500

20,700

20,700

26,000

Single Payment

Compound Present

Equal Payment Series

Sinking Present

Fund

Amount

Worth

Worth

Factor

Factor

Factor

Factor

(F/P, i, N)

(P/F, i, N)

(A/F, i, N)

(P/A, i, N)

1.1100

0.9009

1.0000

0.9009

1.2321

0.8116

0.4739

1.7125

1.3676

0.7312

0.2992

2.4437

1.5181

0.6587

0.2123

3.1024

1.6851

0.5935

0.1606

3.6959

1.8704

0.5346

0.1264

4.2305

2.0762

0.4817

0.1022

4.7122

2.3045

0.4339

0.0843

5.1461

9

2.5580

0.3909

0.0706

5.5370

10

2.8394

0.3522

0.0598

5.8892

The net future worth of this investment will be $ thousand.

AWNIN

1

2

3

4

5

6

7

8

1

2

3

4

5

Compound

Amount

Factor

(F/A, i, N)

1.0000

2.1100

3.3421

4.7097

6.2278

7.9129

9.7833

11.8594

14.1640

16.7220

Capital

Recovery

Factor

(A/P, i, N)

1.1100

0.5839

0.4092

0.3223

0.2706

0.2364

0.2122

0.1943

0.1806

0.1698

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning