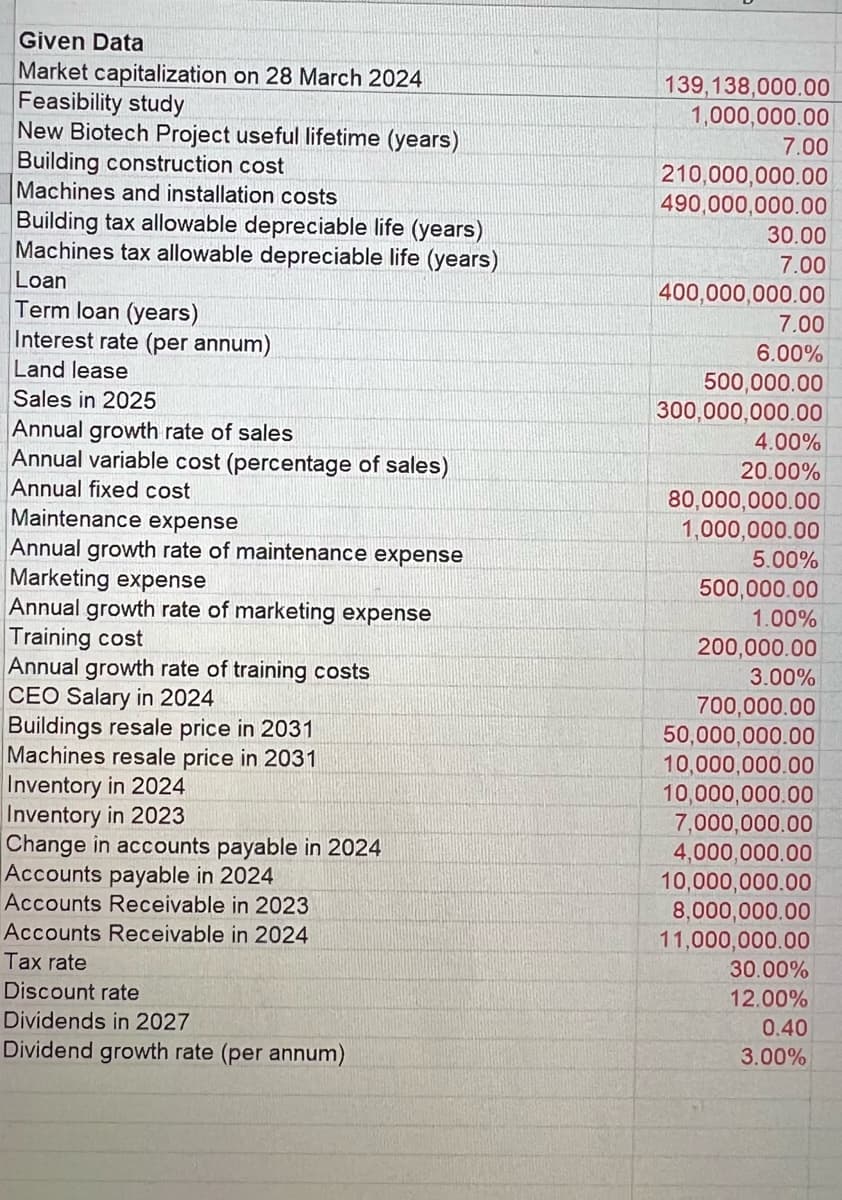

Given Data Market capitalization on 28 March 2024 Feasibility study New Biotech Project useful lifetime (years) Building construction cost Machines and installation costs 139,138,000.00 1,000,000.00 7.00 210,000,000.00 490,000,000.00 Building tax allowable depreciable life (years) 30.00 Machines tax allowable depreciable life (years) 7.00 Loan 400,000,000.00 Term loan (years) 7.00 Interest rate (per annum) 6.00% Land lease 500,000.00 Sales in 2025 Annual growth rate of sales Annual variable cost (percentage of sales) Annual fixed cost Maintenance expense Annual growth rate of maintenance expense Marketing expense Annual growth rate of marketing expense 300,000,000.00 4.00% 20.00% 80,000,000.00 1,000,000.00 5.00% 500,000.00 1.00% 200,000.00 3.00% Training cost Annual growth rate of training costs CEO Salary in 2024 700,000.00 Buildings resale price in 2031 50,000,000.00 Machines resale price in 2031 10,000,000.00 Inventory in 2024 10,000,000.00 Inventory in 2023 7,000,000.00 Change in accounts payable in 2024 4,000,000.00 Accounts payable in 2024 10,000,000.00 Accounts Receivable in 2023 8,000,000.00 Accounts Receivable in 2024 11,000,000.00 Tax rate Discount rate 30.00% 12.00% Dividends in 2027 Dividend growth rate (per annum) 0.40 3.00%

Given Data Market capitalization on 28 March 2024 Feasibility study New Biotech Project useful lifetime (years) Building construction cost Machines and installation costs 139,138,000.00 1,000,000.00 7.00 210,000,000.00 490,000,000.00 Building tax allowable depreciable life (years) 30.00 Machines tax allowable depreciable life (years) 7.00 Loan 400,000,000.00 Term loan (years) 7.00 Interest rate (per annum) 6.00% Land lease 500,000.00 Sales in 2025 Annual growth rate of sales Annual variable cost (percentage of sales) Annual fixed cost Maintenance expense Annual growth rate of maintenance expense Marketing expense Annual growth rate of marketing expense 300,000,000.00 4.00% 20.00% 80,000,000.00 1,000,000.00 5.00% 500,000.00 1.00% 200,000.00 3.00% Training cost Annual growth rate of training costs CEO Salary in 2024 700,000.00 Buildings resale price in 2031 50,000,000.00 Machines resale price in 2031 10,000,000.00 Inventory in 2024 10,000,000.00 Inventory in 2023 7,000,000.00 Change in accounts payable in 2024 4,000,000.00 Accounts payable in 2024 10,000,000.00 Accounts Receivable in 2023 8,000,000.00 Accounts Receivable in 2024 11,000,000.00 Tax rate Discount rate 30.00% 12.00% Dividends in 2027 Dividend growth rate (per annum) 0.40 3.00%

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

Calculate the cash flows for this question

Transcribed Image Text:Given Data

Market capitalization on 28 March 2024

Feasibility study

New Biotech Project useful lifetime (years)

Building construction cost

Machines and installation costs

139,138,000.00

1,000,000.00

7.00

210,000,000.00

490,000,000.00

Building tax allowable depreciable life (years)

30.00

Machines tax allowable depreciable life (years)

7.00

Loan

400,000,000.00

Term loan (years)

7.00

Interest rate (per annum)

6.00%

Land lease

500,000.00

Sales in 2025

Annual growth rate of sales

Annual variable cost (percentage of sales)

Annual fixed cost

Maintenance expense

Annual growth rate of maintenance expense

Marketing expense

Annual growth rate of marketing expense

300,000,000.00

4.00%

20.00%

80,000,000.00

1,000,000.00

5.00%

500,000.00

1.00%

200,000.00

3.00%

Training cost

Annual growth rate of training costs

CEO Salary in 2024

700,000.00

Buildings resale price in 2031

50,000,000.00

Machines resale price in 2031

10,000,000.00

Inventory in 2024

10,000,000.00

Inventory in 2023

7,000,000.00

Change in accounts payable in 2024

4,000,000.00

Accounts payable in 2024

10,000,000.00

Accounts Receivable in 2023

8,000,000.00

Accounts Receivable in 2024

11,000,000.00

Tax rate

Discount rate

30.00%

12.00%

Dividends in 2027

Dividend growth rate (per annum)

0.40

3.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning