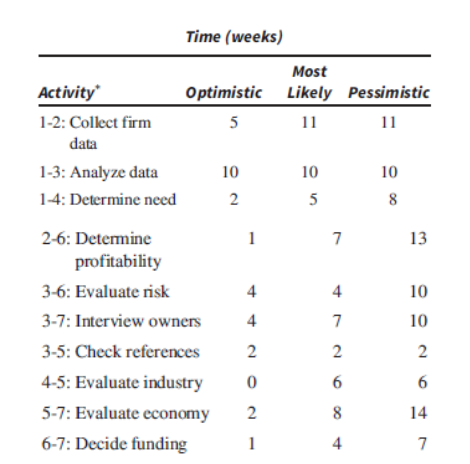

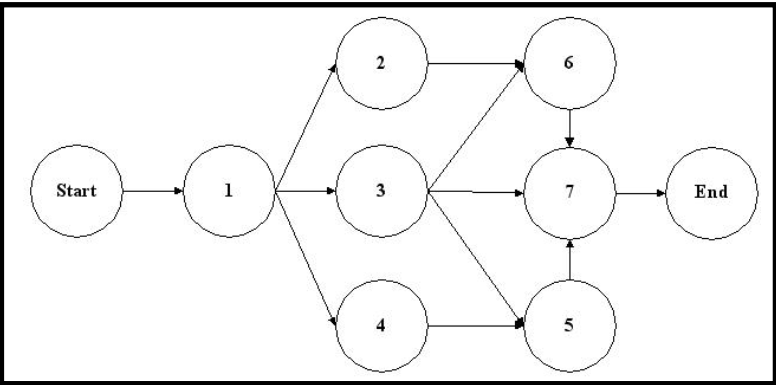

Given the following financing project being considered by a venture firm, find the probability of completing the path with the longest expected duration by 17 weeks. By 24 weeks. By what date is management 90 percent sure that this path will be completed? refer to first pic If the venture firm can complete the project for the customer within 18 weeks, it will receive a bonus of $10,000. But if the project delays beyond 22 weeks, it must pay a penalty of $5,000 due to lost opportunity. If the firm can choose whether or not to bid on this project, what should its decision be if the project is only a breakeven one normally? Figure 8.15a shows the network. refer to second pic

1.15

Given the following financing project being considered by a venture firm, find the probability of completing the path with the longest expected duration by 17 weeks. By 24 weeks. By what date is management 90 percent sure that this path will be completed?

refer to first pic

If the venture firm can complete the project for the customer within 18 weeks, it will receive a bonus of $10,000. But if the project delays beyond 22 weeks, it must pay a penalty of $5,000 due to lost opportunity. If the firm can choose whether or not to bid on this project, what should its decision be if the project is only a breakeven one normally? Figure 8.15a shows the network.

refer to second pic

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images