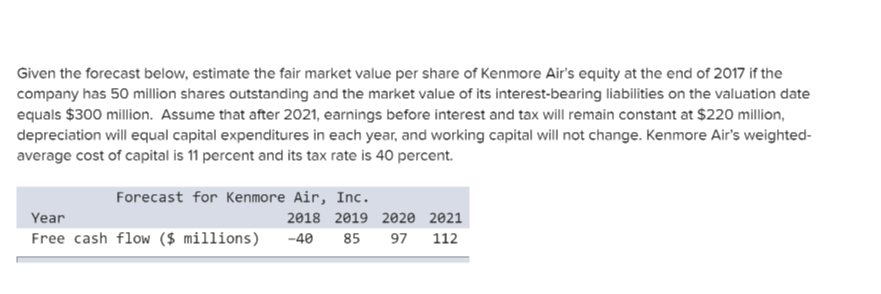

Given the forecast below, estimate the fair market value per share of Kenmore Air's equity at the end of 2017 if the company has 50 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $300 million. Assume that after 2021, earnings before interest and tax will remain constant at $220 million, depreciation will equal capital expenditures in each year, and working capital will not change. Kenmore Air's weighted- average cost of capital is 11 percent and its tax rate is 40 percent. Forecast for Kenmore Air, Inc. Year 2018 2019 2020 2021 Free cash flow ($ millions) -40 85 97 112

Given the forecast below, estimate the fair market value per share of Kenmore Air's equity at the end of 2017 if the company has 50 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $300 million. Assume that after 2021, earnings before interest and tax will remain constant at $220 million, depreciation will equal capital expenditures in each year, and working capital will not change. Kenmore Air's weighted- average cost of capital is 11 percent and its tax rate is 40 percent. Forecast for Kenmore Air, Inc. Year 2018 2019 2020 2021 Free cash flow ($ millions) -40 85 97 112

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 1eM

Related questions

Question

Transcribed Image Text:Given the forecast below, estimate the fair market value per share of Kenmore Air's equity at the end of 2017 if the

company has 50 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date

equals $300 million. Assume that after 2021, earnings before interest and tax will remain constant at $220 million,

depreciation will equal capital expenditures in each year, and working capital will not change. Kenmore Air's weighted-

average cost of capital is 11 percent and its tax rate is 40 percent.

Forecast for Kenmore Air, Inc.

Year

2018 2019 2020 2021

-40

85

97

112

Free cash flow ($ millions)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning