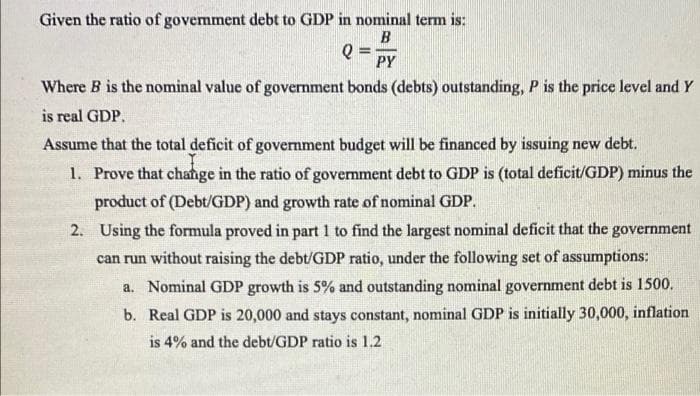

Given the ratio of govemment debt to GDP in nominal term is: B %3D PY Where B is the nominal value of government bonds (debts) outstanding, P is the price level and Y is real GDP. Assume that the total deficit of government budget will be financed by issuing new debt. 1. Prove that change in the ratio of government debt to GDP is (total deficit/GDP) minus the product of (Debt/GDP) and growth rate of nominal GDP. 2. Using the formula proved in part 1 to find the largest nominal deficit that the government can run without raising the debt/GDP ratio, under the following set of assumptions: a. Nominal GDP growth is 5% and outstanding nominal government debt is 1500. b. Real GDP is 20,000 and stays constant, nominal GDP is initially 30,000, inflation is 4% and the debt/GDP ratio is 1.2

Given the ratio of govemment debt to GDP in nominal term is: B %3D PY Where B is the nominal value of government bonds (debts) outstanding, P is the price level and Y is real GDP. Assume that the total deficit of government budget will be financed by issuing new debt. 1. Prove that change in the ratio of government debt to GDP is (total deficit/GDP) minus the product of (Debt/GDP) and growth rate of nominal GDP. 2. Using the formula proved in part 1 to find the largest nominal deficit that the government can run without raising the debt/GDP ratio, under the following set of assumptions: a. Nominal GDP growth is 5% and outstanding nominal government debt is 1500. b. Real GDP is 20,000 and stays constant, nominal GDP is initially 30,000, inflation is 4% and the debt/GDP ratio is 1.2

Chapter12: Federal Budgets And Public Policy

Section: Chapter Questions

Problem 3.8P

Related questions

Question

Transcribed Image Text:Given the ratio of govemment debt to GDP in nominal term is:

PY

Where B is the nominal value of government bonds (debts) outstanding, P is the price level and Y

is real GDP.

Assume that the total deficit of government budget will be financed by issuing new debt.

1. Prove that change in the ratio of government debt to GDP is (total deficit/GDP) minus the

product of (Debt/GDP) and growth rate of nominal GDP.

2. Using the formula proved in part 1 to find the largest nominal deficit that the government

can run without raising the debt/GDP ratio, under the following set of assumptions:

a. Nominal GDP growth is 5% and outstanding nominal government debt is 1500.

b. Real GDP is 20,000 and stays constant, nominal GDP is initially 30,000, inflation

is 4% and the debt/GDP ratio is 1.2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 24 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning