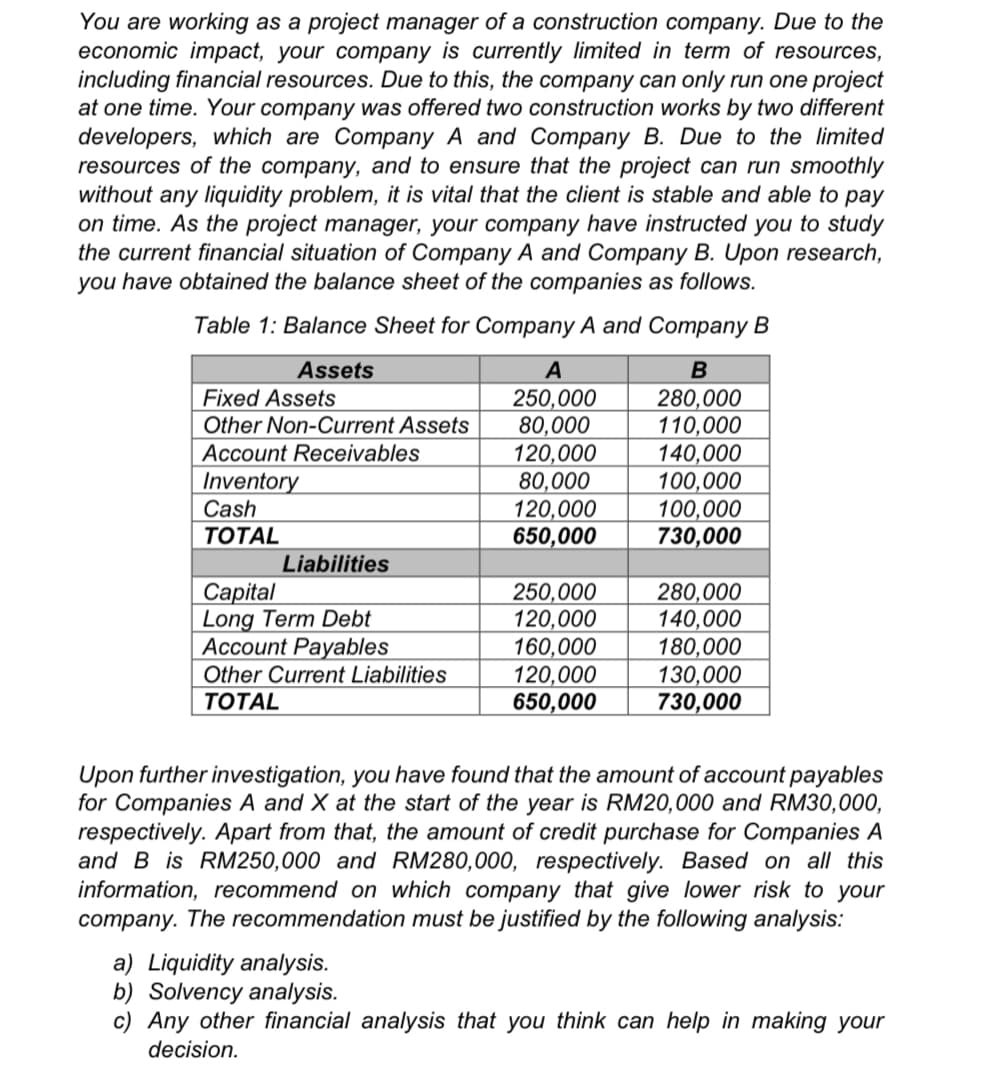

You are working as a project manager of a construction company. Due to the economic impact, your company is currently limited in term of resources, including financial resources. Due to this, the company can only run one project at one time. Your company was offered two construction works by two different developers, which are Company A and Company B. Due to the limited resources of the company, and to ensure that the project can run smoothly without any liquidity problem, it is vital that the client is stable and able to pay on time. As the project manager, your company have instructed you to study the current financial situation of Company A and Company B. Upon research, you have obtained the balance sheet of the companies as follows. Table 1: Balance Sheet for Company A and Company B Assets B 280,000 110,000 140,000 100,000 100,000 730,000 Fixed Assets Other Non-Current Assets Account Receivables Inventory Cash TOTAL Liabilities Capital Long Term Debt Account Payables Other Current Liabilities TOTAL A 250,000 80,000 120,000 80,000 120,000 650,000 250,000 120,000 160,000 120,000 650,000 280,000 140,000 180,000 130,000 730,000 Upon further investigation, you have found that the amount of account payables for Companies A and X at the start of the year is RM20,000 and RM30,000, respectively. Apart from that, the amount of credit purchase for Companies A and B is RM250,000 and RM280,000, respectively. Based on all this information, recommend on which company that give lower risk to your company. The recommendation must be justified by the following analysis: a) Liquidity analysis. b) Solvency analysis. c) Any other financial analysis that you think can help in making your decision.

You are working as a project manager of a construction company. Due to the economic impact, your company is currently limited in term of resources, including financial resources. Due to this, the company can only run one project at one time. Your company was offered two construction works by two different developers, which are Company A and Company B. Due to the limited resources of the company, and to ensure that the project can run smoothly without any liquidity problem, it is vital that the client is stable and able to pay on time. As the project manager, your company have instructed you to study the current financial situation of Company A and Company B. Upon research, you have obtained the balance sheet of the companies as follows. Table 1: Balance Sheet for Company A and Company B Assets B 280,000 110,000 140,000 100,000 100,000 730,000 Fixed Assets Other Non-Current Assets Account Receivables Inventory Cash TOTAL Liabilities Capital Long Term Debt Account Payables Other Current Liabilities TOTAL A 250,000 80,000 120,000 80,000 120,000 650,000 250,000 120,000 160,000 120,000 650,000 280,000 140,000 180,000 130,000 730,000 Upon further investigation, you have found that the amount of account payables for Companies A and X at the start of the year is RM20,000 and RM30,000, respectively. Apart from that, the amount of credit purchase for Companies A and B is RM250,000 and RM280,000, respectively. Based on all this information, recommend on which company that give lower risk to your company. The recommendation must be justified by the following analysis: a) Liquidity analysis. b) Solvency analysis. c) Any other financial analysis that you think can help in making your decision.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Question

Transcribed Image Text:You are working as a project manager of a construction company. Due to the

economic impact, your company is currently limited in term of resources,

including financial resources. Due to this, the company can only run one project

at one time. Your company was offered two construction works by two different

developers, which are Company A and Company B. Due to the limited

resources of the company, and to ensure that the project can run smoothly

without any liquidity problem, it is vital that the client is stable and able to pay

on time. As the project manager, your company have instructed you to study

the current financial situation of Company A and Company B. Upon research,

you have obtained the balance sheet of the companies as follows.

Table 1: Balance Sheet for Company A and Company B

Assets

A

Fixed Assets

Other Non-Current Assets

250,000

80,000

120,000

80,000

120,000

650,000

280,000

110,000

140,000

100,000

100,000

730,000

Account Receivables

Inventory

Cash

ТОTAL

Liabilities

Capital

Long Term Debt

Account Payables

Other Current Liabilities

ТОTAL

250,000

120,000

160,000

120,000

650,000

280,000

140,000

180,000

130,000

730,000

Upon further investigation, you have found that the amount of account payables

for Companies A and X at the start of the year is RM20,000 and RM30,000,

respectively. Apart from that, the amount of credit purchase for Companies A

and B is RM250,000 and RM280,000, respectively. Based on all this

information, recommend on which company that give lower risk to your

company. The recommendation must be justified by the following analysis:

a) Liquidity analysis.

b) Solvency analysis.

c) Any other financial analysis that you think can help in making your

decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning