Glennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: 1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined? a. The amount is estimated based on prior year taxes. b. The amount is estimated based on future year taxes. 2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.

Glennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023. Required: 1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined? a. The amount is estimated based on prior year taxes. b. The amount is estimated based on future year taxes. 2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter11: Accounting For Transactions Using A General Journal

Section11.3: Accounting For The Declaration And Payment Of A Dividend

Problem 4AYU

Related questions

Question

100%

Glennelle's Boutique Incorporated operates in a city in which real estate tax bills for one year are issued in May of the subsequent year. Thus, tax bills for 2022 are issued in May 2023 and are payable in July 2023.

Required:

1. How the amount of tax expense for calendar 2022 and the amount of taxes payable (if any) at December 31, 2022, can be determined?

a. The amount is estimated based on prior year taxes.

b. The amount is estimated based on future year taxes.

2. Use the horizontal model to show the effect of accruing 2022 taxes of $6,900 at December 31, 2022. Indicate the financial statement effect.

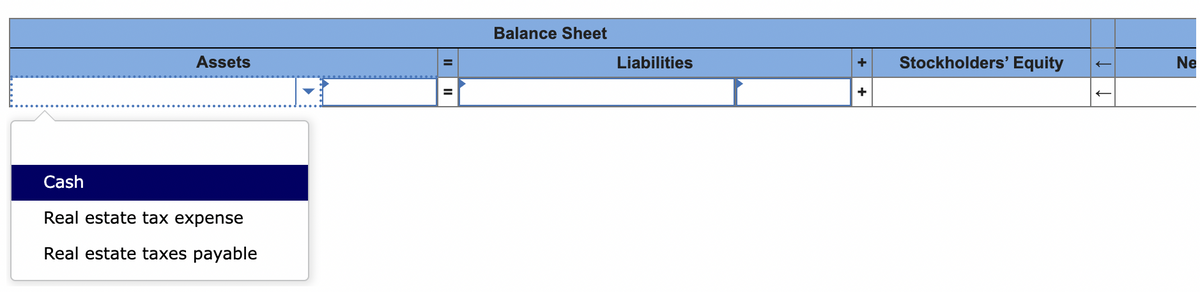

Transcribed Image Text:Assets

Cash

Real estate tax expense

Real estate taxes payable

Balance Sheet

Liabilities

+

+

Stockholders' Equity

Ne

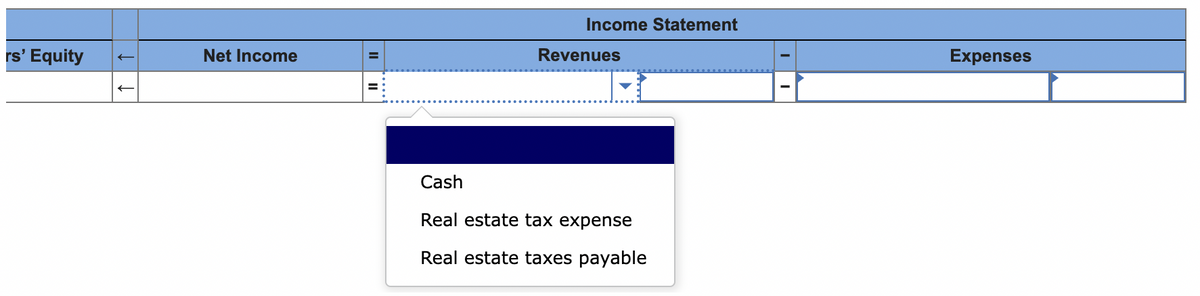

Transcribed Image Text:rs' Equity

Net Income

Income Statement

Revenues

Cash

Real estate tax expense

Real estate taxes payable

Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College