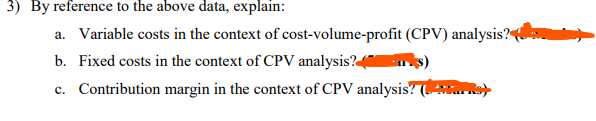

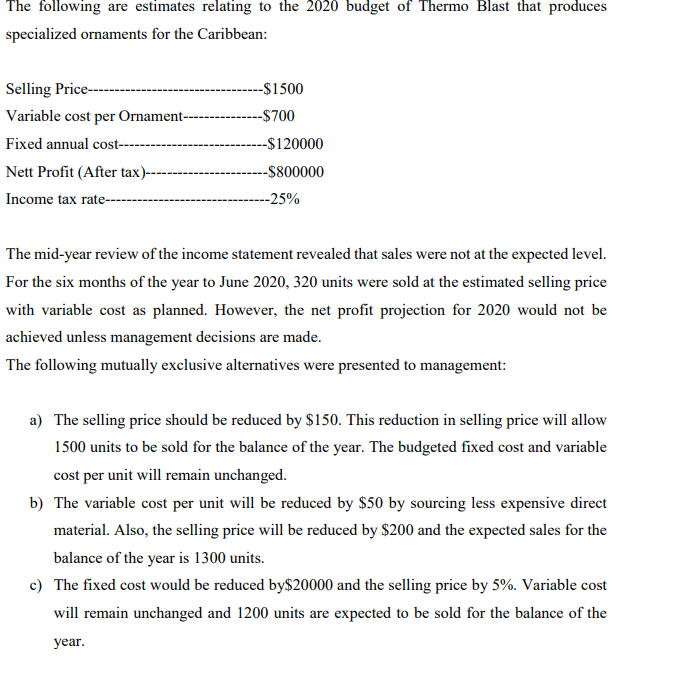

The following are estimates relating to the 2020 budget of Thermo Blast that produces specialized ornaments for the Caribbean: Selling Price--- Variable cost per Ornament- Fixed annual cost--- Nett Profit (After tax)-- Income tax rate-- -$1500 -$700 -$120000 -$800000 --25% The mid-year review of the income statement revealed that sales were not at the expected level. For the six months of the year to June 2020, 320 units were sold at the estimated selling price with variable cost as planned. However, the net profit projection for 2020 would not be achieved unless management decisions are made. The following mutually exclusive alternatives were presented to management: a) The selling price should be reduced by $150. This reduction in selling price will allow 1500 units to be sold for the balance of the year. The budgeted fixed cost and variable cost per unit will remain unchanged. b) The variable cost per unit will be reduced by $50 by sourcing less expensive direct material. Also, the selling price will be reduced by $200 and the expected sales for the balance of the year is 1300 units. c) The fixed cost would be reduced by$20000 and the selling price by 5%. Variable cost will remain unchanged and 1200 units are expected to be sold for the balance of the year.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 2 steps with 2 images