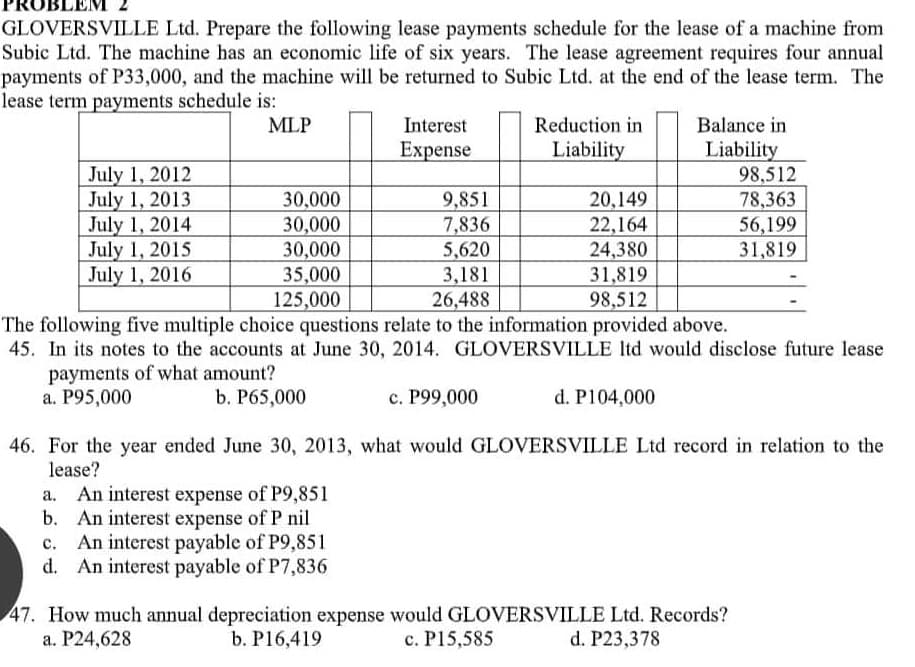

GLOVERSVILLE Ltd. Prepare the following lease payments schedule for the lease of a machine from Subic Ltd. The machine has an economic life of six years. The lease agreement requires four annual payments of P33,000, and the machine will be returned to Subic Ltd. at the end of the lease term. The lease term payments schedule is: MLP Balance in Interest Expense Reduction in Liability Liability July 1, 2012 98,512 July 1, 2013 30,000 9,851 20,149 78,363 July 1, 2014 30,000 7,836 22,164 56,199 July 1, 2015 30,000 5,620 24,380 31,819 July 1, 2016 35,000 3,181 31,819 125,000 26,488 98,512 The following five multiple choice questions relate to the information provided above. 45. In its notes to the accounts at June 30, 2014. GLOVERSVILLE ltd would disclose future lease payments of what amount? a. P95,000 b. P65,000 c. P99,000 d. P104,000 46. For the year ended June 30, 2013, what would GLOVERSVILLE Ltd record in relation to the lease? a. An interest expense of P9,851 b. An interest expense of P nil c. An interest payable of P9,851 d. An interest payable of P7,836 47. How much annual depreciation expense would GLOVERSVILLE Ltd. Records? a. P24,628 b. P16,419 c. P15,585 d. P23,378

GLOVERSVILLE Ltd. Prepare the following lease payments schedule for the lease of a machine from Subic Ltd. The machine has an economic life of six years. The lease agreement requires four annual payments of P33,000, and the machine will be returned to Subic Ltd. at the end of the lease term. The lease term payments schedule is: MLP Balance in Interest Expense Reduction in Liability Liability July 1, 2012 98,512 July 1, 2013 30,000 9,851 20,149 78,363 July 1, 2014 30,000 7,836 22,164 56,199 July 1, 2015 30,000 5,620 24,380 31,819 July 1, 2016 35,000 3,181 31,819 125,000 26,488 98,512 The following five multiple choice questions relate to the information provided above. 45. In its notes to the accounts at June 30, 2014. GLOVERSVILLE ltd would disclose future lease payments of what amount? a. P95,000 b. P65,000 c. P99,000 d. P104,000 46. For the year ended June 30, 2013, what would GLOVERSVILLE Ltd record in relation to the lease? a. An interest expense of P9,851 b. An interest expense of P nil c. An interest payable of P9,851 d. An interest payable of P7,836 47. How much annual depreciation expense would GLOVERSVILLE Ltd. Records? a. P24,628 b. P16,419 c. P15,585 d. P23,378

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 3E: Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides...

Related questions

Question

Transcribed Image Text:GLOVERSVILLE Ltd. Prepare the following lease payments schedule for the lease of a machine from

Subic Ltd. The machine has an economic life of six years. The lease agreement requires four annual

payments of P33,000, and the machine will be returned to Subic Ltd. at the end of the lease term. The

lease term payments schedule is:

MLP

Reduction in

Balance in

Interest

Expense

Liability

Liability

July 1, 2012

98,512

July 1, 2013

30,000

9,851

20,149

78,363

July 1, 2014

30,000

7,836

22,164

56,199

July 1, 2015

30,000

5,620

24,380

31,819

July 1, 2016

3,181

31,819

35,000

125,000

26,488

98,512

The following five multiple choice questions relate to the information provided above.

45. In its notes to the accounts at June 30, 2014. GLOVERSVILLE ltd would disclose future lease

payments of what amount?

a. P95,000

b. P65,000

c. P99,000

d. P104,000

46. For the year ended June 30, 2013, what would GLOVERSVILLE Ltd record in relation to the

lease?

a. An interest expense of P9,851

b. An interest expense of P nil

c. An interest payable of P9,851

d. An interest payable of P7,836

47. How much annual depreciation expense would GLOVERSVILLE Ltd. Records?

a. P24,628

b. P16,419

c. P15,585

d. P23,378

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning